Native to the Binance Guides, Binance Coin (BNB) has undergone significant changes since its launch. BNB, initially developed as a utility token to offer lower trading fees on the Binance platform, has evolved into a multifaceted asset utilised in various ways within the decentralised finance (DeFi) ecosystem.

Many investors are wondering if Binance Coin might reach the $600 mark, as the cryptocurrency market displays signs of renewed optimism. This subject has become popular among crypto enthusiasts, as multiple technical indicators are now glowing green. In this paper, we will examine the factors that influence BNB’s price movement and assess whether a price of $600 is achievable.

Binance Coin Growth

Examining the fundamental importance of the asset in the Bitcoin ecosystem helps one understand why Binance Coin might be reaching new highs. The Binance exchange and Binance Smart Chain (BSC) primarily utilise Binance Coin (BNB). It is fundamental to BSC’s decentralised finance (DeFi) offerings, allowing users to pay transaction fees on the exchange and facilitating token sales on Binance Launchpad.

Binance’s use case on the platform remains one of its most significant selling points, as it has become recognized as the world’s top exchange by trading volume. Beyond its transactability, BNB’s growing acceptance in DeFi initiatives, NFTs, and even as loan collateral has dramatically increased its market share.

Binance’s use case on the platform remains one of its most significant selling points, as it has become recognized as the world’s top exchange by trading volume. Beyond its transactability, BNB’s growing acceptance in DeFi initiatives, NFTs, and even as loan collateral has dramatically increased its market share.

This adaptability has led to continuous price increases; recently, technical indications have increased traders’ optimism that BNB is poised to reach a new all-time high. The issue now is whether $600 is a reasonable goal given the current state of the market.

