Bitcoin Analysis Forum: The digital currency market is headed by Bitcoin, the pioneering and most famous cryptocurrency. Traders, analysts, and enthusiasts have flocked to its innumerable forums to share and discuss ideas, tactics, and trends. For new and seasoned traders, Bitcoin Analysis Forums have become vital meeting places for ongoing conversations and information sharing. This essay delves into the current trends and technical analysis conversations around Bitcoin, examines the impact of Bitcoin forums on market opinions, and highlights important market insights from these platforms in 2024.

The Role of Bitcoin Analysis Forums

Bitcoin forums serve as a meeting point for diverse participants in the crypto space. Traders, investors, developers, and blockchain enthusiasts utilize these platforms to share ideas, trade insights, and analyze price movements. They are crucial because:

- Real-time Market Discussions: Forums allow traders to react to news and trends as they happen. Discussions on geopolitical events, regulatory changes, and economic factors influence Bitcoin prices, and forums instantly capture these sentiments.

- Crowdsourced Insights: Analysis shared on forums can be a goldmine for traders. Many participants share their technical analysis, predictions, and trade setups, offering perspectives to help others make more informed decisions.

- Learning from Experts: Many forums have seasoned traders and market analysts who regularly contribute their insights. Beginners can benefit from these experts by learning new strategies, understanding market dynamics, and avoiding common mistakes.

- Diverse Opinions: Unlike traditional financial analysis platforms, where market perspectives are more homogenized, Bitcoin forums feature diverse views. Traders who are bullish, bearish, and neutral can all present their cases, leading to richer discussions.

Recent Bitcoin Market Trends Discussed in Forums

As we move into 2024, several market trends have dominated Bitcoin discussions on various analysis forums. Here are some of the most prevalent themes and topics making waves:

Bitcoin’s Role as a Safe Haven Asset

One of the most prominent discussion points in 2024 is Bitcoin’s evolving role as a safe-haven asset. With increasing global uncertainty, inflation, and currency devaluation, traders on Bitcoin forums are debating whether Bitcoin is maturing into a hedge against traditional markets, much like gold.

Some traders argue that Bitcoin’s deflationary nature and finite supply make it a better hedge than traditional commodities like gold. Others point to Bitcoin’s volatility as a reason why it might not fully fit the bill as a haven yet. Nevertheless, this debate has gained significant traction, particularly as more institutional investors explore Bitcoin as part of their portfolios.

The Impact of Central Bank Digital Currencies (CBDCs)

Another hot topic in Bitcoin forums is the rise of Central Bank Digital Currencies (CBDCs). Countries like China, the United States, and the European Union have accelerated their efforts to develop CBDCs. Traders are constantly discussing how this could affect Bitcoin’s future.

Many believe that the introduction of CBDCs could lead to increased regulation of cryptocurrencies, possibly stifling the decentralized ethos of Bitcoin. On the other hand, some forum members argue that CBDCs could drive more mainstream adoption of digital currencies, benefiting Bitcoin in the long run.

Institutional Adoption of Bitcoin

Forums are abuzz with news of institutional investors continuing to enter the Bitcoin market in 2024. Discussions focus on the growing interest from hedge funds, pension funds, and even sovereign wealth funds in Bitcoin as an investment. Participants point to major players such as BlackRock and Fidelity, which have launched Bitcoin-related investment products, further legitimizing the cryptocurrency. Traders often share reports and opinions on how these developments will affect Bitcoin’s price, particularly in the long term.

The Halving Event of 2024

One of the most anticipated events for Bitcoin this year is the upcoming halving, expected in April 2024. Every four years, Bitcoin undergoes a halving event, which reduces miners’ reward for adding new blocks to the blockchain by 50%. Historically, Bitcoin’s price has surged following previous halving events, making this a focal point of many forum discussions.

