Every few years, the crypto market enters a phase where everything seems to accelerate at once. Charts turn vertical, forgotten tokens come back to life, and social media turns into a constant stream of new coin tickers and overnight success stories. That period has a name: altcoin season. As we move closer to Altcoin Season 2025, many traders and investors can feel the storm clouds gathering again.

Unlike a normal rally, Altcoin Season 2025 is expected to be a full-scale rotation from Bitcoin into a wide range of altcoins, including DeFi tokens, AI coins, gaming projects, infrastructure networks, and even the most speculative meme coins. It is the moment when capital starts hunting for higher returns outside of Bitcoin and Ethereum and spills over into the broader ecosystem, often creating life-changing gains for some and devastating losses for others.

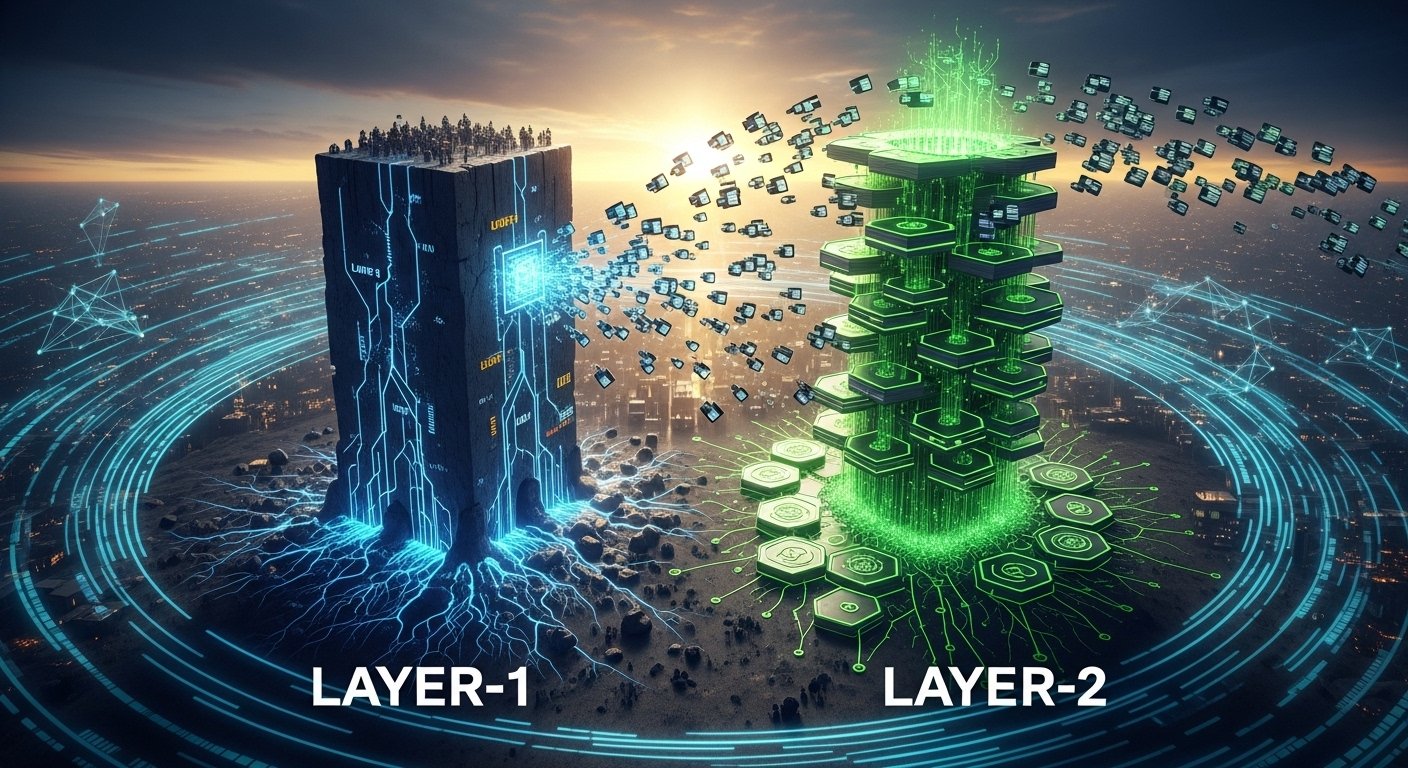

What makes this upcoming cycle different is how much the crypto landscape has matured. There are now more layer-1 blockchains, more layer-2 scaling solutions, better on-ramps for new users, and a far deeper understanding of how previous altcoin seasons played out. This time, the storm is building over a much larger, more complex ocean. In this comprehensive guide, you will learn what altcoin season really means, why 2025 could be a turning point, which sectors are likely to dominate, and how to navigate the coming volatility with a clear plan instead of blind hope.

