The blockchain and cryptocurrency ecosystem continues to evolve at a rapid pace, with interoperability and decentralized finance emerging as two of the most powerful drivers of innovation. One of the most significant recent developments reflecting this trend is that Wrapped XRP launches on Solana, opening the door for XRP holders to participate more deeply in decentralized finance. This milestone represents far more than a simple technical integration; it signals a strategic expansion of XRP’s utility beyond its native network and into one of the fastest-growing DeFi ecosystems in the industry.

Wrapped XRP Launches For years, XRP has been known primarily for its role in fast, low-cost cross-border payments. While this use case remains central to its identity, the rise of DeFi has reshaped expectations for what digital assets can do. As Wrapped XRP becomes available on Solana, it gains access to smart contracts, decentralized exchanges, and innovative financial products that were previously out of reach. At the same time, Solana’s high throughput and low transaction costs provide an ideal environment for XRP-based liquidity to flourish.

This article explores what it means that Wrapped XRP launches on Solana, how the wrapping process works, and why this development matters for DeFi users, developers, and the broader crypto market. By examining the technical, economic, and strategic implications, we can better understand how this integration could reshape the future of XRP and strengthen Solana’s position as a leading DeFi hub.

Understanding Wrapped Assets in Crypto

Wrapped assets have become a cornerstone of interoperability in blockchain networks. To fully appreciate why Wrapped XRP launching on Solana is so impactful, it is important to understand what wrapped tokens are and why they exist.

What Is Wrapped XRP?

Wrapped XRP is a tokenized version of XRP that exists on a blockchain other than the XRP Ledger. When XRP is wrapped, the original tokens are locked in custody, and an equivalent amount of wrapped tokens is minted on another network. This ensures a one-to-one peg, meaning each unit of Wrapped XRP is backed by real XRP held in reserve. This mechanism allows XRP to move beyond its native environment and interact with smart contracts, decentralized applications, and DeFi protocols. By design, Wrapped XRP maintains the price exposure of XRP while gaining new functionality on networks like Solana.

Why Wrapping Matters for Interoperability

Interoperability is one of the biggest challenges in blockchain technology. Each network has its own strengths, but assets are often confined to their native chains. Wrapped tokens solve this problem by enabling cross-chain liquidity and asset mobility. When Wrapped XRP launches on Solana, it bridges the gap between the XRP ecosystem and Solana’s DeFi infrastructure. This allows value to flow more freely across networks, increasing efficiency and unlocking new opportunities for users who want to maximize the utility of their holdings.