Forum analysts debate whether Bitcoin’s value is already factored into the imminent halving or if the market will rally significantly. After the reward cut, smaller miners may find their operations less profitable. Therefore, there’s conjecture regarding their reactions.

Regulatory Developments

Regulatory discussions are always front and center in Bitcoin forums. In 2024, the primary focus has been on two key areas: the evolving regulatory landscape in the United States and Europe and the potential for greater global cooperation on cryptocurrency regulations.

Forum users are dissecting proposed regulations from the U.S. Securities and Exchange Commission (SEC) and the European Commission, both looking to clarify the classification of Bitcoin as an asset and the rules governing its use. These discussions often include predictions about how regulations will impact price action, particularly in the short term.

Technical Analysis on Bitcoin Forums: Tools and Trends

Bitcoin forums are a treasure trove for technical analysis (TA) enthusiasts. As the market becomes more sophisticated, the tools and techniques used for TA have evolved, with many new strategies being discussed on these platforms. Below are some of the most popular analytical tools and trends dominating Bitcoin forums in 2024:

On-Chain Analysis

On-chain analysis, which involves studying data from the Bitcoin blockchain, has become an essential part of the analysis on forums. Metrics like the MVRV (Market Value to Realized Value) ratio, SOPR (Spent Output Profit Ratio), and hash rate are frequently discussed. Traders use these indicators to assess Bitcoin’s market sentiment and predict prices.

Fibonacci Retracement Levels

Fibonacci retracement tools remain a staple in Bitcoin trading forums. Traders use Fibonacci levels to identify potential areas of support and resistance in Bitcoin’s price movements. With Bitcoin’s volatility, these levels often serve as key points for entry or exit strategies, and forum members frequently share their charts and predictions based on Fibonacci analysis.

