Every time the market plunges, the same question returns with a new sense of urgency: after a sudden crypto crash, will Bitcoin and altcoins recover, or is this the start of a deeper crypto winter? December brings its own drama. It is the final chapter of the trading year, a time when portfolios are tidied up, taxes are considered, and traders either chase a last rally or lock in profits and walk away.

This year, the combination of a sharp Bitcoin price drop, aggressive selling in the altcoin market and a wave of liquidations has rattled even experienced investors. Green candles that once seemed unstoppable have been replaced by red daily closes, falling market cap, and a mood that swings between denial and panic. Social feeds that were full of victory screenshots now show threads about risk management and “lessons learned.”

Despite the fear, the question “Will Bitcoin and altcoins recover in December?” does not have a simple yes or no answer. Short-term market moves are driven by a complex mix of leverage, emotion, macroeconomic data, regulation and technical factors. However, by understanding what drives a crypto crash, how Bitcoin typically behaves around year-end, and what separates strong altcoin projects from weak ones, you can form a more grounded view and decide how to position yourself. This in-depth guide explores the mechanics of the recent crypto crash, the prospects for a December rebound, and practical strategies you can use whether the market recovers quickly or takes months to stabilise.

Understanding the latest crypto crash

A crypto crash is rarely the result of one single event. It is usually a chain reaction that begins quietly and ends loudly, with cascading liquidations and panic selling.

What typically triggers a crypto crash

The most obvious trigger for a crypto crash is an abrupt shift in sentiment. When the Bitcoin price has been climbing for weeks or months, leverage starts to build up in the system. Traders use margin, futures and perpetual swaps to amplify gains. As long as prices move up, this seems like free money.

The problem appears when a negative catalyst arrives. It could be hawkish central bank comments, a new regulatory headline, large outflows from a popular ETF, a major exchange issue or even just a technically overbought chart. When price starts moving down quickly, highly leveraged positions become vulnerable. Once liquidation levels are hit, automatic selling kicks in. That selling pushes prices lower, which triggers more liquidations in a vicious circle.

Because Bitcoin is the benchmark of the market, its move often sets the tone. When a leveraged flush hits Bitcoin, traders rushed into altcoins during the bull phase may discover that there are not enough buyers under the market. Thin order books in smaller coins amplify each sell order, creating extremely sharp moves. This is why altcoin prices typically fall harder than Bitcoin during a crypto crash.

How deep the damage can go

The depth of a crypto crash depends on where the market is in the cycle. At the very beginning of a bull run, pullbacks often get bought quickly as fresh capital enters. Late in a cycle, after months of hype and aggressive risk-taking, there may be fewer sidelined buyers and more tired holders looking for any excuse to exit.

In a severe crash, you will often see three things. First, dramatic intraday ranges and heavy liquidations, particularly on leveraged perpetual contracts. Second, a sharp drop in total crypto market capitalization, with small and illiquid coins losing a large portion of their value. Third, rising fear indicators, such as sentiment indices plunging into “extreme fear,” funding rates flipping negative and social media mood turning aggressively bearish. Understanding this structure helps you read the current crypto crash more clearly and assess whether the market is closer to panic-driven capitulation or simply in the middle of a deeper, grinding correction.

Bitcoin in December: crash or setup for a rebound?

Because Bitcoin is the anchor of the digital asset space, any talk about whether the crypto crash will end in December has to start with Bitcoin itself.

Seasonal patterns and year-end dynamics

Historically, December has been a mixed month for the Bitcoin price. Some years it has delivered powerful “Santa rallies,” where BTC surged into year-end as traders chased performance and fear of missing out returned. Other years it has seen painful selloffs, especially when a prior bull run extended too far and tax-related selling or profit-taking dominated.

There is no magical December effect that guarantees a recovery after a crypto crash. However, a few year-end dynamics are worth noting. Many funds and active traders rebalance portfolios, locking in gains or crystallising losses for tax purposes. If Bitcoin has fallen sharply in the weeks before December, some investors may actually buy on weakness to position for the next year, while others sell remaining winners to offset losses.

