In Bitcoin news today, one price level keeps showing up in headlines, charts and social media discussions: $94,000. After years of volatility, halving cycles, regulatory debates and institutional adoption, Bitcoin (BTC) now finds itself hovering around this powerful psychological and technical zone. For traders and long-term holders alike, seeing BTC hold near $94K amid key technical tests feels like standing at a crossroads. The market knows a big move is brewing, but the direction is still being decided in real time.

This moment is more than just another line on a price chart. The $94K BTC price level sits at the intersection of major support and resistance, shifting market sentiment, on-chain flows from large holders, and the broader macroeconomic background. When Bitcoin holds near $94K, it tells a story about how the crypto market has matured, how trading behavior has evolved, and how closely traditional finance is now intertwined with digital assets.

In this detailed guide, we will break down why Bitcoin news today is so focused on this area, how traders are reading the charts, what long-term investors are thinking, and what scenarios could unfold next. The aim is not to hype Bitcoin or scare you away from it, but to explain clearly and calmly what this key technical test means and how it fits into the bigger picture of the crypto market.

Why BTC Holding Near $94K Matters

When people talk about Bitcoin news today, they often mention round numbers such as $50K, $75K, $100K and, now, $94K. These levels matter because they act as magnets for orders and emotions. Traders remember them, media outlets repeat them, and algorithms track them. As a result, they become turning points where major decisions are made.

The $94,000 level is especially important for several reasons. First, it is close to the symbolic $100K mark, which has been discussed for years as a possible milestone for Bitcoin. When the BTC price hovers just below such a big round number, both bulls and bears become more active. Bulls see it as a final stretch to a historic moment, while bears view it as a potential area for overvaluation and profit taking.

Second, $94K often lines up with important technical indicators, such as moving averages and previous trading ranges. When price revisits areas where a lot of buying and selling has happened before, it tends to slow down, consolidate or reverse. That is why you see the phrase “key technical tests” attached to this level in many Bitcoin market updates.

Third, the longer BTC holds near $94K, the more meaningful this zone becomes. A quick spike and rejection can be written off as noise. However, when Bitcoin price action spends days or weeks dancing around the same level, it signals that big players are actively negotiating value there. This is exactly what gives Bitcoin news today its tense, “watch-and-wait” feeling.

Market Sentiment Around Bitcoin News Today

The Emotional Side of $94K

Beyond pure numbers, Bitcoin news today is full of emotion. Fear, excitement, greed and doubt all rise as BTC moves closer to or away from $94K. For many investors who entered the market at much lower prices, this level represents unreal gains and life-changing profits. For others who joined near previous highs, it is a chance to finally break even or step into the green.

When BTC holds near $94K, social media sentiment tends to swing quickly. One strong daily candle can trigger a wave of bullish posts predicting imminent new all-time highs. A sudden pullback of a few thousand dollars can just as quickly generate gloomy forecasts of a deep correction. This back-and-forth shows how sensitive traders are to every move when Bitcoin is near a major level.

At the same time, there is a growing group of long-term holders who have lived through multiple cycles. For them, Bitcoin news today is interesting, but not everything. They see BTC near $94K as one chapter in a longer story that still includes future halvings, regulatory developments, technological upgrades and expanding institutional adoption.

The Macro and Crypto Backdrop

Sentiment in Bitcoin news today cannot be separated from the macroeconomic background. Interest rate expectations, inflation trends, central bank decisions and overall risk appetite influence how investors treat BTC as an asset. When rates are stable or falling and liquidity is abundant, speculative assets such as Bitcoin and other cryptocurrencies tend to attract more attention. In such environments, a level like $94K can be seen as a stepping stone toward higher valuations. When the macro picture looks tighter or more uncertain, the same level may look fragile, and traders may worry about downside risk.

Within the crypto market itself, the performance of altcoins, the health of DeFi, and the stability of major exchanges also affect how people read Bitcoin news today. If BTC is strong while everything else feels shaky, investors may treat it as a relative safe haven within crypto. If the whole market is running hot, some may fear an overheated environment ripe for a correction.