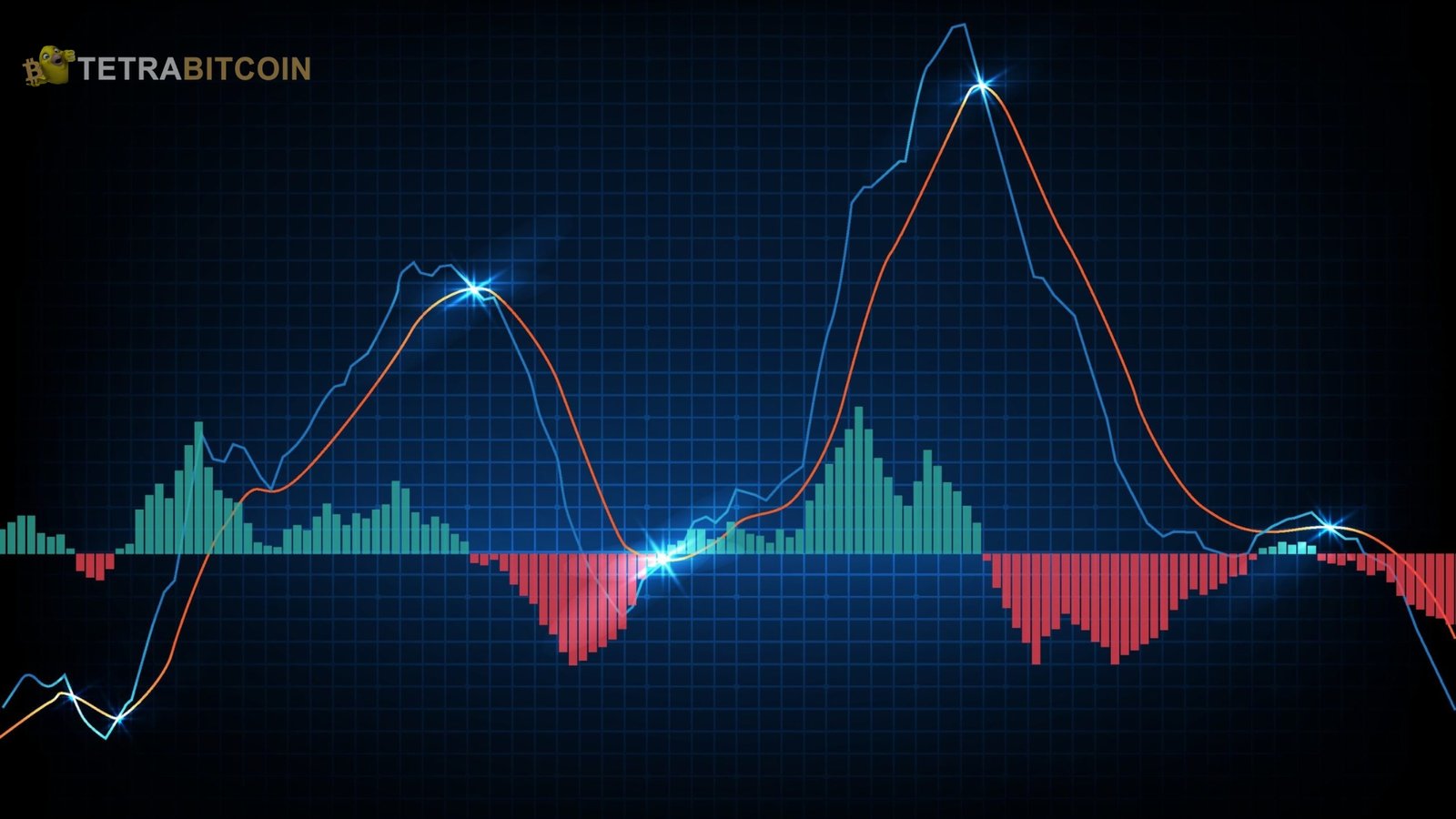

Moving Averages and MACD

Moving averages (MA) and the Moving Average Convergence Divergence (MACD) indicator are widely used in forum discussions. Traders track short-term and long-term moving averages to spot potential trend reversals and use the MACD to confirm the strength of these trends. Crossovers between different MAs (such as the 50-day and 200-day moving averages) are closely watched by forum participants for buy or sell signals.

Elliott Wave Theory

Elliott Wave Theory has gained renewed interest among Bitcoin traders. This theory posits that markets move in predictable waves, and Bitcoin’s price movements can be mapped accordingly. Traders on forums analyze these waves to forecast future price action, sharing detailed charts that show where Bitcoin might be in the current wave cycle.

Sentiment Analysis in Bitcoin Forums

Forums are not just for technical analysis—they also serve as a gauge of market sentiment. Sentiment analysis is the practice of analyzing the mood of market participants, and it plays a vital role in determining market trends. In 2024, several sentiment indicators are being discussed in forums, including:

- Fear & Greed Index: This popular index quantifies market sentiment into a single score, ranging from extreme fear to extreme greed. Forum traders frequently reference this index to gauge whether the market is overheated or undervalued.

- Social Media Mentions: The number of times Bitcoin is mentioned on social media platforms is often seen as a leading indicator of market sentiment. Many forums track this data in real time, using it to predict potential price surges or drops.

- News Sentiment: News headlines can have a significant impact on Bitcoin prices. Forum participants constantly share news articles and discuss their potential effects on the market, from geopolitical tensions to major company announcements involving Bitcoin.

Conclusion

Bitcoin Analysis Forums remain critical for traders and investors looking to stay informed about the latest market developments. From discussions on Bitcoin’s role as a safe-haven asset to technical analysis and regulatory developments, these forums offer real-time insights into the factors shaping Bitcoin’s future.

As Bitcoin continues to evolve in 2024, the collective wisdom of forum participants will play a crucial role in helping traders navigate the ever-changing crypto landscape. Whether you’re a seasoned trader or a newcomer, these forums provide a wealth of knowledge and analysis to help you stay ahead in the dynamic world of Bitcoin trading.