December has arrived with exactly what the crypto market is famous for: volatility, surprises and a fresh wave of opportunities for keen-eyed investors. As major coins swing sharply, one narrative is steadily gaining traction among traders searching for high-upside bets. Apeing is emerging as one of December’s best altcoin picks under $1, catching attention as a speculative yet promising low-cap player. At the same time, Bitcoin stabilizes at $93K, acting as a crucial anchor for market sentiment, while Cardano (ADA) rallies and showcases renewed strength in an unpredictable, risk-on environment.

This unique combination of a steady Bitcoin, a resurgent Cardano and an up-and-coming micro-cap altcoin under $1 is creating fertile ground for both traders and longer-term investors. As capital rotates between large caps and smaller speculative tokens, many are asking the same questions. Why is Apeing gaining attention now? Is this just another meme-driven rally, or is there a more solid speculative thesis building underneath the hype? What does Bitcoin’s price behavior at $93K tell us about the market’s next major directional move? And how does Cardano’s rally fit into this wider seasonal pattern of volatility and opportunity?

In this in-depth guide, we will explore how Apeing has climbed to the top of December’s low-priced altcoin watchlist, why Bitcoin’s stability at $93K is so important, and what Cardano’s renewed strength means for the broader altcoin market. You will also learn about the risks, narratives and strategies that often drive these under-$1 coins during volatile periods, helping you approach this season with more clarity and less emotion.

Why December Is a Powerful Month for Altcoins Under $1

Seasonal Volatility and Risk Appetite

Historically, December is often associated with heightened volatility in the crypto market. Part of this comes from end-of-year portfolio rebalancing, profit-taking after strong rallies and speculative rotations into higher-risk altcoins. Coins trading under one dollar, like Apeing, tend to attract a particular type of trader who is comfortable with large percentage swings and is hunting for the next potential low-cap gem.

During such periods, the combination of news headlines, social media narratives and liquidity shifts creates an environment where small-cap and cheap altcoins can move quickly. A token like Apeing, priced under $1, becomes psychologically appealing because traders feel they can accumulate a larger number of tokens for a relatively modest capital outlay. This does not automatically mean it is undervalued or guaranteed to rise, but it does create strong speculative interest, especially when the broader crypto narrative is heating up.

The Psychological Power of Price Tags Under $1

There is a strong psychological component to why investors gravitate toward altcoins under $1. A lower nominal price gives the impression of affordability and upside potential. Many new or retail investors find it easier to visualize a move from $0.10 to $1 than from $93K to $150K, even if the percentage increase is what truly matters. Tokens like Apeing capitalize on this psychological dynamic, especially when they are positioned as possible breakout candidates during a bullish or transitional phase of the market.

December’s volatility amplifies this effect. With Bitcoin stabilizing at a relatively high level and large caps like Cardano rallying, attention naturally trickles down to smaller altcoins that may have lagged but now appear ready to catch up. In this context, Apeing’s positioning as one of the top December altcoin picks under $1 feels particularly relevant to traders searching for asymmetric risk-reward setups.

Apeing: Standing Out Among December’s Best Altcoin Picks Under $1

What Makes Apeing Different from Other Low-Priced Tokens

In a crowded altcoin landscape filled with meme coins, experimental DeFi tokens and niche utility projects, Apeing has started to distinguish itself as a standout speculative pick. While many sub-$1 tokens rely solely on hype, Apeing is framed as a high-risk, high-reward altcoin that aligns with the current speculative appetite of the market. The token’s low price, combined with circulating narratives around potential growth, community activity or upcoming catalysts, fuels its image as a coin that could benefit disproportionately from a renewed altcoin rally.

The fact that Apeing is being discussed alongside the phrase “December’s best altcoin picks under $1” adds another layer of momentum. These labels matter in crypto because they shape perception. When traders repeatedly see Apeing included in lists of top under-$1 altcoins, they begin to treat it as part of a curated selection rather than a random micro-cap. This can elevate liquidity, trading volume and social media coverage, all of which feed into price action.

Speculation, Narrative and the Role of Community

For tokens like Apeing, narrative and community often matter just as much as technical or fundamental indicators. A passionate base of holders can drive organic marketing through social platforms, forming a feedback loop where rising attention leads to higher demand, which in turn brings more attention. When such dynamics play out in December, a month famous for sharp breakouts and sudden reversals, the result can be spectacular short-term moves.

However, this same mechanism also makes Apeing and similar low-cap altcoins inherently risky. Just as hype can push prices up, any loss of confidence, negative news or broader risk-off mood can lead to equally rapid declines. This is why it is vital for investors to distinguish between carefully considered speculative positioning and pure impulse buying. Apeing may be topping December’s altcoin watchlists, but that does not remove the need for caution and clear risk management.

