Bitcoin Mining Setup: Mining is the process of creating new bitcoins and adding them to the blockchain. It also verifies transactions. Solving these complicated mathematical problems calls for a lot of processing power. The desire to establish a mining operation is directly proportional to the rising popularity of Bitcoin. The Bitcoin mining industry is still in a state of flux in 2024 due to shifting market conditions and technological developments. The fundamentals of establishing a Bitcoin mining setup are covered in this article.

What is Bitcoin Mining?

Bitcoin mining is the process through which new bitcoins are created and transactions are verified on the Bitcoin blockchain. Miners use computational power to solve complex mathematical puzzles, and the first miner to solve the puzzle adds a new block to the blockchain. In return, they receive a reward in the form of new bitcoins (the block reward) and transaction fees.

Bitcoin’s network is designed to adjust the difficulty of these puzzles every 2,016 blocks, ensuring that new blocks are added approximately every 10 minutes. This dynamic difficulty makes mining increasingly competitive as more miners join the network.

Key Components of a Bitcoin Mining Setup

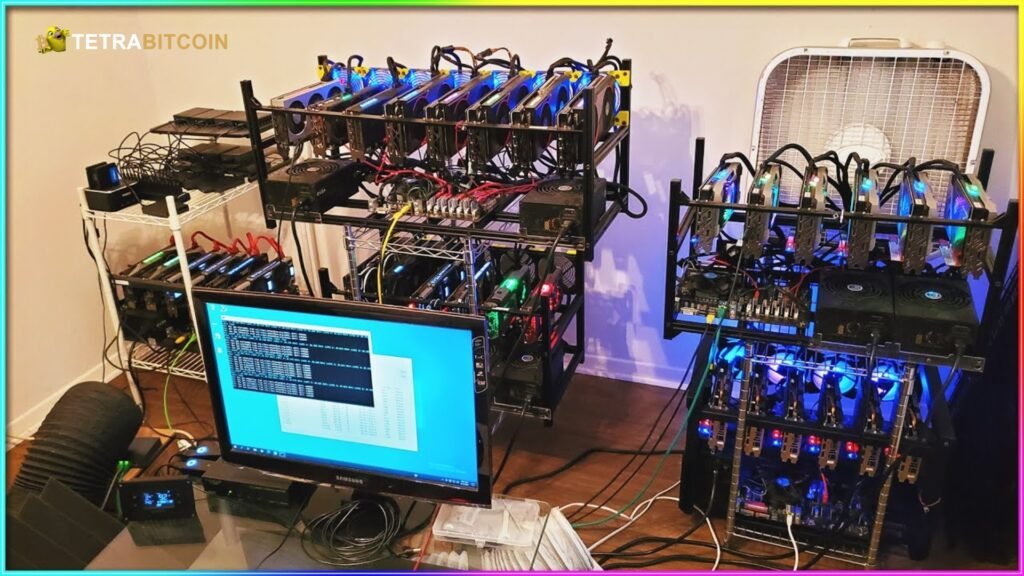

A successful Bitcoin mining setup involves more than just powerful hardware. It requires an optimized environment that balances performance and cost. The main components of any mining operation include:

- Mining Hardware

- Mining Software

- Electricity and Power Management

- Cooling Systems

- Location Considerations

- Mining Pools

Let’s break down each of these components in detail.

Mining Hardware: The Backbone of Bitcoin Mining

The type of hardware you choose for mining will largely determine your efficiency and profitability. In 2024, mining with regular CPUs and GPUs (graphics processing units) is no longer feasible due to the computational power required to mine Bitcoin. The industry standard today is ASIC miners (Application-Specific Integrated Circuits). These devices are purpose-built for Bitcoin mining and offer significantly better performance compared to GPUs.

Popular ASIC Miners in 2024

- Bitmain Antminer S19 XP: One of the most efficient ASIC miners, capable of producing up to 140 TH/s (terahashes per second) while consuming around 3,010 watts. It is currently one of the best performers in the market.

- MicroBT WhatsMiner M50S: Another powerhouse in the ASIC space, this machine delivers 136 TH/s at 3,270 watts. It’s designed for efficiency and durability.

- Canaan AvalonMiner 1366: A reliable option with a hash rate of around 130 TH/s and power consumption of 3,250 watts.

When selecting an ASIC miner, it’s crucial to consider the balance between hash rate and power consumption. More efficient miners may have a higher upfront cost but save on electricity expenses in the long run.

