Top bitcoin market news for buyers can mean the difference between seizing opportunity and getting caught unprepared. With prices swinging wildly and market sentiment shifting daily, this article breaks down the most important developments affecting Bitcoin today and offers insights buyers can use to make smarter decisions.

Whether you’re a seasoned investor or a curious newcomer, understanding the latest news helps you time your entry, grasp market dynamics, and avoid unnecessary risk. Let’s dive into the trends shaping Bitcoin’s trajectory, what analysts are saying, and how buyers can navigate this market with more confidence.

Current Price Trends and What They Mean for Buyers

One of the most talked-about pieces of market news right now is Bitcoin’s price behavior in late 2025. Recent reports show that Bitcoin experienced notable volatility, sliding from record highs near $126,000 down toward the mid-$80,000s. This drop reflects both broader risk-off sentiment in financial markets and specific triggers like disappointing corporate earnings and macroeconomic pressures.

For buyers, these price trends represent a mixed signal. On one hand, a lower price point can offer what many investors see as a “discounted entry,” especially if they believe in Bitcoin’s long-term value. On the other hand, persistent downside pressure and sharp drops can signal continued uncertainty in the near term. It’s important to monitor price action alongside other market indicators so your buying decisions are informed, not impulsive.

Top bitcoin market news for buyers Institutional Moves and Market Sentiment

Beyond pure price movements, top bitcoin market news for buyers today also includes actions by major institutional players. High-profile moves by institutional investors can influence confidence in the Bitcoin market and even affect retail buying behavior.

For example, ARK Invest recently made significant purchases in crypto-related stocks despite a weaker market environment, signaling institutional confidence in the sector’s long-term prospects. Meanwhile, Strategy (formerly MicroStrategy) revealed a massive acquisition of Bitcoin, spending nearly a billion dollars to add more BTC to its holdings — a bold statement on continued belief in the asset’s future potential.

However, institutional sentiment isn’t uniformly bullish. Some major financial institutions have adjusted their outlooks, with forecasts cutting back on prior high targets due to cooling buying activity from digital-asset treasury (DAT) firms and ETF outflows. This divergence in sentiment highlights the complexity of the current market — smart buyers take both sides of the narrative into account rather than following headlines blindly.