Bitcoin Stabilizes at $93K: Why It Matters for Apeing and Other Altcoins

Bitcoin as the Market Anchor

The statement that Bitcoin stabilizes at $93K carries significant implications for the entire crypto ecosystem. Bitcoin acts as the anchor for digital assets. When its price is relatively stable around a strong level such as $93K, traders feel more comfortable exploring riskier positions, including altcoins under $1 like Apeing. Stability in Bitcoin often translates into increased confidence and risk appetite in the broader market.

When Bitcoin is aggressively trending up or down, many traders retreat to safety or position themselves cautiously. In contrast, sideways consolidation around a stable price encourages capital rotation. As Bitcoin trades within a defined range near $93K, speculative energy frequently flows toward altcoins, especially those that appear undervalued or have not yet experienced a strong seasonal rally. Apeing benefits directly from this pattern, as traders search for coins that can outperform Bitcoin on a percentage basis.

The Relationship Between Bitcoin Dominance and Altcoin Performance

Bitcoin dominance, the metric that compares Bitcoin’s market capitalization to the rest of the crypto market, is another fundamental driver of altcoin cycles. When Bitcoin dominance is high and rising, altcoins often lag behind. When dominance begins to decline while price holds steady near key levels, the stage is often set for altcoin season.

In an environment where Bitcoin’s price is stable at $93K, and sentiment is cautiously optimistic, investors often look to outperform the benchmark by identifying coins like Apeing, which offer greater upside potential due to their smaller market caps and lower nominal prices. This does not guarantee success, but it does provide a rational explanation for why Apeing and other altcoins under $1 garner renewed interest when Bitcoin’s volatility temporarily cools.

Cardano Rallies in a Volatile Season

ADA’s Comeback and Its Influence on Market Confidence

While Apeing tops December’s best altcoin picks under $1, Cardano (ADA) offers a contrasting yet complementary story. Cardano is a well-established Layer 1 blockchain known for its methodical development approach and strong community. A renewed rally in ADA during a volatile season signals that investors are not only chasing speculative micro-caps but also returning to fundamentally solid, large-cap altcoins.

Cardano’s rally acts as a confidence boost for the entire altcoin market. When a major project like ADA starts gaining momentum, it sends a message that market participants are willing to allocate capital beyond Bitcoin, into both reliable large caps and promising smaller plays. This combination of a rising Cardano and a stable Bitcoin environment creates a supportive backdrop for altcoins under $1, including Apeing.

Cardano’s Role in a Broader Altcoin Rotation

The rally in ADA can also be interpreted as the early phase of a broader rotation from Bitcoin into altcoins. Traders often move from Bitcoin to high-quality majors like Ethereum and Cardano first. Once those begin to perform, attention tends to trickle down into mid-cap and low-cap names. By the time a token like Apeing is being discussed as one of December’s best altcoins under $1, it is a sign that this rotation may be well underway.

Cardano’s strength in a volatile season also shows that investors are being selective. They are not blindly chasing every coin, but instead focusing on narratives that combine credible development, active communities and favorable technical setups. In such an environment, Apeing stands out as a smaller, more speculative bet that benefits from the overall optimism flowing through the market.

How Apeing Fits into a December Portfolio Strategy

Balancing High-Risk Picks with Blue-Chip Crypto

For many investors, a sensible approach to December’s volatility is balance. While it can be tempting to go all-in on altcoins under $1 like Apeing, a more resilient strategy involves combining speculative positions with more established assets. This includes keeping a meaningful allocation in Bitcoin, which is stabilizing at $93K, and Cardano, which is rallying and reaffirming its position among top Layer 1 projects.

In this balanced framework, Apeing plays the role of a high-risk, high-upside component within a diversified portfolio. Its low entry price and potential to ride a speculative wave make it attractive, but its volatility means it should typically be sized carefully relative to the larger, more stable holdings. This way, even if Apeing experiences a sharp pullback, the overall portfolio remains anchored by the relative stability of Bitcoin and the structured growth thesis of Cardano and other blue-chip altcoins.

Time Horizons and Expectations

Another key aspect of including Apeing in a December strategy is understanding time horizons. Some traders may view Apeing primarily as a short-term seasonal trade driven by December volatility, social buzz and rotating liquidity. Others might see it as an early-stage opportunity with potential relevance in the next market cycle. In both cases, clarity on time horizon helps avoid emotional decision-making.