This tug-of-war can create sharp moves both ways. A Bitcoin recovery in December is more likely if the broader macro backdrop supports risk assets, if the selling has exhausted major sellers, and if there are clear catalysts on the horizon such as ETF developments, halving narratives or positive regulatory clarity.

Key signals to watch for a Bitcoin rebound

When asking whether Bitcoin will recover in December, it is more useful to watch signals than to rely on calendar myths. There are several clues that often precede a stabilisation phase after a crypto crash.

One is the behaviour of long-term holders. When on-chain data shows that long-term wallets are accumulating rather than dumping, it suggests that strong hands still believe in the long-term story and view the drop as an opportunity. Another is the pace of liquidations. If large chunks of leveraged positions have already been flushed out, there may be less forced selling left.

Price action itself matters too. After a chaotic crypto crash, the Bitcoin chart often needs time to build a base. That can look like a sideways range with gradually decreasing volatility, where each new low is less dramatic than the last. A series of higher lows on the daily chart, strong rebounds from key support zones and increasing spot volumes can all point toward a potential December recovery, even if the path remains volatile.

Altcoins after the crash: which ones can recover?

Whenever a crypto crash hits, altcoins suffer the most. The big question is not whether they fall more – they almost always do – but which ones have a realistic chance to recover if Bitcoin stabilises.

Large-cap altcoins versus small-cap tokens

Large-cap altcoins such as Ethereum and other established layer-one networks tend to track the Bitcoin price with higher volatility. In a crash, they drop deeper. In a rebound, they can climb faster. Their ability to recover in December depends on both general market risk appetite and their own narratives, such as upgrades, ecosystem growth or staking demand.

Mid- and small-cap altcoins are a different story. Many of these coins are driven largely by speculation. During a bull market, they can multiply in value purely on hype, with little revenue or real-world usage. In a crypto crash, that lack of fundamental support becomes painfully clear. A token that rallied tenfold on thin liquidity can fall 80 or 90 percent once buyers disappear.

For a genuine altcoin recovery in December, you usually need two ingredients. First, Bitcoin must stop crashing and at least move sideways or higher. Second, capital must be willing to take risk again, flowing from Bitcoin and large caps into promising projects. Coins with strong developer activity, clear use cases and active communities stand a better chance than short-lived meme tokens that relied solely on social buzz.

How to separate survivors from casualties

After a crypto crash, it is tempting to treat every coin as a bargain simply because the price is lower. However, not every project comes back. Some tokens never revisit old highs, especially if their only appeal was speculation in the last cycle. To judge whether an altcoin might recover in December or beyond, look beyond price. Check whether the project is shipping updates, retaining developers and growing real usage.

Examine tokenomics: is there constant new supply hitting the market, or is issuance limited and predictable? Consider whether the project has an actual competitive advantage or if it is just a copy of another trend. In a shaken altcoin market, money tends to consolidate into fewer, stronger names. That means some coins can rebound dramatically while many others stagnate or drift lower even after the broader crypto crash ends.

Macro forces shaping December’s crypto outlook

No crypto crash happens in a vacuum. Macro conditions and traditional finance play a huge role in whether Bitcoin and altcoins can recover in December.

Interest rates, liquidity and risk appetite

The single most important macro story for any risk asset is the path of interest rates and liquidity. When central banks keep rates high and drain liquidity, risk assets such as tech stocks, Bitcoin and speculative altcoins all feel the pressure. Safe yields become more attractive, and investors demand a higher risk premium to hold volatile assets.

If December comes with signs that inflation is easing and central banks are closer to cutting rates or at least pausing hikes, risk appetite can improve. In such an environment, a crypto crash can be followed by a relief rally as traders anticipate easier financial conditions in the coming year.

If, instead, macro data forces central banks to remain restrictive or even more aggressive, the path to a December recovery becomes tougher. The crypto market may try to bounce, but sustained upside would clash with a macro headwind that keeps buyers cautious and large players focused on preserving capital rather than chasing high-risk trades.

Regulation, ETFs and institutional flows

Another key factor for December is the regulatory and institutional landscape. Positive developments, such as approval of new Bitcoin ETFs, clearer guidelines for crypto custody or constructive regulation on stablecoins, can help rebuild confidence after a crypto crash. They make it easier for institutions to allocate capital and for retail investors to access the market safely.

