The cryptocurrency mining landscape continues to evolve rapidly, and finding the most profitable Bitcoin mining machine 2025 has become more critical than ever for both newcomers and experienced miners. Bitcoin miners are currently mining around $20 million worth of Bitcoin per day, representing $600 million per month, making the selection of the right mining equipment crucial for success.

As we navigate through 2025, the Bitcoin mining industry faces unique challenges and opportunities. With Bitcoin’s price volatility, increasing network difficulty, and evolving hardware technology, choosing a profitable Bitcoin mining machine requires careful analysis of multiple factors including hash rate, energy efficiency, initial investment costs, and electricity consumption.

This comprehensive guide will explore the top Bitcoin mining machines available in 2025, analyzing their profitability potential, technical specifications, and return on investment (ROI) calculations. Whether you’re a small-scale home miner or looking to scale up your mining operations, understanding which machines offer the best profit margins is essential for your mining success.

What Makes a Bitcoin Mining Machine Profitable in 2025?

Hash Rate and Mining Efficiency

The profitability of any Bitcoin mining machine depends primarily on its hash rate and energy efficiency. Hash rate, measured in terahashes per second (TH/s), determines how many calculations your machine can perform per second. Higher hash rates generally translate to better mining rewards, but they must be balanced against power consumption.

Energy efficiency, expressed in watts per terahash (W/TH), has become the most critical factor in determining long-term profitability. With electricity costs typically accounting for 60-80% of mining expenses, machines with superior energy efficiency ratios provide sustainable profit margins even during market downturns.

Current Market Conditions

ASIC mining remains profitable in 2025, but it depends on several key factors including electricity costs, cryptocurrency prices, and the efficiency of mining hardware. The current Bitcoin bull run has improved mining profitability significantly compared to the challenging conditions of 2022-2023.

Mining difficulty adjustments continue to impact profitability calculations. As more miners join the network, difficulty increases, requiring more computational power to mine the same amount of Bitcoin. This dynamic makes choosing efficient hardware even more crucial for maintaining profitability.

Top 5 Most Profitable Bitcoin Mining Machines for 2025

1. Bitmain Antminer S21 XP – The Efficiency Champion

The Antminer S21 XP stands out as one of the most promising options for profitable Bitcoin mining in 2025. The Bitmain Antminer S21 XP (270TH/s) has been calculated to generate $7.08 daily, $212.4 monthly, and $2584.2 yearly, considering an electricity cost of $0.1/KWh.

Key Specifications:

- Hash Rate: 270 TH/s

- Power Consumption: 3,510W

- Efficiency: 13 J/TH

- Daily Profitability: $7.08 (at $0.10/kWh)

The S21 XP represents Bitmain’s latest advancement in mining technology, offering exceptional energy efficiency that makes it particularly attractive for miners in regions with moderate electricity costs.

2. Whatsminer M60S – Power and Performance

The M60S entails a daily profitability profile of $5.22 (assuming an electricity cost of 6 cents per kWh). This machine offers solid performance for miners with access to cheap electricity.

Key Specifications:

- Hash Rate: 170 TH/s

- Power Consumption: 3,230W

- Efficiency: 19 J/TH

- Price Range: $4,590-$5,022

The M60S provides a good balance between initial investment and mining capacity, making it suitable for both individual miners and small mining farms.

3. Antminer T21 – Best Budget Option

The T21 is considered the best Profitable Bitcoin Mining Machine 2025 for those who want to save money, with automatic overclocking capabilities achieving higher hashrates without requiring power supply upgrades.

The T21 offers an excellent entry point for new miners while providing features typically found in more expensive models. Its automatic overclocking feature allows users to maximize performance without technical expertise.

4. Antminer S21 Standard Model

The Antminer S21 can reach 200 TH/s hashrate and 3500 W power consumption for mining BTC, earning around $10.55 USD per day.