Short-term traders may monitor technical levels, liquidity and news closely, aiming to capture rapid price swings. Long-term holders, on the other hand, may focus more on community strength, tokenomics, roadmap expectations and future adoption. Either way, recognizing Apeing’s position as a speculative asset under $1 helps keep expectations realistic, even as hype and excitement build around its inclusion in lists of top December altcoin picks.

The Risks of Apeing into Altcoins Under $1

Volatility, Liquidity and Market Sentiment

While the narrative around Apeing and other altcoins under $1 can be compelling, the risks cannot be ignored. Low-priced tokens are inherently more volatile, often see exaggerated price reactions to relatively small order flows and can be heavily influenced by sentiment rather than fundamentals. When market mood shifts from greedy to fearful, these coins are usually the first to suffer.

Liquidity is another important factor. During bullish phases, trading volume can surge and make it easy to enter or exit positions. However, if interest fades or a sudden market drop occurs, slippage can increase dramatically, making it harder to sell larger positions without impacting the price. Anyone considering Apeing as a speculative play this December should be aware of this dynamic and size their involvement accordingly.

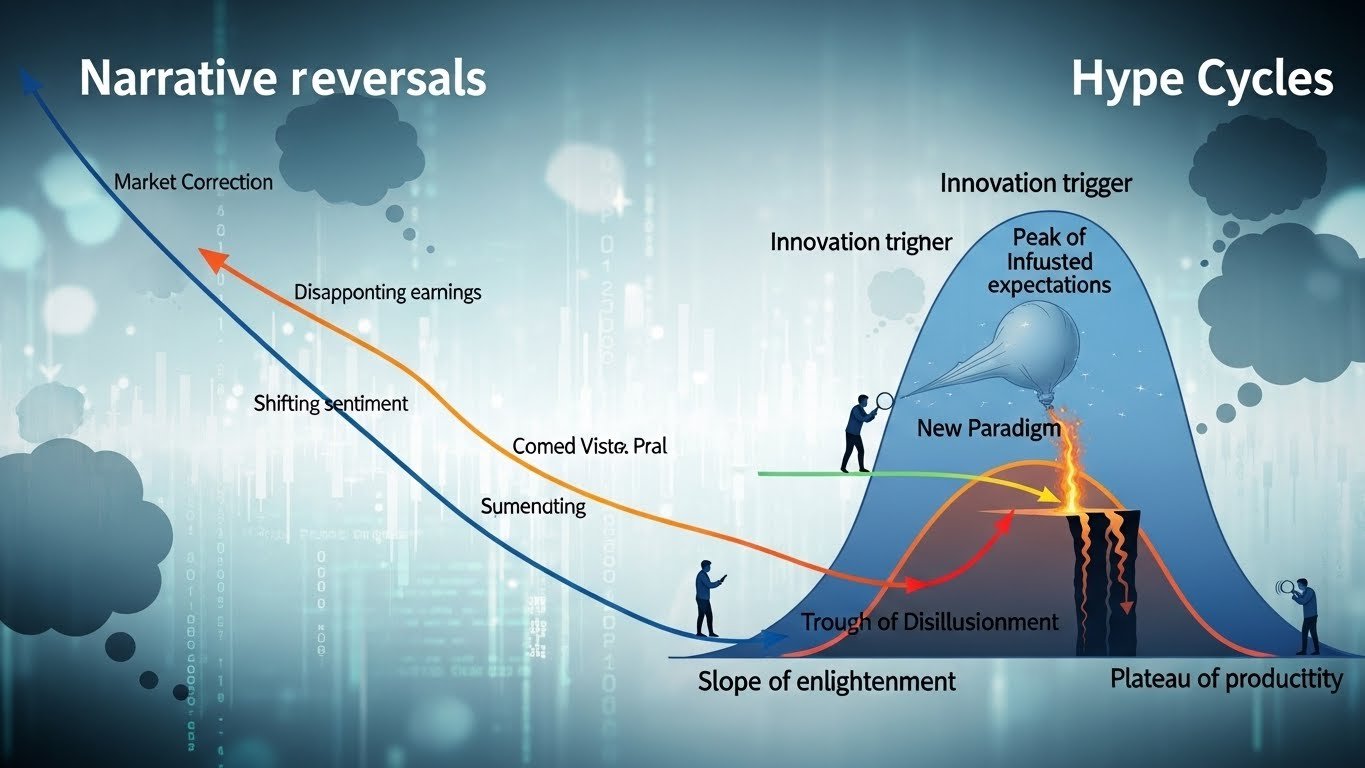

Narrative Reversals and Hype Cycles

Many cheap altcoins go through intense hype cycles where expectations become unrealistic. A token like Apeing can quickly move from being the darling of December altcoin lists to a forgotten name if the narrative fades or new opportunities emerge elsewhere. Narrative reversals often happen faster than most traders anticipate, especially in a volatile season where attention can shift overnight.