Understanding Altcoin Season in the Crypto Market

Altcoin season is not simply a few days of random pumps. It is a sustained period when altcoins outperform Bitcoin across the board. During these phases, traders measure performance not just in dollars, but in BTC and ETH terms. When the market enters a real altcoin season, you will often see coins gaining value both in fiat and relative to the top two cryptocurrencies.

Historically, altcoin seasons have followed a fairly recognizable pattern. Bitcoin usually leads the way, posting strong gains and drawing capital back into crypto from the sidelines. Once Bitcoin reaches a certain level of dominance and begins to slow down or consolidate, traders look around and start shifting funds into altcoins. At first, this rotation favors large, well-known projects such as Ethereum, leading smart contract platforms, and established DeFi protocols. Over time, as confidence grows and greed starts to dominate, the same wave of capital begins to reach smaller, riskier tokens that offer higher upside but far less fundamental support.

In practical terms, Altcoin Season 2025 would mean a period where Bitcoin feels almost calm compared to the rest of the market. While BTC might be grinding slowly higher or moving sideways, altcoins would be exploding higher in clusters, with new narratives, new sectors and new leaders emerging week after week.

Why 2025 Could Be a Pivotal Altcoin Year

There are several reasons why many traders expect Altcoin Season 2025 to be especially explosive. The first reason is structural. Each cycle, the base of users, capital and infrastructure in crypto tends to grow. More people know about digital assets, more exchanges and wallets exist, and more institutional players are at least partially involved. That means the starting point for the next altcoin wave is larger than ever before.

Another key factor is how much the crypto narrative has broadened. In earlier years, it was mostly about Bitcoin as digital gold or Ethereum as the smart contract leader. Today the conversation includes decentralized finance, Web3 applications, real-world asset tokenization, AI-integrated protocols, decentralized data networks, and a sophisticated ecosystem of layer-2 solutions. Each of these themes comes with its own set of altcoins that could benefit from renewed attention and capital inflows.

2025 also sits at a point where traditional financial markets may still be digesting earlier shocks and policy shifts. If global liquidity conditions become more favorable and risk appetite returns, crypto as a whole could benefit. In that environment, Bitcoin often acts as the gateway, with altcoins capturing the bulk of the speculative upside once the initial capital has entered the market.

The Classic Cycle: From Bitcoin Dominance to Altcoin Mania

To understand Altcoin Season 2025, you need to appreciate the classic sequence that has repeated in previous cycles. The first stage is usually a strong Bitcoin rally. The BTC price dominates headlines, institutional interest rises, and mainstream media rediscover the asset. During this time, Bitcoin’s dominance over total crypto market capitalization tends to increase because most of the new capital flows into BTC.

Once Bitcoin has rallied significantly and early investors sit on large unrealized profits, its upward momentum often slows. It may begin to trade within a range or move in a more predictable upward channel instead of surging higher. At this point, experienced traders start to rotate some of their gains into altcoins, looking for the next wave of outperformance. The first beneficiaries are usually the strongest large-cap projects, especially Ethereum and other major layer-1 networks.

As the rotation continues and sentiment becomes more optimistic, mid-cap and small-cap altcoins begin to awaken. This is the heart of altcoin season. Charts that were flat for months suddenly begin to trend upward. Tokens that were ignored during the Bitcoin rally now post large daily candles. Entire sectors such as DeFi, gaming, AI, or meme coins can rise in unison as narratives spread.

The final stage is often dominated by excess and emotional decision-making. Retail traders arrive late, chasing coins that have already multiplied several times. Projects with weak fundamentals may pump purely because they belong to a fashionable sector. When this phase ends, it usually does so violently, with rapid drawdowns and a return to more sober valuations.

How Altcoin Season 2025 Might Be Different

Although the general pattern may repeat, Altcoin Season 2025 is unlikely to be a perfect copy of past cycles. One major difference is the presence of more robust infrastructure. Transaction fees on many networks are lower, execution is faster, and the user experience has improved. This makes high-frequency trading, cross-chain rotations and active portfolio management more accessible to a wider audience.

Another difference is the depth of knowledge in the market. Many participants have now lived through at least one full bull and bear cycle. They have seen how quickly things can reverse and how dangerous leverage can be in volatile altcoins. This accumulated experience may lead to more disciplined behavior from some players, even as newer participants repeat the same old mistakes.

The regulatory environment has also evolved. In several regions, authorities have clarified rules around exchanges, stablecoins, token offerings, and institutional participation. While there are still many gray areas, this general trend toward clearer guidelines can make altcoin exposure more acceptable for cautious investors, especially if packaged through structured products or diversified funds. All of these factors suggest that the storm of Altcoin Season 2025 will unfold over a larger, more interconnected system, with new channels for both opportunity and risk.