This standard model provides reliable performance with:

- Hash Rate: 200 TH/s

- Power Consumption: 3,500W

- Daily Earnings: $10.55

5. VolcMiner D1 Hydro – Advanced Cooling Technology

The VolcMiner D1 Hydro delivers a hash rate of 30.4 GH/s while consuming 7,600W, achieving an energy efficiency of 0.253 J/MH, with prices starting from $7,999. While primarily designed for Scrypt mining (Litecoin, Dogecoin), its advanced hydro cooling technology represents the future of mining hardware design.

Calculating Bitcoin Mining Profitability in 2025

Essential Profitability Factors

When evaluating a profitable Bitcoin mining machine 2025, consider these crucial variables:

Electricity Costs: Current calculations show that mining 1 Profitable Bitcoin Mining Machine 2025 computational power, with a Bitcoin mining hashrate of 390.00 TH/s consuming 7,215.00 watts of power at $0.05 per kWh.

Network Difficulty: Bitcoin’s mining difficulty adjusts approximately every two weeks, directly impacting mining rewards. Higher difficulty means more competition and lower individual mining rewards.

Bitcoin Price: Cryptocurrency volatility significantly affects mining profitability. Price increases can make previously unprofitable machines viable, while price drops can eliminate profit margins.

Pool Fees: Most miners join mining pools to ensure steady income, typically paying 1-3% fees that must be factored into profitability calculations.

ROI Timeline Analysis

Most profitable Bitcoin mining machines in 2025 show ROI periods ranging from 12-24 months under optimal conditions. However, this timeline can vary significantly based on:

- Local electricity rates

- Bitcoin price movements

- Network difficulty changes

- Machine reliability and uptime

The key to successful mining is choosing equipment that remains profitable even during market downturns. Machines with superior energy efficiency provide better protection against profit margin compression during challenging market conditions.

Factors Affecting Mining Machine Profitability

Electricity Costs – The Primary Profitability Driver

Electricity costs represent the largest ongoing expense in Profitable Bitcoin Mining Machine 2025. Successful miners typically secure electricity rates below $0.08 per kWh to maintain healthy profit margins. Regions with cheap renewable energy have become mining hotspots due to this cost advantage.

Countries like Kazakhstan, Russia, and certain U.S. states offer competitive electricity rates that make mining operations more profitable. However, regulatory considerations must also be evaluated when selecting mining locations.

Cooling and Maintenance Requirements

Modern ASIC miners generate substantial heat and require proper cooling systems to maintain optimal performance. Inadequate cooling can lead to:

- Reduced hash rates

- Increased power consumption

- Hardware degradation

- Higher failure rates

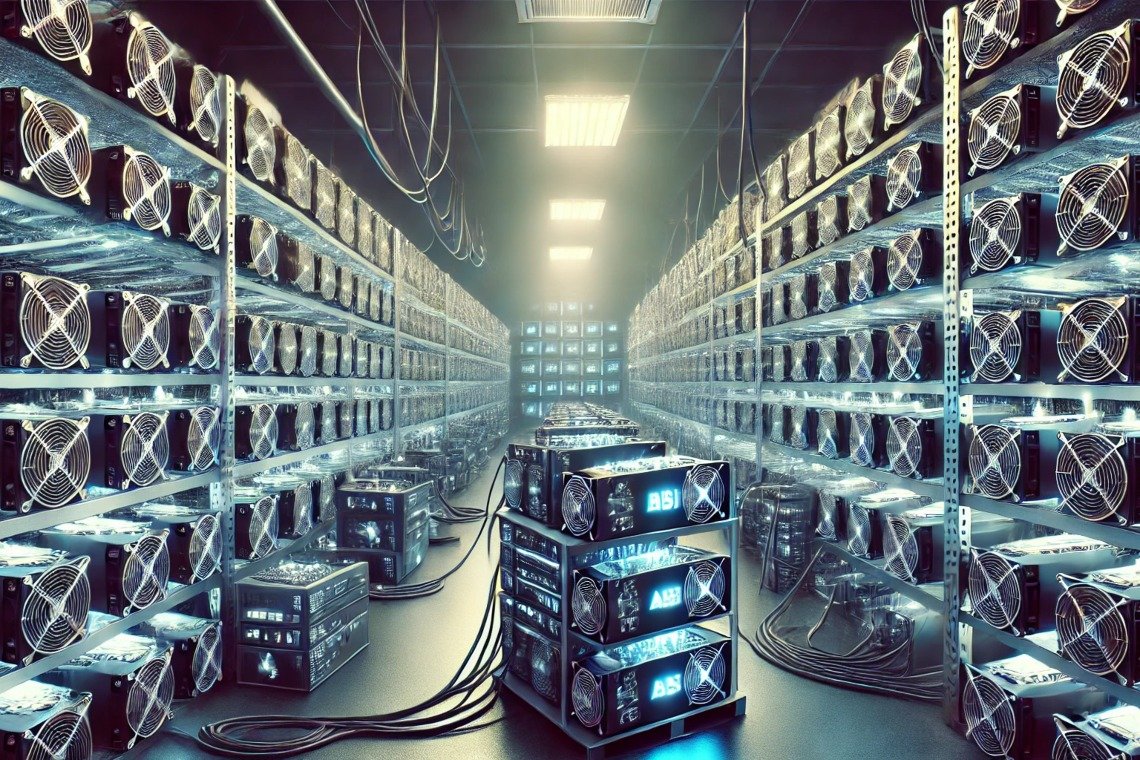

Professional mining operations invest in sophisticated cooling infrastructure, including immersion cooling and specialized ventilation systems. Home miners should factor cooling costs and noise considerations into their profitability calculations.

Mining Pool Selection

Joining a reputable mining pool is essential for consistent returns. Pool selection affects profitability through:

- Fee structures (typically 1-3%)

- Payout methods (PPS, PPLNS, etc.)

- Pool reliability and uptime

- Geographic proximity for reduced latency

Popular mining pools like AntPool, F2Pool, and ViaBTC offer different fee structures and payout mechanisms that can impact overall profitability.

Setting Up Your Profitable Bitcoin Mining Operation

Infrastructure Requirements

Establishing a profitable Bitcoin mining operation requires careful planning of electrical infrastructure, cooling systems, and network connectivity. Professional installations often require:

- Dedicated electrical circuits with appropriate amperage

- Reliable internet connectivity with low latency

- Climate-controlled environments

- Security measures for equipment protection

- Backup power systems for continuous operation

Regulatory Compliance

Profitable Bitcoin Mining Machine 2025 significantly by jurisdiction. Some regions have embraced cryptocurrency mining with favorable policies, while others have imposed restrictions or outright bans. Key regulatory considerations include:

- Energy consumption regulations

- Noise ordinances for residential areas

- Tax implications of mining rewards

- Import duties on mining equipment

- Environmental impact assessments

Scaling Considerations

Many successful miners start with single machines and gradually scale their operations. Scaling strategies include:

- Reinvesting mining profits into additional hardware

- Negotiating bulk electricity rates

- Implementing industrial-grade cooling systems

- Developing relationships with equipment suppliers

- Exploring mining facility partnerships

Future Trends in Bitcoin Mining Technology

Next-Generation ASIC Development

The Bitcoin mining industry continues to push the boundaries of chip technology. Upcoming developments include:

- Advanced semiconductor processes (3nm and below)

- Improved chip architectures for better efficiency

- Integration of artificial intelligence for optimization

- Enhanced cooling technologies

- Modular designs for easier maintenance

Sustainable Mining Initiatives

Environmental sustainability has become a major focus for the mining industry. Trends include:

- Renewable energy integration

- Carbon-neutral mining operations

- Heat recycling for practical applications

- Efficiency improvements to reduce energy consumption

- Green mining certifications and standards

Market Evolution

The Profitable Bitcoin Mining Machine 2025 to evolve with institutional adoption and technological advancement. Key trends shaping the future include:

- Increased institutional mining participation

- Geographic diversification of mining operations

- Integration with renewable energy projects

- Development of mining-as-a-service platforms

- Advancement in mining pool technologies

Tips for Maximizing Your Mining Profits

Optimization Strategies

Maximizing profits from your Bitcoin mining machine requires ongoing optimization:

Firmware Updates: Regularly updating miner firmware can improve efficiency and unlock additional features. Some third-party firmware options provide enhanced performance capabilities.

