Top Altcoins LINK talk about “distribution,” they’re describing a market phase where supply quietly changes hands—often from stronger hands to weaker ones—after a strong run-up or during a prolonged choppy top. In crypto, that phase can feel like endless sideways price action that punishes both bulls and bears: rallies fail, dips don’t fully collapse, and conviction slowly drains. But the moment distribution starts to fade, the tone changes. Volatility compresses, selling pressure becomes less aggressive, and price begins to react more positively to demand. That transition is exactly why so many eyes are on top altcoins that look like they may be rotating from distribution into early accumulation.

In late 2025 market conversations, three names keep showing up whenever traders discuss potential “rebound” structures: Chainlink (LINK), Sei (SEI), and Sui (SUI). Each represents a different corner of the altcoin universe—oracles and real-world asset infrastructure, high-performance trading-focused Layer-1, and next-gen parallelized execution Layer-1—yet all three have been associated with themes that commonly appear near the end of distribution: cooling sell pressure, pockets of renewed interest, and narrative tailwinds that can revive demand when the broader market mood improves.

This article explains what it means when top altcoins “signal the end of distribution,” why LINK, SEI, and SUI are being watched for a potential rebound, and how to interpret these setups without falling into hype. We’ll cover market-cycle context, the mechanics of distribution and accumulation, token-specific catalysts, and the realistic risks that could invalidate a rebound thesis.

Understanding distribution in crypto: the market-cycle lens

Distribution is often explained using the Wyckoff Method, a framework that maps market behavior into phases like accumulation, markup, distribution, and markdown. In a distribution phase, price tends to chop within a range while large sellers gradually exit into buying interest. Traders commonly look for repeated failures at resistance, weakening momentum, and shifting volume behavior as clues that the market is handing off supply before another down move—or before a long basing process starts. Mudrex+1

Crypto distribution can look slightly different than traditional markets because altcoins deal with additional forces: token unlock schedules, liquidity fragmentation across exchanges, and narrative-driven inflows that can ignite quick rallies even in weak structures. Still, the core idea remains the same: if the market is distributing, upside attempts get absorbed. When distribution ends, the market often shifts toward accumulation, where dips are bought more aggressively and sellers become less dominant.

For top altcoins, spotting the transition early can be valuable because altcoins often move in waves. When capital rotates from BTC into majors and then into smaller caps, a handful of leaders tend to signal the turn first. LINK, SEI, and SUI are being discussed as potential “early leaders” because they sit at the intersection of liquidity, narrative relevance, and technical structures that traders associate with an improving risk environment.

Why “end of distribution” can lead to a rebound

An “end of distribution” doesn’t automatically mean prices moon. It means the market may be exhausting the persistent sell-side flow that kept rallies capped. Once that supply overhang weakens, price can respond more cleanly to demand. That’s when rebounds become more likely, especially in top altcoins that already have a strong holder base, recognizable branding, and active ecosystems.

The rebound mechanism is usually simple. When sellers stop hitting bids as aggressively, liquidity stabilizes. Buyers notice that dips stop breaking lower. The market begins printing higher lows, then challenges range highs, and eventually breaks out if demand persists. In crypto, this can accelerate through liquidations, short squeezes, and momentum flows, particularly when open interest builds in the wrong direction.

But the cleanest rebounds often happen when two things line up: market structure improves and fundamentals stop deteriorating. That’s why it helps to look at LINK, SEI, and SUI not only as charts, but as networks with evolving adoption stories.

H2: Top altcoins in focus—why LINK, SEI, and SUI stand out

H3: LINK as infrastructure, SEI as speed, SUI as next-gen execution

The reason these top altcoins keep appearing together isn’t because they’re identical. It’s because they each represent a “category bet” that institutions and serious builders can understand.

LINK is widely discussed as the leading oracle network and has increasingly been associated with tokenization and interoperability narratives, including activity around real-world assets (RWA) and data verification layers. Analysts frequently frame LINK’s long-term demand around infrastructure usage and institutional integration themes. OKX+1

SEI is positioned as a performance-oriented network that has often marketed itself around trading and fast execution, a theme that tends to attract users during risk-on cycles when on-chain activity expands. Market commentary in late 2025 has frequently highlighted liquidity dynamics and technical setups for SEI that can create sharp moves when sentiment flips.

SUI, meanwhile, sits in the Layer-1 race with a focus on scalable execution and an ecosystem narrative that traders watch closely. Reports and analyses have discussed SUI’s market structure, ecosystem upgrades, and accumulation-style behavior following deep drawdowns.

Together, these top altcoins combine three elements that often matter during the end of distribution: liquidity, recognizable narratives, and a base of participants ready to re-engage when conditions improve.

