The Bitcoin correction of 2025 has been on a remarkable journey throughout the year, with the cryptocurrency reaching a new all-time high of $112,000 amid growing institutional adoption and easing trade tensions. However, as we approach the middle of the year, several technical indicators and market dynamics suggest that Bitcoin might be setting up for a significant correction. Understanding these warning signs can help investors make more informed decisions about their cryptocurrency portfolios.

Technical Indicators Signal Potential Reversal

Both fundamental analysis and technical patterns have long driven the cryptocurrency market, and recent data suggest that caution may be warranted. Multiple bearish divergence signals in Bitcoin suggest a possible price reversal as early as June 2025, with patterns resembling those observed in 2021 trends in technical indicators such as the RSI and MACD.

These technical signals don’t emerge in a vacuum. When Bitcoin’s price continues to climb while momentum indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), show weakening momentum, it often indicates that the current uptrend may be losing steam. This divergence pattern has historically preceded significant corrections in Bitcoin’s price action, making it a crucial factor for traders and investors to monitor.

The significance of these technical patterns becomes even more apparent when we consider Bitcoin’s historical behavior. Previous bull runs have often ended with similar divergence signals, where price action and momentum indicators move in opposite directions. This creates a warning system that experienced traders use to anticipate potential market reversals before they fully materialize.

Market Structure and Institutional Dynamics

While retail enthusiasm continues to drive much of Bitcoin’s narrative, institutional behavior tells a different story that may be more predictive of short-term price movements. The relationship between Bitcoin and traditional financial markets has become increasingly correlated, particularly during periods of market stress or uncertainty. This correlation indicates that broader economic factors, including interest rate policies and macroeconomic conditions, now play a significantly larger role in Bitcoin’s price movements than ever before.

Institutional accumulation patterns have also shifted in recent months. While long-term holders continue to maintain their positions, the rate of new institutional buying has begun to slow compared to the explosive growth seen in early 2025. This deceleration in institutional demand, combined with profit-taking behavior from early adopters, creates a supply-demand imbalance that could contribute to downward pressure on prices.

The derivatives market provides additional insight into potential correction scenarios. Futures contracts and options positioning often reveal the true sentiment of sophisticated traders, and recent data suggests that many institutional players are hedging their Bitcoin exposure or positioning for potential downside moves. This defensive positioning by major market participants often precedes broader market corrections.

Current Market Sentiment and Price Levels

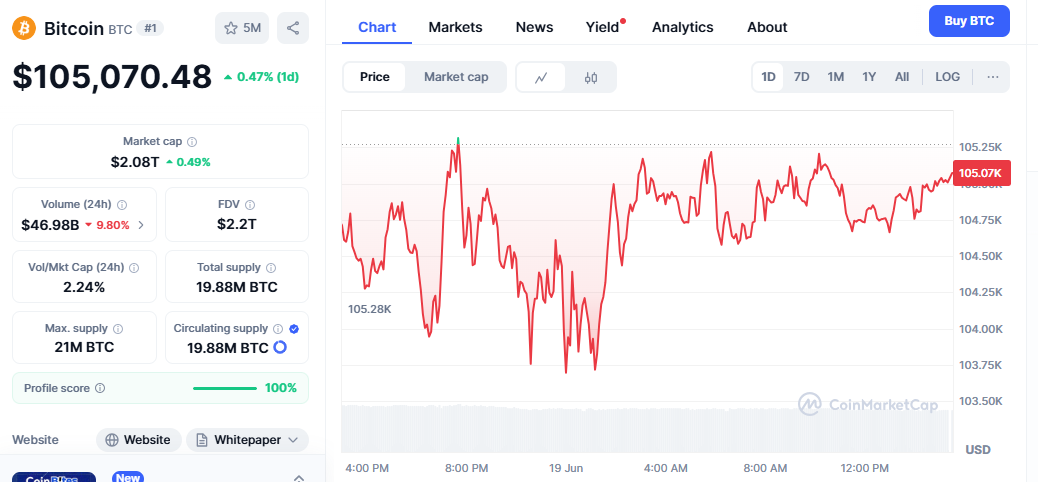

Bitcoin’s current trading range around $104,000 represents a critical juncture for the cryptocurrency. This level has acted as both support and resistance in recent weeks, creating a technical battleground between bulls and bears. The inability of Bitcoin to maintain momentum above its recent highs while simultaneously showing signs of exhaustion at these levels suggests that a correction may be necessary to reset market dynamics.

Market sentiment indicators, including the Fear and Greed Index and on-chain metrics, have begun to show signs of overheating. When markets become overly optimistic, corrections often follow as a natural part of the price discovery process. The current environment, characterized by widespread bullish sentiment and mainstream media coverage, bears a resemblance to previous market tops that were followed by significant pullbacks.

Current forecasts already anticipate a drop to $74,000, which could signal the beginning of a new bear market, though such scenarios are considered less likely in the immediate term. However, even a correction to these levels would represent a healthy retracement that could set the stage for renewed upward momentum later in the year.

Strategic Considerations for Bitcoin Investors

Understanding the potential for a Bitcoin correction doesn’t necessarily mean investors should panic or completely exit their positions. Instead, it presents an opportunity to reassess risk management strategies and position sizing. Corrections in Bitcoin’s price history have often provided attractive entry points for long-term investors, particularly those who missed earlier opportunities to accumulate the cryptocurrency at lower prices.

The key for investors is distinguishing between a healthy correction and the beginning of a prolonged bear market. In 2026, Bitcoin may experience consolidation after the 2025 highs, with an average forecast of $111,187 suggesting a potential correction or stabilization phase. This longer-term perspective encourages viewing any near-term correction in the context of Bitcoin’s adoption cycle and technological advancements.