Conversely, unexpected enforcement actions, bans or negative headlines about major exchanges or stablecoins can delay any December recovery. Even if prices appear cheap, uncertainty about the rules of the game can keep larger pools of capital on the sidelines.

Institutional flows matter because they often move slower but in larger size. A few big asset managers deciding to increase Bitcoin exposure after a crash can support a rebound. A few deciding to reduce risk at the end of the year can cap upside, even if retail traders are eager to buy the dip.

On-chain and technical clues for a December recovery

Beyond macro and narrative, the crypto market offers unique data that can help answer whether Bitcoin and altcoins are likely to recover in December.

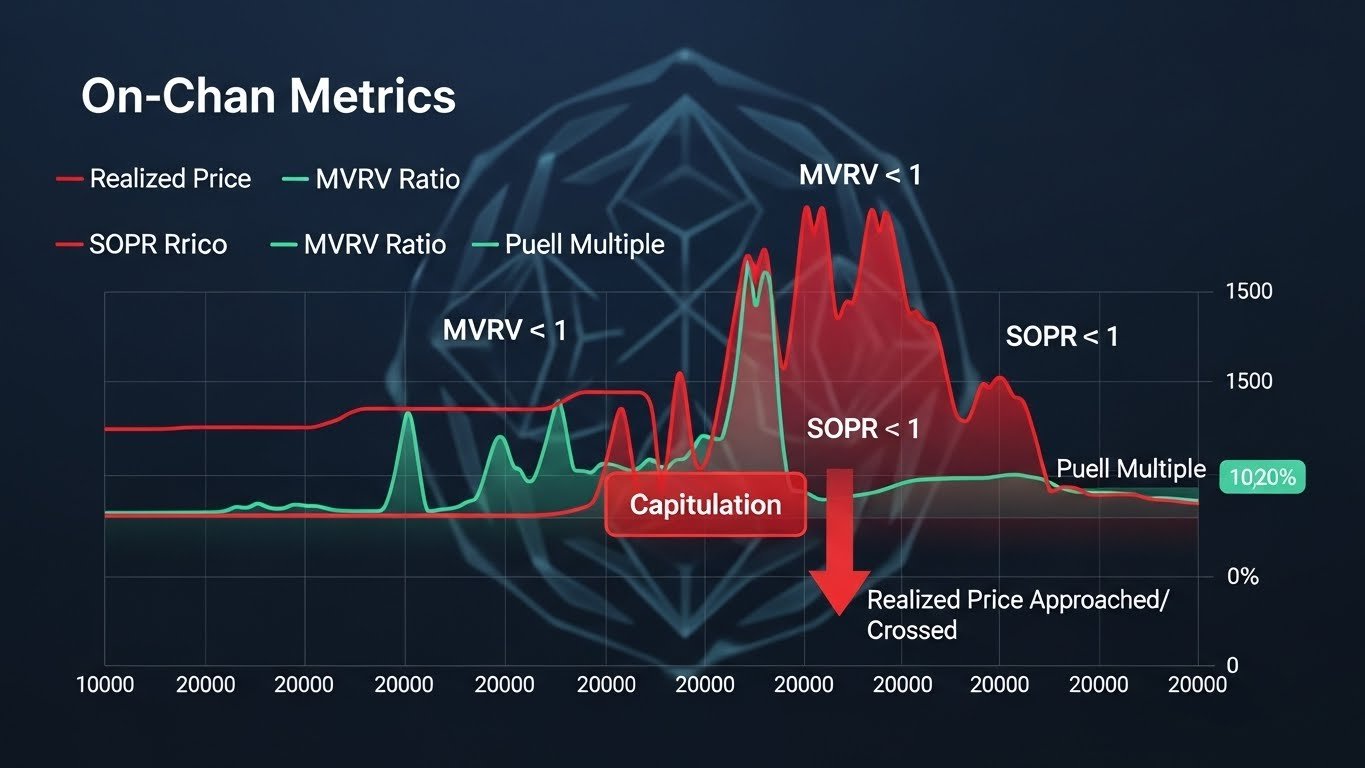

On-chain metrics that indicate capitulation

On-chain analysis looks at data recorded directly on blockchains: transactions, wallet balances, realized profits and losses, and more. Certain metrics tend to spike during a crypto crash, reflecting capitulation. If realized losses surge as many addresses sell below their cost basis, it suggests that weaker hands are purging their holdings. If long-term holders remain relatively stable or even increase their balances during the same period, it indicates confidence beneath the surface. A crypto crash where both long-term and short-term holders are dumping is usually more severe and may take longer to heal.