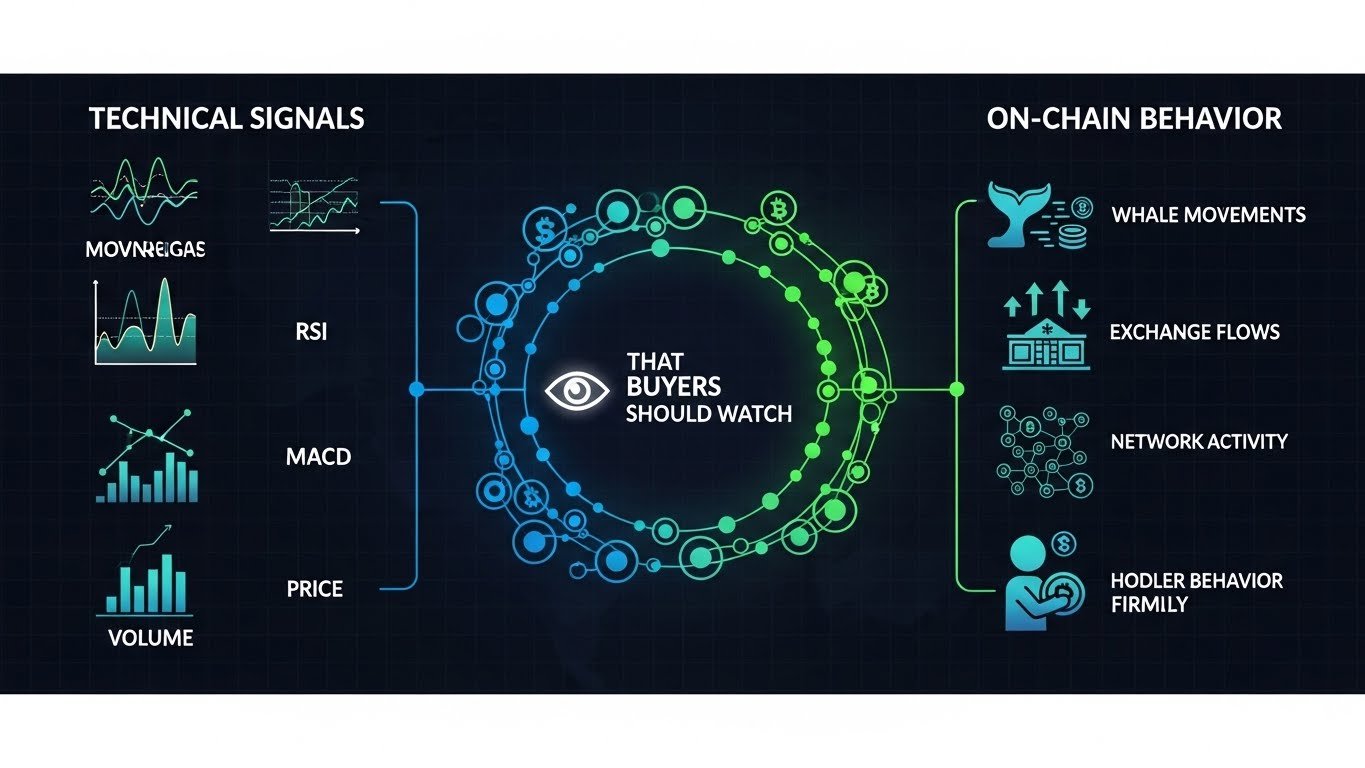

Technical Signals and On-Chain Behavior That Buyers Should Watch

While headlines often focus on price and institutional moves, underlying technical indicators and on-chain data offer deeper clues about Bitcoin’s future trajectory. Recent market analysis suggests that certain contrarian signals, such as futures market metrics, have flipped to “buy” indicators after sharp price drops, indicating potential upcoming rebounds.

Additionally, data showing capitulation among short-term holders — where traders who bought at higher prices finally sell at a loss — has, in past cycles, marked market bottoms and preceded rebound phases. Long-term holders maintaining their positions through volatility also suggests that “smart money” isn’t rushing for the exits, which historically is a supportive signal for patient buyers.

These insights remind buyers that understanding price trends requires digging beyond daily headlines into trading psychology and on-chain metrics. A well-rounded approach can help you identify attractive buying windows and avoid entering during purely emotion-driven spikes or troughs.

Expert Opinions on Bitcoin’s Short-Term and Long-Term Outlook

When it comes to expert insights on Bitcoin, opinions vary — and that’s a good thing for informed buyers. Some analysts forecast relatively cautious price action into year-end, driven by macroeconomic forces and technical resistance levels. Others maintain a bullish outlook based on fundamentals like institutional adoption, network growth, and historical cycle behavior.

A common theme among many experts is that Bitcoin’s journey isn’t a straight line. Short-term volatility and pullbacks are expected, especially in response to macro policy decisions and shifts in risk appetite across markets. But over longer horizons, factors like expanded institutional involvement, ETF innovations, and broader adoption trends continue to support the argument that Bitcoin remains a core digital asset for diversified portfolios.

For buyers, this means weighing both short-term noise and long-term catalysts. Rather than reacting to every price slip or headline, consider building a structured investment plan that accounts for volatility and your individual risk tolerance.

Practical Considerations for Bitcoin Buyers Today

So what does all this mean for someone looking to buy Bitcoin right now? The most reliable approach isn’t to chase headlines but to combine timing, strategy, and awareness of the broader market landscape. Top bitcoin market news for buyers underscores four key ideas you can act on immediately.

First, use current price dips as potential entry points, but confirm those opportunities with technical and on-chain signals rather than headlines alone. Second, pay attention to institutional trends — big purchases or reduced targets often influence market psychology. Third, keep an eye on macroeconomic news, especially policy decisions affecting risk assets, which tend to influence Bitcoin’s short-term price action. Lastly, maintain a long-term perspective, remembering that volatility is inherent but can be managed with strategy rather than emotion.

Conclusion

Today’s Bitcoin market is shaped by a blend of price volatility, shifting institutional sentiment, and evolving technical signals. For buyers, that mix might seem daunting at first glance. But by focusing on top bitcoin market news for buyers, you position yourself to make more informed decisions rather than reacting to fear or hype.

Remember, Bitcoin’s path isn’t linear — its market reflects global investor behavior, macroeconomic forces, and technological evolution all at once. Smart buyers understand that context matters as much as price.

If you stay informed, thoughtful, and patient, you can turn the noise of market news into meaningful insight that serves your investment goals — whether you’re dollar-cost averaging, timing a strategic buy, or simply expanding your crypto knowledge.

Also More: Bitcoin Hoarding Company Strategy Stays in Nasdaq 100