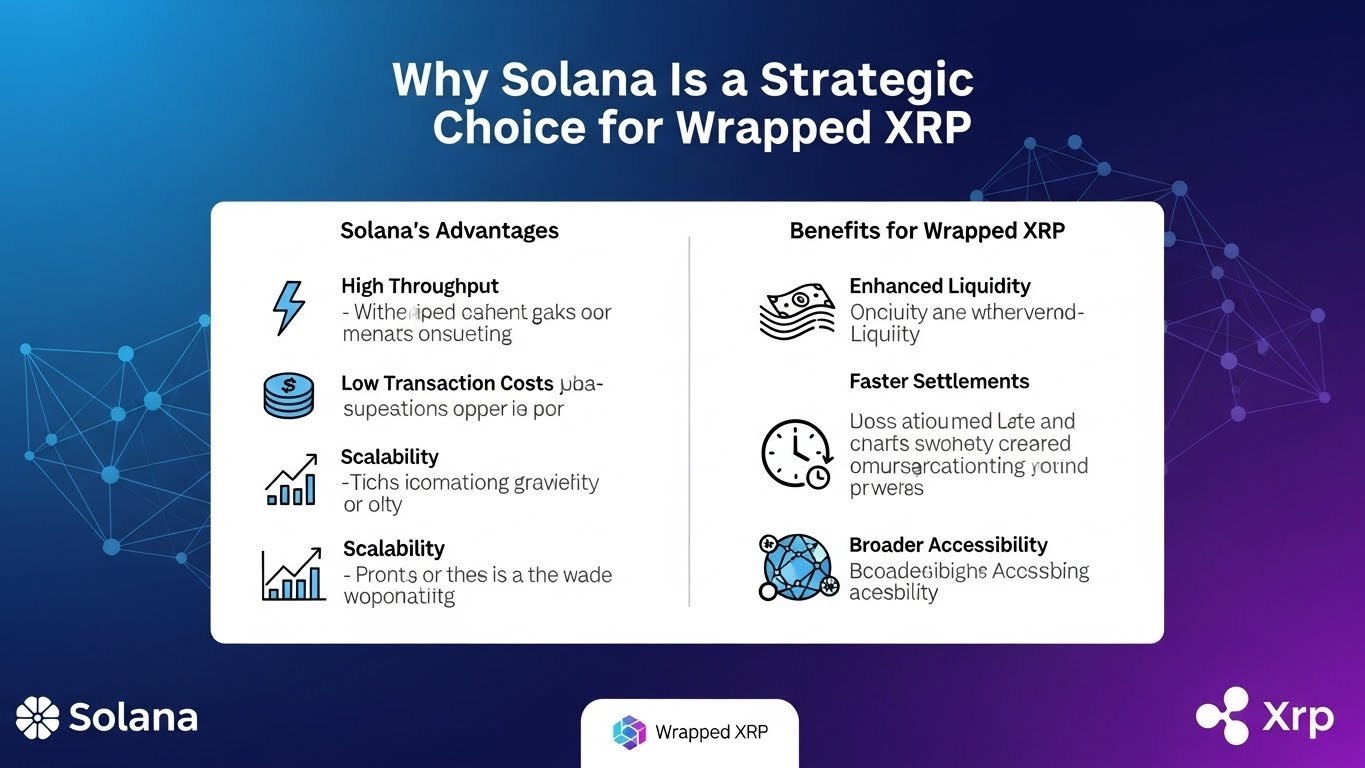

Why Solana Is a Strategic Choice for Wrapped XRP

Solana has emerged as a major player in the blockchain space, particularly in decentralized finance. Its technical advantages make it an attractive destination for wrapped assets like XRP.

Solana’s High-Performance Blockchain

Solana is known for its ability to process thousands of transactions per second with minimal fees. This high-performance design makes it ideal for DeFi applications that require speed and scalability. When Wrapped XRP operates on Solana, it benefits from these features, enabling fast swaps, efficient lending, and seamless participation in complex financial protocols. Low transaction costs also make DeFi more accessible. Users can experiment with smaller amounts of Wrapped XRP without worrying about prohibitive fees, encouraging broader adoption and increased network activity.

A Thriving DeFi Ecosystem

The Solana DeFi ecosystem includes decentralized exchanges, automated market makers, lending platforms, and yield optimization tools. By launching on Solana, Wrapped XRP instantly gains access to this vibrant environment. This integration allows XRP holders to use their assets in ways that were not possible before, such as providing liquidity, earning yield, or using Wrapped XRP as collateral. For Solana, the arrival of Wrapped XRP adds a well-established asset with a strong community, further enriching the ecosystem.

How Wrapped XRP Launches on Solana

The process behind launching Wrapped XRP on Solana involves a combination of technical infrastructure, custodial solutions, and smart contracts designed to maintain trust and transparency.

The Wrapping and Unwrapping Process

To create Wrapped XRP, users deposit XRP into a designated custody solution. These tokens are securely locked, and an equivalent amount of Wrapped XRP is minted on Solana. When users want to redeem their assets, the process is reversed: Wrapped XRP is burned, and the original XRP is released. This system ensures that Wrapped XRP remains fully backed at all times. Transparency and audits play a critical role in maintaining confidence, as users need assurance that the wrapped tokens truly represent real XRP.

Security and Trust Considerations

Security is paramount when dealing with wrapped assets. The launch of Wrapped XRP on Solana relies on robust smart contracts and trusted custodians to minimize risk. Regular audits and on-chain transparency help build confidence among users and developers alike. By combining Solana’s reliable infrastructure with well-established custody practices, the Wrapped XRP ecosystem aims to provide a secure and efficient bridge between networks.

DeFi Use Cases Unlocked by Wrapped XRP

One of the most exciting aspects of this development is the range of new use cases it unlocks. When Wrapped XRP launches on Solana, it transforms XRP from a primarily transactional asset into a versatile DeFi instrument.

Liquidity Provision and Trading

Wrapped XRP can be paired with other assets on Solana-based decentralized exchanges. By providing liquidity, users can earn trading fees while contributing to market depth. This not only benefits individual participants but also improves price stability and efficiency across the ecosystem. Trading Wrapped XRP on Solana allows for fast execution and low fees, making it attractive to both retail and institutional users seeking exposure to XRP in a DeFi setting.

Lending, Borrowing, and Yield Opportunities

Another major use case is lending and borrowing. Wrapped XRP can be deposited into lending protocols, allowing holders to earn interest on their assets. Alternatively, users can borrow against Wrapped XRP as collateral, unlocking liquidity without selling their holdings. These opportunities are central to yield farming and other DeFi strategies, enabling XRP holders to generate passive income while maintaining exposure to the asset’s price movements.