Other on-chain indicators, such as funding rates on perpetual futures and open interest, tell you how much leverage remains in the system. When these metrics drop sharply after a crash, it means that excessive leverage has been flushed out. While this process is painful, it also creates the conditions for a healthier recovery, potentially even within December if other factors line up.

Technical patterns and timeframes

Technical analysis does not predict the future, but it helps frame possibilities. After a crypto crash, the daily and weekly charts of Bitcoin and major altcoins often show large impulsive down moves followed by attempts to stabilise. Key support and resistance levels form around previous consolidation zones, psychological round numbers and moving averages.

A December recovery is more plausible if Bitcoin can reclaim lost support levels and turn them into new floors rather than ceilings. For example, if a major level that broke during the crash is retaken and defended on pullbacks, traders view that as a sign of strength. Tight, sideways ranges with higher lows can serve as launchpads for relief rallies. Conversely, repeated failures at resistance with lower highs suggest that sellers still dominate.

Timeframe matters as well. A strong weekly candle after multiple red weeks carries more weight than a brief intraday spike. When evaluating whether Bitcoin and altcoins are recovering or simply bouncing within a downtrend, zooming out often provides a clearer view than staring at five-minute charts.

Strategies for crypto investors during a December crash

Whether or not Bitcoin and altcoins recover in December, you still have to make real decisions with real money. The right strategy depends on your time horizon, risk tolerance and goals.

Short-term traders: volatility and discipline

For short-term traders, a crypto crash can be both a nightmare and a dream. Volatility explodes, which creates opportunities to profit from both long and short positions. At the same time, the risk of sharp, unexpected reversals increases dramatically. Discipline matters more than ever.

Successful short-term traders in a crashing market focus on position sizing, clear stop losses and defined setups rather than random guesswork. They avoid revenge trading after losses and accept that not every move is theirs to catch. In December, when liquidity can thin out around holidays and year-end, managing overnight risk is crucial. Moves during low-liquidity periods can be especially wild, particularly in smaller altcoins.

If a December recovery starts, short-term traders can ride momentum, but they should remember that bear market rallies and relief bounces can be fierce yet short-lived. Respecting the larger trend while exploiting intraday volatility is a delicate balance that requires experience and emotional control.

Long-term holders: patience and risk management

Long-term crypto investors experience a crypto crash differently. They feel the same drawdowns on their screen, but their time horizon stretches across multiple cycles. For them, the key questions are not “What will Bitcoin do tomorrow?” but “Does my thesis still make sense?” and “Is my allocation appropriate for this level of volatility?”

If you believe that Bitcoin and a select group of altcoins will be worth more years from now, a December crash may be an opportunity to accumulate at lower prices, provided you are not overexposed already. Many long-term investors use strategies like dollar-cost averaging, spreading purchases over time instead of trying to call the bottom.

At the same time, risk management remains essential. No thesis is guaranteed. A healthy long-term approach recognises that crypto is a high-risk asset class and keeps the overall allocation at a level where even large drawdowns do not threaten financial stability. If a crypto crash exposes that you were too heavily invested or using too much leverage, December can be the moment to reset and rebuild a more robust plan.

Will Bitcoin and altcoins recover in December?

With all of this in mind, can we say with certainty that Bitcoin and altcoins will recover in December? The honest answer is that no one can guarantee short-term timing in such a volatile market. What we can do is outline plausible scenarios and the conditions that make each more likely.

A bullish scenario sees the crypto crash exhaust most sellers early in the month. Macro data softens, rate expectations ease, and risk appetite slowly returns. On-chain data shows reduced leverage and renewed accumulation by long-term holders. Bitcoin stabilises above key support, then breaks out of its range, dragging large-cap altcoins higher and igniting a speculative rebound.