Sectors That Could Lead Altcoin Season 2025

DeFi and the Search for Real Yield

One of the most promising areas for altcoins in 2025 is a new generation of DeFi protocols focused on real yield and sustainable business models. Early DeFi booms relied heavily on inflationary token emissions and aggressive incentives to attract liquidity. Many of those models proved unsustainable once the incentives faded.

The new wave of DeFi projects is different. They prioritize revenue sharing, fee generation and tokenomics designed around real economic activity. Protocols that earn fees from trading, lending, derivates, staking or real-world assets and then share those revenues with token holders are likely to attract serious attention in Altcoin Season 2025. In such a market, capital tends to flow toward tokens that can justify their valuations with actual cash flows instead of pure speculation.

Layer-1 and Layer-2 Platforms Competing for Dominance

Competition among layer-1 blockchains and layer-2 scaling solutions will almost certainly remain intense. Projects that can offer speed, scalability, security and a vibrant developer ecosystem are well-positioned to benefit from a broad altcoin rally. In previous cycles, single chains had their moment in the spotlight, capturing much of the attention and liquidity for a period.

In 2025, it is more likely that several platforms share the stage, each attracting different communities and use cases. This could include general-purpose smart contract platforms, high-performance chains optimized for trading or gaming, and specialized networks focused on privacy, interoperability or data. As more users and builders migrate to the platforms that best serve their needs, the native tokens of these ecosystems can act as leveraged plays on that growth.

AI, Data and Decentralized Compute

The intersection of artificial intelligence and crypto is another theme that may define Altcoin Season 2025. Many believe that AI will continue to dominate the broader tech narrative, and crypto projects that truly integrate with AI in meaningful ways could see outsized interest. Examples include decentralized compute networks that offer GPU resources to AI developers, data marketplaces that allow users to monetize their data for AI training, and protocols that explore verifiable and auditable AI outputs using blockchain technology.

Tokens that power these systems may be seen as a way to gain exposure to both AI and Web3 at the same time. Of course, this sector is also vulnerable to shallow projects that simply attach the word “AI” to their branding without real substance. Distinguishing between genuine infrastructure and opportunistic marketing will be crucial.

Gaming, Metaverse and Digital Ownership

The concept of digital ownership remains one of the most powerful ideas in Web3. Blockchain gaming, metaverse experiences and NFT-based ecosystems are likely to return as major narratives during Altcoin Season 2025. The difference compared to earlier attempts is that developers now understand the importance of building fun, sustainable games and worlds, rather than simply bolting a token economy onto a shallow experience.

Projects that can combine compelling gameplay, fair monetization and meaningful ownership of in-game assets may attract both traditional gamers and crypto-native users. Tokens tied to gaming infrastructure, virtual worlds, and NFT marketplaces could benefit if this sector catches fire again.

Recognizing the Onset of Altcoin Season 2025

For many traders, one of the hardest challenges is knowing whether altcoin season has truly started or whether they are simply witnessing another short-lived rally. A genuine altcoin season usually reveals itself through a combination of factors rather than a single signal. One sign is persistent outperformance of altcoins against Bitcoin over several weeks.

When you see Ethereum gaining against BTC, followed by strong moves in other large caps and then a broad surge across multiple mid caps and small caps, you are likely in the early or middle stages of altcoin season. Another sign is a visible increase in trading volume and social media activity around specific sectors. When entire categories such as DeFi, gaming or AI start to trend at the same time, it suggests coordinated capital flows rather than isolated pumps.

In Altcoin Season 2025, you may also notice an explosion of new narratives and terms. Traders and influencers will coin new labels for emerging trends, and some of the vocabulary will spread quickly across platforms. Paying attention to these shifts can help identify where the market’s focus is moving.

Strategies for Navigating Altcoin Season 2025

Surviving and thriving during Altcoin Season 2025 requires more than luck. It demands a combination of preparation, discipline and emotional control. One of the most effective approaches is to adopt a clear framework before the market becomes chaotic. That can include deciding how much of your portfolio you are willing to allocate to altcoins, how you will balance larger, more established projects with smaller speculative plays, and what kind of time horizon you are targeting for each position.

Risk management is the foundation of any successful strategy. It is easy to become overconfident when every chart is up only, but that is usually when risks are highest. Setting personal rules for maximum drawdowns, avoiding excessive leverage and reducing exposure when euphoria becomes obvious can make the difference between leaving altcoin season in a stronger position or watching paper profits vanish in a matter of days.

It is also helpful to think in terms of narratives and sectors rather than just individual coins. During altcoin season, capital often flows in waves. A sector wakes up, leading projects move first, and then secondary projects follow. Understanding this pattern can help you focus on strong leaders while being cautious with latecomers.