Overclocking and Underclocking: Carefully adjusting hash rates and power consumption based on electricity costs and Bitcoin prices can optimize profitability.

Maintenance Schedules: Regular cleaning and maintenance prevent performance degradation and extend equipment lifespan.

Monitoring and Analytics: Implementing comprehensive monitoring systems helps identify issues before they impact profitability.

Risk Management

Successful mining operations implement risk management strategies:

- Diversifying across multiple machine models

- Maintaining cash reserves for equipment repairs

- Hedging against Bitcoin price volatility

- Securing insurance for valuable equipment

- Developing contingency plans for regulatory changes

Market Timing

Strategic equipment purchases can significantly impact profitability:

- Buying during market downturns when equipment prices drop

- Timing upgrades with Bitcoin halving events

- Monitoring manufacturer release cycles for new models

- Taking advantage of bulk purchase discounts

Common Mistakes to Avoid When Buying Mining Equipment

Overlooking Total Cost of Ownership

Many new miners focus only on initial purchase price without considering:

- Ongoing electricity costs

- Cooling and ventilation expenses

- Maintenance and repair costs

- Pool fees and transaction costs

- Potential regulatory compliance costs

Ignoring Network Difficulty Trends

Profitable Bitcoin Mining Machine 2025 generally increases over time, reducing individual mining rewards. Buyers should:

- Project difficulty increases into profitability calculations

- Choose machines with efficiency margins for future difficulty growth

- Consider the machine’s useful lifespan before becoming unprofitable

Inadequate Due Diligence

Thorough research is essential before purchasing mining equipment:

- Verify seller reputation and warranty terms

- Compare specifications across multiple sources

- Read user reviews and mining community feedback

- Understand support and service availability

- Confirm regulatory compliance in your jurisdiction

Investment Alternatives to Direct Mining

Cloud Mining Services

For investors seeking Bitcoin mining exposure without hardware management, cloud mining offers an alternative. However, careful evaluation is necessary due to:

- Service provider reliability concerns

- Contract terms and fee structures

- Profitability compared to direct mining

- Regulatory status of cloud mining providers

Mining Stocks and ETFs

Publicly traded mining companies provide exposure to Profitable Bitcoin Mining Machine 2025 traditional investment vehicles:

- Mining company stocks (Marathon Digital, Riot Blockchain, etc.)

- Bitcoin mining ETFs

- Cryptocurrency-focused mutual funds

- Blockchain technology investment funds

Mining Equipment Leasing

Some companies offer mining equipment leasing arrangements that can reduce upfront capital requirements while providing access to latest-generation hardware.

Conclusion

Selecting the most profitable Bitcoin mining machine 2025 requires careful analysis of multiple factors including hash rate, energy efficiency, initial costs, and ongoing operational expenses. The machines highlighted in this guide represent the current leaders in mining profitability, with the Antminer S21 XP and Whatsminer M60S offering excellent options for different budget ranges and electricity cost scenarios.

Success in Profitable Bitcoin Mining Machine 2025 only on choosing the right equipment but also on optimizing operations, managing costs, and staying informed about market trends. With mining machines costing $2,000-$20,000, making it challenging for anyone but professional miners to participate, careful planning and execution are essential for achieving profitable operations.

As the cryptocurrency market continues to evolve, staying updated on technological advances and market conditions will help you maintain competitive mining operations. Whether you’re starting with a single machine or planning a larger mining farm, the key to success lies in thorough research, proper planning, and continuous optimization of your mining strategy.