This is why due diligence and personal conviction are important. Following trends and narratives blindly can lead to buying near local tops and capitulating near bottoms. By understanding both the strengths and the vulnerabilities of Apeing’s narrative, investors can approach it with a more rational mindset, even when social media sentiment turns euphoric.

Looking Ahead: Could Apeing Sustain Momentum Beyond December?

From Seasonal Play to Ongoing Story

The big question for any altcoin under $1 that spikes during a specific season is whether it can sustain interest beyond that window. For Apeing, topping December’s best altcoin lists is an important milestone, but long-term relevance will depend on what comes next. Sustaining momentum usually requires a combination of continued community engagement, meaningful updates, strategic partnerships or evolving utility.

If Apeing manages to transform from a purely speculative December play into a token with an ongoing story, it may attract a different class of investor who values more than short-term price moves. This could gradually shift its profile from a high-risk micro-cap to a more recognized mid-cap contender, though such transitions are rare and take time.

The Role of Bitcoin and Cardano in the Next Phase

Looking beyond December, the trajectory of Bitcoin at $93K and Cardano’s rally will continue to shape the environment in which Apeing trades. If Bitcoin remains stable or trends higher, and if Cardano’s ecosystem continues to grow, the entire altcoin sector could experience a longer-lasting period of strength. In such a setting, Apeing might find more opportunities to prove its staying power.

On the other hand, if macro conditions deteriorate and Bitcoin loses its footing, the pressure on speculative altcoins would likely intensify. In that scenario, the resilience of Apeing will be tested far more rigorously. This is why it is helpful for investors to track not just the coin itself, but the larger crypto market context in which it operates.

Conclusion

December’s crypto landscape is defined by volatility, rotation and opportunity. Against this backdrop, Apeing tops December’s best altcoin picks under $1, capturing the imagination of traders eager for high-upside plays in a market where Bitcoin stabilizes at $93K and Cardano rallies with renewed strength. The combination of a steady Bitcoin, a resurgent Cardano and a speculative under-$1 altcoin like Apeing offers a vivid snapshot of how capital and attention flow during an energetic phase of the cycle.

Apeing’s appeal lies in its low entry price, compelling narrative and position within a broader wave of interest in cheap altcoins and low-cap gems. Yet the same factors that make it exciting also make it risky. Volatility, liquidity challenges and shifting sentiment are ever-present considerations when dealing with altcoins under $1. Investors who recognize these dynamics, balance their portfolios with stronger assets such as Bitcoin and Cardano, and maintain a clear strategy stand the best chance of navigating this volatile season successfully.

As always, the key is to combine curiosity with caution, enthusiasm with discipline and speculation with sound risk management. December will come and go, but the lessons learned from how Apeing performs in this unique environment can shape how you approach altcoins in every season that follows.

FAQs

Q: Why is Apeing considered one of December’s best altcoin picks under $1?

Apeing is gaining attention because it combines a low nominal price with strong speculative interest during a season known for volatility and capital rotation into altcoins. Its inclusion in discussions about December’s top altcoin picks under $1 reflects growing trader focus and the potential for outsized percentage moves relative to larger, more established coins.

Q: How does Bitcoin stabilizing at $93K impact Apeing and other altcoins?

When Bitcoin stabilizes at a strong level like $93K, it often reduces fear and encourages traders to seek higher returns in altcoins. This stability acts as a foundation for risk-taking, leading investors to explore coins such as Apeing that can potentially outperform Bitcoin on a percentage basis in the short to medium term.

Q: What role does Cardano’s rally play in the current market environment?

Cardano’s rally signals that investors are willing to allocate capital beyond Bitcoin and into solid large-cap altcoins. This rising confidence in ADA often precedes broader altcoin strength and can create a favorable backdrop for speculative under-$1 coins like Apeing, as traders rotate from major caps into smaller, more aggressive bets.

Q: What are the main risks of investing in Apeing and other altcoins under $1?

The primary risks include extreme volatility, lower liquidity, rapid shifts in sentiment and the potential for narratives to fade quickly. While these factors can generate impressive gains during bullish phases, they can also lead to sudden and severe drawdowns, especially when the broader market turns risk-off.

Q: Is Apeing more suitable for short-term trading or long-term holding?

Apeing can be used in both ways, but its current profile as a speculative altcoin under $1 makes it particularly attractive to short-term traders targeting seasonal volatility. Long-term investors may also consider it if they believe in the token’s long-range potential, but they should be prepared for significant price swings and ensure that their position size aligns with their risk tolerance and overall strategy.