Major Risks and Pitfalls During Altcoin Season

Every altcoin season carries significant risk. The very volatility that creates extraordinary gains can also produce devastating losses. One of the most dangerous pitfalls is chasing momentum too aggressively. Buying at the top of a parabolic move simply because everyone is talking about a token is rarely a winning strategy. When the mood shifts even slightly, late entrants are often the first to suffer.

Another serious risk is exposure to low-quality projects. During Altcoin Season 2025, a wave of new tokens will appear, many of them rushed to market to take advantage of hype. Some will have anonymous or unproven teams, unclear tokenomics, or outright scam intentions. Without careful research, it is easy to confuse well-marketed narratives with genuine innovation.

Emotional decision-making is a third major threat. Fear of missing out can push people into positions that do not fit their risk tolerance, while fear of loss can cause panic selling at exactly the wrong time. Practicing emotional discipline, keeping a long-term perspective and sticking to pre-defined strategies can help mitigate these psychological traps.

Preparing Today for the Storm of Altcoin Season 2025

The best way to face Altcoin Season 2025 is to prepare while the market still feels relatively calm. That preparation can include studying past altcoin seasons to understand how quickly conditions can change, reviewing your own performance in previous cycles to identify mistakes and strengths, and building a watchlist of projects you genuinely understand and believe in.

Education is one of your strongest tools. Learning about concepts such as tokenomics, on-chain activity, protocol revenue, total value locked, and community engagement will help you separate promising altcoins from empty shells. The more you know about how a project works and why it might accrue value, the less likely you are to be swayed by hype alone.

Finally, it is important to know yourself. Define what altcoin season success looks like for you. For some, it may be doubling their portfolio and then rotating into more stable assets. For others, it may be a smaller, more conservative gain with limited stress. There is no single correct approach, but there is definitely a wrong one: entering a highly volatile market with no plan and no boundaries.

Conclusion

ALTCOIN SEASON 2025: THE STORM THAT’S ABOUT TO UNFOLD is both a warning and an opportunity. It is a warning because altcoin seasons are never gentle. Prices move fast, narratives change overnight, and those who are not prepared often get swept away by volatility. It is an opportunity because periods like these can compress years of market movement into a handful of months, offering rare chances to accelerate financial progress for those who approach them with respect and discipline.

As the crypto market matures, the next altcoin season will not be a simple replay of the past. It will unfold across a richer ecosystem of DeFi, AI, gaming, infrastructure, and layer-2 networks, with more capital, more players and more complexity. Your goal is not to predict every move, but to understand the forces at work, choose your battles wisely and protect yourself from the most common traps. Altcoin Season 2025 may indeed become the storm that reshapes the landscape of digital assets. Whether it leaves you stronger or stranded will depend less on luck and more on the choices you make before and during the storm.

FAQs

Q: What is Altcoin Season 2025 in simple terms?

Altcoin Season 2025 refers to a potential period when a large number of altcoins outperform Bitcoin for an extended time. During this phase, capital rotates from BTC and other major coins into a variety of smaller projects, causing rapid price appreciation across sectors like DeFi, gaming, AI and infrastructure. It is not guaranteed, but many traders expect such a phase as part of the natural crypto cycle.

Q: Why do altcoins usually pump after Bitcoin?

Altcoins often rally after Bitcoin because BTC typically attracts the first wave of new capital in any bull cycle. Once Bitcoin has moved significantly and begins to consolidate, investors who want higher returns start looking at altcoins. This rotation pushes money into Ethereum and other large caps first, then into riskier mid caps and small caps, creating the conditions for an altcoin season.

Q: Which types of altcoins might perform best in 2025?

No one can know in advance, but historically the strongest performers tend to be tokens tied to powerful narratives and real usage. In Altcoin Season 2025, that might include DeFi protocols with solid revenue, efficient layer-1 and layer-2 networks, AI and data infrastructure projects, and well-designed gaming or metaverse ecosystems. The key is to look for genuine utility, active development and growing communities rather than pure speculation.

Q: How risky is it to invest during altcoin season?

Investing during altcoin season is inherently risky. Volatility is extreme, prices can move dozens of percentage points in a day, and many projects will eventually retrace most of their gains. However, with careful risk management, clear position sizing and a well-defined exit plan, some investors choose to participate to capture potential upside. It is vital to only use capital you can afford to lose.

Q: How can I prepare myself for Altcoin Season 2025?

To prepare for Altcoin Season 2025, focus on education, research and planning. Learn how to evaluate projects, study previous cycles, and decide in advance how much of your portfolio you are willing to allocate to altcoins. Build a watchlist of tokens you understand, set personal rules for risk management and be ready to act deliberately rather than impulsively when the market begins to move.

Also Read: Altcoin Price Watch XRP, Zcash Under Fire