Impact on the XRP Ecosystem

The launch of Wrapped XRP on Solana has significant implications for the broader XRP ecosystem, extending its relevance beyond its traditional use cases.

Expanding Utility Beyond Payments

XRP has long been associated with fast and efficient payments. While this remains a core strength, DeFi integration adds a new dimension to its value proposition. By participating in smart contracts and decentralized finance, XRP becomes more versatile and competitive in a rapidly evolving market. This expansion of utility can attract new users and developers who may not have previously considered XRP, strengthening the ecosystem as a whole.

Increased Demand and Liquidity

As Wrapped XRP gains traction on Solana, demand for XRP itself may increase. More use cases typically translate into higher liquidity and broader market participation. This can have positive effects on price stability and overall market perception. By tapping into Solana’s active DeFi community, XRP gains exposure to a new audience, potentially driving long-term growth and adoption.

Benefits for the Solana Network

The integration of Wrapped XRP is not a one-sided development. Solana also stands to gain significantly from welcoming this established asset into its ecosystem.

Attracting New Users and Capital

XRP has one of the largest and most dedicated communities in the crypto space. When Wrapped XRP launches on Solana, it encourages XRP holders to explore Solana-based applications, bringing new users and capital into the network. This influx can boost total value locked across Solana DeFi protocols, enhancing the network’s reputation as a leading destination for decentralized finance.

Strengthening Cross-Chain Interoperability

Cross-chain integrations are increasingly important as the blockchain industry matures. By supporting Wrapped XRP, Solana demonstrates its commitment to interoperability and openness. This positions the network as a hub for diverse assets and innovative financial solutions. Such integrations reinforce Solana’s role in the broader multi-chain ecosystem, where collaboration often drives the most meaningful progress.

Challenges and Risks to Consider

While the launch of Wrapped XRP on Solana is promising, it is not without challenges. Understanding these risks is essential for users and developers alike.

Smart Contract and Custodial Risks

Wrapped assets depend on smart contracts and custodial solutions, both of which introduce potential vulnerabilities. Although audits and security measures reduce risk, they cannot eliminate it entirely. Users should remain informed and cautious when interacting with Wrapped XRP in DeFi protocols.

Market Volatility and Adoption Hurdles

DeFi markets are inherently volatile, and adoption is not guaranteed. The success of Wrapped XRP on Solana will depend on sustained interest, robust liquidity, and continued development. Market conditions and regulatory developments could also influence outcomes. Despite these challenges, the long-term potential remains strong if the ecosystem continues to mature responsibly.

The Broader Implications for DeFi and Altcoins

The fact that Wrapped XRP launches on Solana reflects a broader trend in the crypto industry. Established altcoins are increasingly seeking relevance in DeFi by leveraging interoperability and cross-chain solutions. This movement highlights a shift toward collaboration rather than competition among blockchain networks. By enabling assets to move freely across chains, the industry can unlock new efficiencies and create a more inclusive financial system. Wrapped XRP’s integration into Solana’s DeFi landscape serves as a powerful example of how legacy assets can adapt and thrive in a rapidly changing environment.

Conclusion

The launch of Wrapped XRP on Solana marks a pivotal moment for both ecosystems. By bridging XRP with Solana’s high-performance DeFi infrastructure, this integration expands the altcoin’s reach and unlocks a wide range of new use cases. XRP holders gain access to decentralized trading, lending, and yield opportunities, while Solana benefits from increased liquidity, users, and cross-chain relevance.

As interoperability continues to shape the future of blockchain, developments like this demonstrate the power of collaboration and innovation. While challenges remain, the potential upside is significant. Wrapped XRP on Solana is more than a technical upgrade; it is a strategic step toward a more connected and versatile decentralized financial system.

FAQs

Q: What is Wrapped XRP?

Wrapped XRP is a tokenized version of XRP that exists on another blockchain, such as Solana, allowing it to be used in DeFi applications while remaining fully backed by real XRP.

Q: Why is Wrapped XRP launching on Solana important?

When Wrapped XRP launches on Solana, it enables XRP holders to access Solana’s DeFi ecosystem, including trading, lending, and yield opportunities, significantly expanding XRP’s utility.

Q: How is Wrapped XRP kept secure?

Wrapped XRP relies on secure custodial solutions and audited smart contracts to ensure that each wrapped token is backed one-to-one by locked XRP reserves.

Q: Can Wrapped XRP be converted back to XRP?

Yes, users can unwrap their tokens by burning Wrapped XRP on Solana and releasing the original XRP from custody.

Q: Does Wrapped XRP benefit Solana as well?

Absolutely. Wrapped XRP brings new liquidity, users, and capital to Solana, strengthening its DeFi eco reinforcing its role as a cross-chain hub.