Key Technical Tests Around the $94K Level

Support Zones That Could Keep BTC Elevated

Technical analysis is a big part of Bitcoin news today, and the $94K BTC price level is surrounded by several important zones. Support levels are areas where buying historically has stepped in, slowing down or reversing a fall. When BTC holds near $94K, traders ask how far it could drop before significant support is expected.

Just below $94K, there is often a cluster of demand in the low $90K region. Many traders view the $92K–$93K band as an early warning area. If Bitcoin dips into this zone and quickly bounces back, the market can treat it as healthy volatility. If price slices through it with high volume, it suggests that bulls are losing control, at least in the short term.

Below that, some analysts watch the upper $80K to high $80K levels. These areas frequently align with rising trend lines, longer-term moving averages or previous consolidation zones where BTC paused before pushing higher. When Bitcoin news today reports that the price is “testing support,” these are the kinds of levels being referenced. The key idea is that support zones act like safety nets. As long as BTC price stays above them and keeps reclaiming $94K after any dips, traders can argue that the broader uptrend remains intact.

Resistance Levels And Breakout Scenarios

On the flip side, resistance levels are where selling pressure historically increases. Around $94K, the obvious resistance band lies just overhead. Levels in the $95K region often act as a ceiling that BTC must break decisively to convince the market that a genuine breakout is underway. In Bitcoin news today, you often see phrases like “BTC faces rejection near resistance” or “Bitcoin struggles to clear $95K.” This reflects the pattern of price pushing into that band, meeting sell orders, and either failing or needing several attempts before finally punching through.

If BTC holds near $94K and eventually breaks cleanly above $95K, many traders will look for confirmation through stronger volume and sustained price action rather than a quick wick. In that scenario, talk of a move toward the psychological $100K level naturally intensifies, and the bullish narrative gains fuel. If Bitcoin repeatedly fails at these resistance zones, however, Bitcoin news today can flip in tone, emphasizing possible double tops or distribution patterns that often precede deeper pullbacks.

Indicators Traders Watch Around $94K

In addition to horizontal levels, traders studying Bitcoin technical analysis near $94K lean on several popular indicators. Moving averages help them see whether the current price is stretched too far above its recent trend or still sitting in a comfortable zone. When Bitcoin is trading above important moving averages, it suggests buyers remain in control on higher time frames.

The Relative Strength Index (RSI) is another favorite tool. If RSI is extremely high while BTC holds near $94K, it may signal overbought conditions and a greater probability of a short-term correction. If RSI has cooled off even as price consolidates near the top, it can be seen as a healthy reset that might support another leg higher.

Volume is also critical. Bitcoin news today often comments on whether breakouts or breakdowns are “supported by strong volume.” When BTC attempts to clear $95K or defend $92K, traders look closely at volume bars. High volume suggests genuine conviction, while low volume can indicate a lack of enthusiasm and a higher chance of false moves.