BNB Bullish Momentum

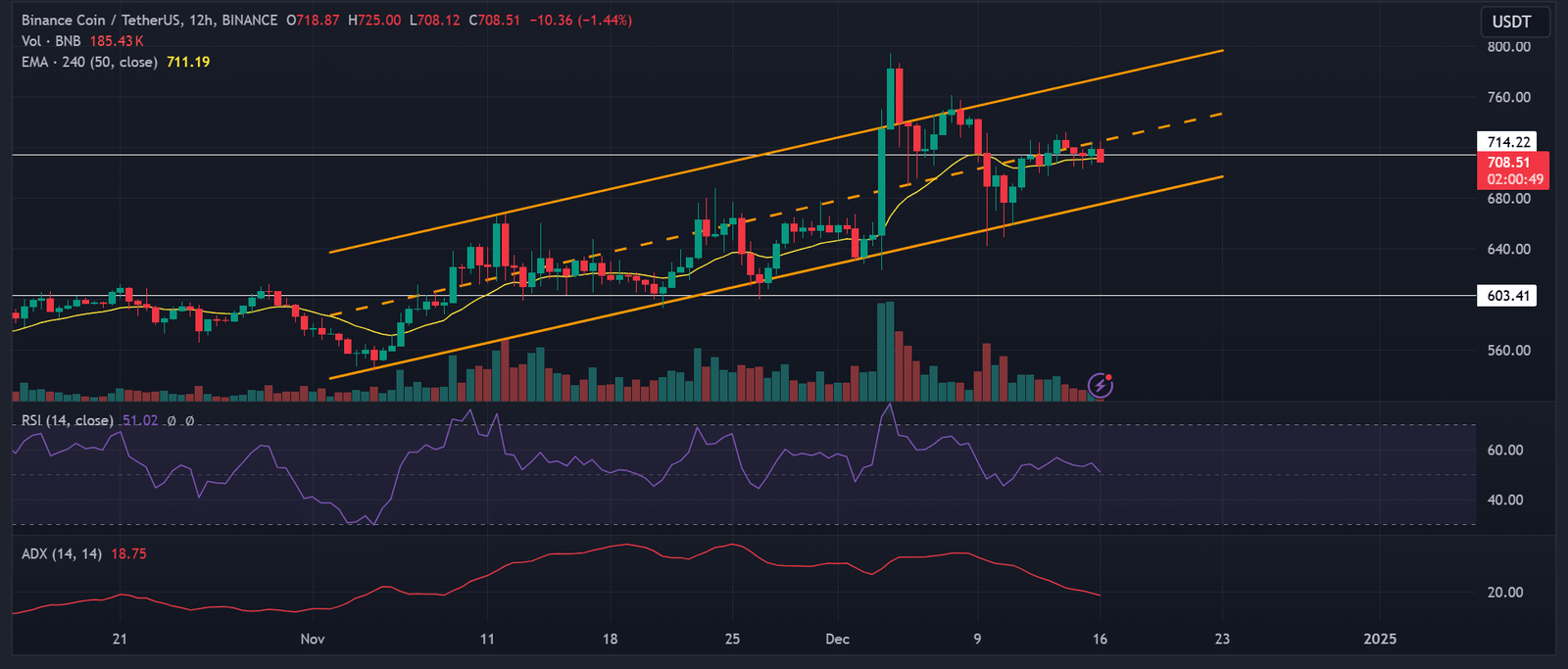

Several technical signals suggest that BNB could continue its upward trajectory and potentially reach $600 shortly. Let’s separate the main technical elements that can support this optimistic view.

BNB Bullish Breakout

The effective breakthrough over key resistance levels is one of the most notable recent changes in BNB’s price behavior. Notably, the $450 resistance had already shown to be a significant obstacle for BNB, stopping it from moving to higher pricing levels. However, BNB has recently surpassed this resistance zone, indicating an important turning point in the asset.

After surpassing this level, BNB slightly retraced to confirm that the $450 mark had transitioned from resistance to support, a common trend following such surges. This “bullish retest” suggests that the asset has the potential to continue moving upward, provided that buying pressure remains intense. Now that the next significant resistance level falls around $600, this is the one that readers and investors should aim for.

BNB Golden Cross

A “golden cross” occurrence indicates a positive sign for Binance Coin. When a short-term moving average, such as the 50-day moving average, crosses over a long-term moving average—say, the 200-day moving average—a golden cross occurs. Usually regarded as a strong indication of a continued rise, this pattern is

Recently, Binance Coin experienced a golden cross, a historically reliable indicator of positive momentum. The golden cross implies that, given the possibility of significant price gains in the following weeks, BNB’s increasing trend could continue. Many traders and analysts saw this crossover as solid evidence that BNB could finally reach its next significant target of $600.

RSI and MACD

Among the most commonly used momentum indicators are the Relative Strength Index (RSI) and the Moving Average Convergence/Divergence (MACD). While the MACD charts variations in momentum, the RSI helps traders determine if an asset is overbought or oversold. The RSI for BNB is currently within a healthy range of 60 to 70, suggesting that the asset is not yet overbought.

Although a high RSI would indicate that an asset is poised for a correction, BNB’s RSI shows that, absent overbought territory, there is still the possibility of more upside. This data suggests that, given overbought conditions, BNB has potential for ongoing expansion before encountering resistance. With a positive crossover and increasing momentum, the MACD is also in a bullish position. Rising MACD histograms suggest increasing buying pressure, hence reinforcing the idea that BNB might trend higher in the short term.

BNB Price Challenges

The various issues that Binance Coin (BNB) faces could potentially impact its intended price range. Regulatory pressure plays a significant role in this determination. Regulators worldwide have examined Binance, and several have banned or restricted its activities. Since BNB primarily connects to Binance’s ecosystem, a worsening trend could limit its usefulness. Any changes in compliance or extra regulations could immediately impact BNB’s value.

Another major obstacle is competitiveness. Other blockchains, such as Ethereum Price, Solana, and Avalanche, are gaining popularity, offering alternatives for smart contracts and decentralized finance (DeFi). Binance might lose market share if these platforms become increasingly popular, which could lower demand for BNB. Further reducing BNB’s use on the Binance Smart Chain (BSC), Layer-2 technologies like Optimism and Arbitrum could make Ethereum faster and more cost-effective.

Another major obstacle is competitiveness. Other blockchains, such as Ethereum Price, Solana, and Avalanche, are gaining popularity, offering alternatives for smart contracts and decentralized finance (DeFi). Binance might lose market share if these platforms become increasingly popular, which could lower demand for BNB. Further reducing BNB’s use on the Binance Smart Chain (BSC), Layer-2 technologies like Optimism and Arbitrum could make Ethereum faster and more cost-effective.

Final thoughts

With $600 potentially within reach in a few days, Binance Coin’s technical indicators present a compelling argument for further price increases. A breakout over essential resistance levels, the occurrence of a golden cross, optimistic RSI and MACD readings, and a rise in trading volume all indicate that BNB may continue its upward trend.

Until then, one must consider factors such as regulatory uncertainty and market volatility. Technical studies suggest that BNB has a promising future; however, investors should exercise caution and stay informed about broader market developments.