A more neutral scenario has Bitcoin chopping sideways in a wide range through December. Volatility remains elevated, but each new low sees less follow-through as buyers and sellers reach a temporary balance. Some strong altcoins start to outperform quietly, but broad enthusiasm does not fully return until the new year brings fresh catalysts.

A bearish scenario extends the crypto crash into a longer crypto winter. Macro remains hostile, regulation leans negative, or a major structural shock like an exchange failure undermines confidence. In this case, any December bounce might be short-lived, with new lows appearing before a durable bottom is found later.

Recognising which scenario is unfolding means watching macro data, price action, on-chain trends and sentiment rather than relying on calendar wishes. December can absolutely host a recovery, but it can also be a period of consolidation or further decline. That uncertainty is part of the reality of the crypto market.

Conclusion

The latest crypto crash is a stark reminder that Bitcoin and altcoins are still among the most volatile assets in the world. Massive rallies can be followed by equally dramatic drops, and the emotional roller coaster can be intense. Asking whether Bitcoin and altcoins will recover in December is natural, especially as the year draws to a close and investors reassess their positions.

The real value lies not in trying to guess the next few candles, but in understanding the forces at work. Rising or falling interest rates, changing liquidity, regulatory news, on-chain data, leverage and market structure all play a role in shaping how deep a crypto crash cuts and how quickly the market can heal. Some December periods will see powerful rebounds; others will mark the start of longer consolidations.

By looking beyond headlines, focusing on quality projects, managing risk and aligning your strategy with your time horizon, you can navigate the noise more calmly. Whether December delivers a sharp recovery or a slow grind, your long-term success will depend less on perfect timing and more on disciplined decision-making in both good times and bad.

FAQs about the crypto crash and December recovery

Q: Why did the latest crypto crash happen so quickly?

The latest crypto crash happened quickly because the market was heavily leveraged and sentiment was stretched. When a negative catalyst appeared, the initial selling pushed prices down enough to trigger margin calls and liquidations on leveraged positions. Automatic selling from these liquidations accelerated the move, especially on derivatives platforms. Thin liquidity in some altcoins made each sell order more impactful, turning what could have been a normal pullback into a sharp cascade lower.

Q: Is December historically a good month for Bitcoin?

December has been both positive and negative for the Bitcoin price in different years. Some cycles have seen strong “Santa rallies,” while others have been dominated by profit-taking and tax-related selling. There is no guaranteed December effect. The behaviour of Bitcoin in December depends on broader market conditions, macroeconomic trends and where the market sits in the overall cycle. Seasonal patterns can add context, but they do not override fundamentals, liquidity or sentiment.

Q: Will all altcoins recover if Bitcoin bounces in December?

If Bitcoin recovers in December, many altcoins are likely to bounce, but not all will return to previous highs. Large-cap altcoins with strong ecosystems, real usage and active development usually have a better chance of recovering over time. Smaller speculative tokens, meme coins and projects without clear utility may experience only brief relief rallies or never fully recover. A crypto crash often acts as a filter, separating more durable projects from those that relied purely on hype.

Q: Is it smart to buy the dip during a crypto crash?

Buying the dip during a crypto crash can be rewarding, but it is also risky. The safest approach is to align any dip-buying with a long-term plan and a clear understanding of your risk tolerance. Using strategies like dollar-cost averaging can reduce the pressure of timing the exact bottom. However, if you are over-leveraged or investing money you cannot afford to lose, buying aggressively into a crash can be dangerous. It is important to evaluate your overall allocation to Bitcoin and altcoins and ensure you are not betting more than you can handle emotionally or financially.

Q: How can I prepare for future crypto crashes?

Preparing for future crypto crashes starts with accepting that volatility is a permanent feature of this market, not a bug. You can reduce the impact by limiting your overall exposure, avoiding excessive leverage, diversifying across assets and keeping a cash buffer for opportunities and emergencies. Having a written plan that defines your time horizon, target allocation and rebalancing rules helps you act rationally when emotions run high. Instead of reacting in panic when the next crypto crash hits, you can follow your framework, adjust thoughtfully and continue building your position in Bitcoin and carefully chosen altcoins over time.