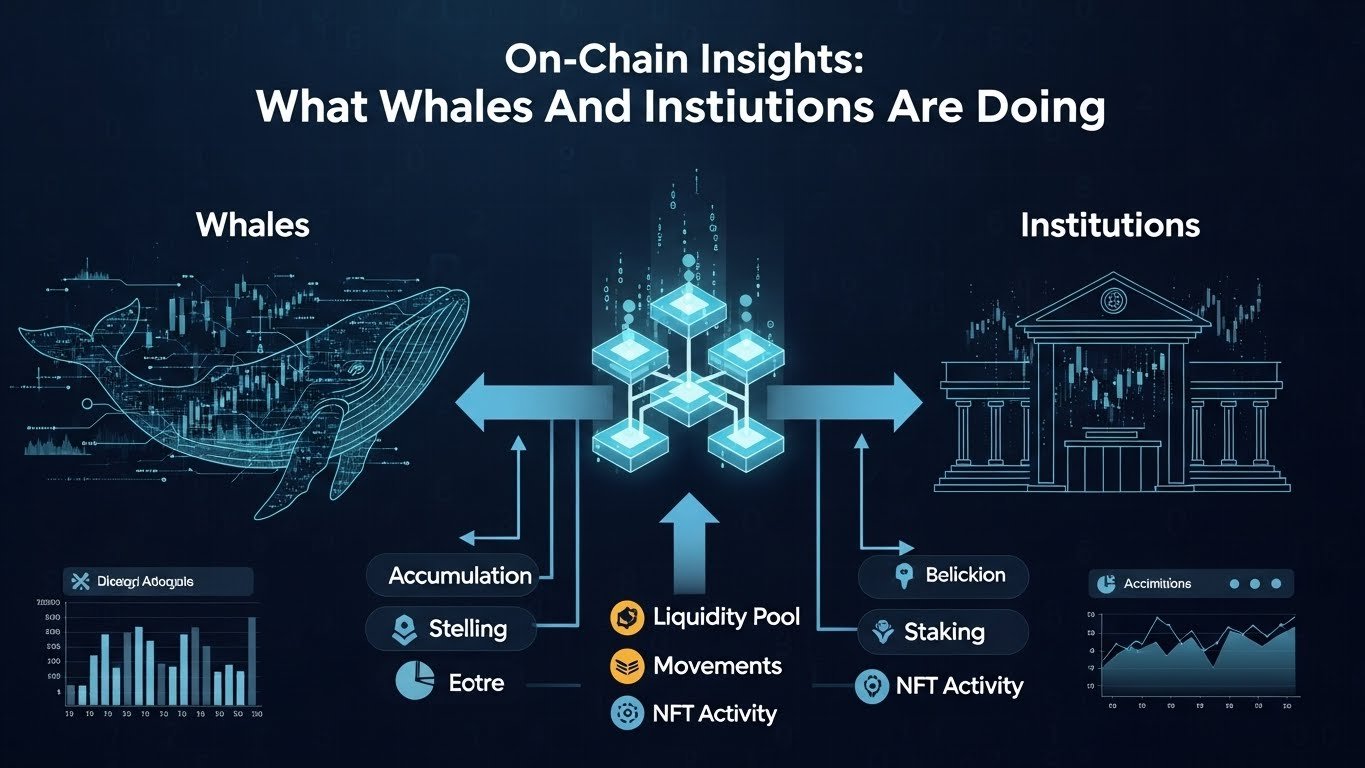

On-Chain Insights: What Whales And Institutions Are Doing

A major reason Bitcoin news today is more sophisticated than in earlier cycles is the availability of on-chain data. Analysts can now watch how whales, long-term holders and large institutions behave around critical levels such as $94K. When BTC holds near $94K amid key technical tests, on-chain indicators like large transaction counts, exchange inflows and outflows, and long-term holder supply provide extra clues. Increased whale accumulation in this region can suggest that big players view this price as attractive for building or adding to positions. Rising exchange inflows, on the other hand, may hint that some holders are preparing to take profits or hedge risk.

Institutional involvement, often tracked indirectly via custody addresses and ETF-related activity, also shapes the narrative. Strong inflows into institutional Bitcoin products while BTC lingers near $94K can reinforce the sense that traditional finance is still bullish on the long-term story, even if short-term traders are nervous. For smaller investors, the value of this on-chain perspective is that it adds another layer of evidence to the picture. Price alone can be deceptive. Seeing how coins move under the surface helps filter noise and gives Bitcoin news today more depth and context.

Trading Around $94K: Balancing Opportunity And Risk

When you see headlines like “Bitcoin news today: BTC holds near $94K amid key technical tests”, the obvious temptation is to ask whether this is the time to buy, sell or simply watch. Although any serious decision must be based on your own research and risk tolerance, it is helpful to understand how different types of traders think about such situations. Short-term traders see BTC near $94K as an opportunity for tactical positioning. They look for clear setups on shorter time frames, such as breakouts above resistance, retests of support, or momentum shifts indicated by RSI and volume.