Mining Software: Controlling Your Hardware

Mining software connects your hardware to the Bitcoin network and helps you manage your mining operation. The software you choose should be compatible with your ASIC miner, offer monitoring tools, and be regularly updated to adapt to changes in the network.

Popular Bitcoin Mining Software in 2024

- CGMiner: A versatile and open-source mining software compatible with most ASIC miners. It allows users to adjust fan speed, voltages, and other mining parameters.

- BFGMiner: Known for its flexibility, BFGMiner offers real-time statistics, supports mining with both CPUs and ASICs, and allows users to mine multiple cryptocurrencies.

- NiceHash: This platform lets users rent out their mining hardware and automatically switches to the most profitable cryptocurrency, including Bitcoin.

Additionally, mining software should be configured to connect your miner to a mining pool, which we’ll discuss later.

Electricity: The Biggest Cost Factor

Mining Bitcoin consumes a significant amount of electricity, making power management crucial for maintaining profitability. The efficiency of your mining operation is often measured in watts per terahash (W/TH), a unit that shows how much energy is used to generate a terahash of computing power.

Calculating Your Energy Costs

To calculate the electricity cost of your mining operation, use this formula:

Electricity cost= Power consumption (in kW) × Electricity rate (per kWh) × Time(in hours)

For example, if you’re using an Antminer S19 XP that consumes 3,010 watts and you pay $0.10 per kWh for electricity, your daily cost would be:

(3,010 / 1,000) × $0.10 × 24 = $7.22 per day

Important Note: In regions where electricity is expensive (e.g., $0.20 per kWh or higher), mining may be unprofitable without access to cheaper power sources.

Cooling Systems: Managing Heat for Longevity

Mining equipment generates substantial heat, especially in large-scale operations. Proper cooling is essential not only for preventing damage to your hardware but also for maintaining its efficiency. There are two common cooling methods used in Bitcoin mining:

Air Cooling

- Air circulation: Fans and ventilation systems push hot air out of the room and allow cooler air to enter.

- Temperature management: Keeping the mining room at a consistent temperature (preferably below 25°C/77°F) is essential for optimal performance.

Immersion Cooling

- In immersion cooling, miners are submerged in a thermally conductive but non-conductive liquid. This method efficiently transfers heat away from the equipment, allowing higher hash rates and reducing the wear on hardware.

- Although more expensive upfront, immersion cooling can drastically lower energy consumption from cooling systems.

Location: Choose the Right Place to Mine

Where you set up your mining operation can significantly impact profitability. Consider the following factors when selecting a location:

- Electricity costs: As mentioned earlier, power consumption is the primary ongoing cost for miners. Countries like Iceland, Kazakhstan, and Canada offer some of the cheapest electricity in the world.

- Temperature: Cooler climates naturally help keep equipment from overheating, reducing the need for extensive cooling systems.

- Government regulations: Bitcoin mining is banned or restricted in some countries, so it’s important to ensure that mining is legal in your location.

If you’re planning a large-scale operation, consider partnering with local power companies for discounted rates or setting up operations in regions with renewable energy sources like hydroelectric power.

Mining Pools: Collaborating for Consistency

Mining Bitcoin solo can be extremely difficult due to the high competition and network difficulty. Instead, most miners join mining pools, where resources are pooled together to increase the chances of solving a block. The rewards are then distributed proportionally based on each miner’s contribution.

Popular Mining Pools in 2024

- F2Pool: One of the largest and most reliable mining pools, F2Pool supports various cryptocurrencies, including Bitcoin.

- Antpool: Operated by Bitmain, this pool offers robust features and high payouts for Bitcoin miners.

- Slush Pool: Known for its transparency and innovative features, Slush Pool allows users to track detailed performance metrics.

When joining a mining pool, consider the pool’s fee structure (usually 1-3% of your rewards), payout frequency, and overall reputation.

Conclusion

Bitcoin mining in 2024 remains a competitive and energy-intensive endeavor. To be successful, miners must invest in efficient hardware, choose suitable mining software, manage electricity costs, and ensure proper cooling and ventilation. Location plays a critical role in determining profitability, with lower energy costs and cooler climates offering clear advantages.

While profitability depends on several factors—Bitcoin’s price, network difficulty, electricity costs, and hardware efficiency—a well-optimized mining operation can still yield positive returns. With careful planning and the right resources, you can set up a robust Bitcoin mining operation that thrives in the ever-evolving crypto landscape.