Their focus is on risk-reward in the near term, sometimes with tight invalidation levels if price moves against them. Swing traders typically zoom out a bit. For them, the question is whether the broader trend remains up and whether current consolidation near $94K is a pause before continuation or a warning of potential reversal. They may watch daily or weekly closes around these levels, waiting for patterns such as higher lows, strong bullish candles or clear breakdowns before acting.

Long-term investors, including many who follow Bitcoin news today mainly to stay updated, use levels like $94K differently. Rather than trying to time every small move, they focus on whether the long-term thesis for Bitcoin remains intact. For them, temporary tests of support and resistance are expected parts of a larger journey that includes multiple cycles, advancing technology and changing regulations. In every case, the central idea is that key technical tests around $94K are important, but they are not the only thing that matters. Time horizon, risk appetite and conviction in Bitcoin’s long-term role all play critical roles in shaping decisions.

Long-Term Outlook For Bitcoin Beyond $94K

Even though Bitcoin news today is dominated by the question of what happens around $94,000, the long-term story is bigger than any single price. Over its history, Bitcoin has repeatedly moved through phases of aggressive bull markets, crushing bear markets, and extended consolidation. Each time it has emerged with a larger user base, more infrastructure and deeper integration into the global financial system.

Looking beyond the current BTC price, there are several trends that shape the long-term outlook. The halving cycle, which reduces the rate of new Bitcoin issuance roughly every four years, continues to support the narrative of digital scarcity. Adoption by institutions, whether through direct holdings, ETFs, or integration into payment and investment platforms, keeps expanding access to BTC for mainstream investors.

Regulation also plays a role. While regulatory headlines can create fear in the short term, clearer and more consistent rules often make it easier for large, regulated firms to engage with Bitcoin and other cryptocurrencies over time. This can add depth and stability to the market, even if it introduces new constraints.

From this long-term perspective, BTC holding near $94K is a milestone rather than a destination. If Bitcoin continues to follow its historical pattern of higher highs and higher lows across multiple cycles, the importance of this level may eventually be similar to how earlier milestones like $20K or $60K are viewed now: meaningful in their time, but just one part of a much longer story.

Risks To Watch In Bitcoin News Today

No discussion of Bitcoin news today would be complete without recognizing the risks involved. Crypto remains a highly volatile asset class, and even when BTC holds near $94K amid key technical tests, there is never a guarantee that support will hold or that resistance will break in the direction you hope.

Sharp corrections can and do happen, sometimes triggered by macro shocks, regulatory surprises, exchange issues or sudden shifts in sentiment. Leverage in the system can amplify moves in both directions, leading to cascading liquidations in derivatives markets. There is also the psychological risk of chasing hype or panicking during dips. When Bitcoin price approaches big levels like $94K or $100K, it can be tempting to focus only on the upside. On the other hand, rapid drops can push people to sell at the worst possible moment.

Managing emotions becomes a crucial part of navigating Bitcoin news today. Being aware of these risks does not mean avoiding Bitcoin entirely. Instead, it encourages a more thoughtful approach, one that balances optimism about Bitcoin’s long-term potential with realistic expectations about its short-term unpredictability.

Conclusion

The headline “Bitcoin News Today: BTC Holds Near $94K Amid Key Technical Tests” captures a pivotal moment in the ongoing story of the world’s leading cryptocurrency. The $94,000 level represents more than a price; it is a meeting point for technical analysis, on-chain behavior, institutional flows, macro forces and human emotion.

As BTC holds near $94K, traders watch how support and resistance behave, how indicators like moving averages and RSI respond, and how whales and institutions move coins on-chain. Long-term investors, meanwhile, see this as one more checkpoint in Bitcoin’s evolution from a niche experiment to a globally recognized asset.

Whether the next major move is a clean breakout toward $100K or a deeper correction back into lower ranges, understanding the significance of this level helps you read Bitcoin news today with more clarity and less noise. Instead of reacting to every headline, you can see how each piece of information fits into the broader picture of a market still finding its place in the financial world.