LINK price rebound setup—why traders see distribution fading

Why LINK often leads when macro sentiment improves

Chainlink tends to behave like a “blue-chip altcoin” during rotation phases. When risk appetite returns, capital often seeks liquid names with strong brand recognition before it moves into smaller, riskier assets. That’s one reason LINK is frequently watched as a bellwether among top altcoins.

Recent market commentary has pointed to LINK’s technical behavior and the idea that it can transition from range-bound trading into breakout attempts when momentum returns. While any single technical analysis can be wrong, the broader point is consistent: if a coin has been capped during distribution, it often needs one clean “regain” of key levels to shift sentiment from “sell the bounce” to “buy the dip.”

The fundamental narrative that supports LINK demand

From a fundamentals angle, LINK is often discussed through its role as critical infrastructure—providing data feeds and interoperability tools that help smart contracts interact with external systems. That narrative becomes especially powerful when markets focus on tokenization, RWAs, and institutional-grade crypto rails. Some analyses explicitly connect LINK’s outlook to these themes and to broader adoption drivers.

When distribution ends, narratives matter because they determine whether fresh buyers show up. If LINK is perceived as a “picks-and-shovels” play for on-chain finance, demand can return more sustainably than for purely speculative tokens. That doesn’t eliminate volatility, but it can help explain why LINK is often treated as one of the top altcoins to watch for a rebound.

What “end of distribution” might look like on LINK

In plain language, fading distribution on LINK often shows up as fewer sharp selloffs on rallies and stronger bids on dips. Instead of constant rejection at the same resistance zone, price begins to spend more time above prior pivot levels. Traders also watch whether momentum improves after retests—because in distribution, retests fail more often than they succeed.

The key idea is not predicting a number. The key idea is spotting behavior: if LINK stops behaving like an asset trapped in a selling range and starts behaving like an asset building a base, the rebound thesis gets stronger.

SEI rebound potential—how liquidity and positioning can flip fast

SEI and the “fast move” profile of top altcoins

SEI has often been treated as the kind of asset that can move sharply once momentum returns, partly because traders tend to engage it through derivatives and rotation strategies. Late-2025 analysis has discussed SEI in the context of breakout potential and liquidity-driven moves, including the idea that concentrated short positioning can fuel rapid upside if resistance breaks.

This matters for “end of distribution” narratives because distribution phases frequently build crowded positioning. If traders repeatedly short the same resistance area and the market finally breaks through, the unwind can be aggressive. That’s how rebounds can become violent rather than gradual, especially in top altcoins that sit in the sweet spot of liquidity and speculation.

What could bring demand back to SEI

A rebound isn’t only about price. It’s also about whether users and capital return to the chain. When on-chain activity improves—whether through DeFi usage, trading activity, or ecosystem incentives—demand for the token can recover alongside sentiment. Some market write-ups have pointed to on-chain growth narratives around SEI as part of the bullish case traders discuss.

At the same time, it’s important to stay grounded: SEI remains more sensitive to broader altcoin sentiment than a “pure infrastructure” play might be. If the overall risk environment weakens, SEI can struggle even if its network metrics improve. That’s why “end of distribution” signals should be read as conditional, not guaranteed.

The distribution-to-accumulation transition in SEI terms

For SEI, the transition often looks like reclaiming key mid-range levels and holding them during pullbacks. In distribution, rallies are often quick and then fully retraced. When distribution fades, the market begins to leave behind higher floors. Traders also pay attention to whether volatility compresses before expansion, a classic pre-breakout behavior.

If SEI shifts from “sharp spikes that fail” to “controlled advances that consolidate,” it starts looking less like distribution and more like early accumulation—one of the clearest rebound signals among top altcoins.

SUI rebound thesis—why deep drawdowns can become accumulation zones

SUI’s pullback narrative and the psychology of capitulation

SUI has been discussed in late 2025 as a token that experienced steep drawdowns from prior highs, raising the classic question: is the decline a warning—or an opportunity? Some commentary has framed SUI’s post-drop region as a potential accumulation zone if network activity and ecosystem development remain constructive.

That framing fits the “end of distribution” theme because heavy drawdowns often end with a period of exhaustion selling. Once that selling fades, the market may shift into basing behavior. The rebound doesn’t have to be immediate; sometimes it begins with a slow grind that feels boring, which is exactly why it’s easy to miss.

Ecosystem signals and why they matter for SUI

SUI’s rebound argument is often tied to whether the network continues to ship upgrades, attract developers, and grow usage. Some analyses have pointed to ecosystem upgrades, liquidity developments, and broader market structure as variables that shape whether SUI’s weakness becomes a base rather than a breakdown.

For top altcoins, fundamentals are rarely the short-term trigger, but they often decide whether a rebound can sustain. If a token rebounds on pure liquidity and then fades because there’s no underlying ecosystem traction, the move can be short-lived. If traction exists, rebounds are more likely to develop into trends.

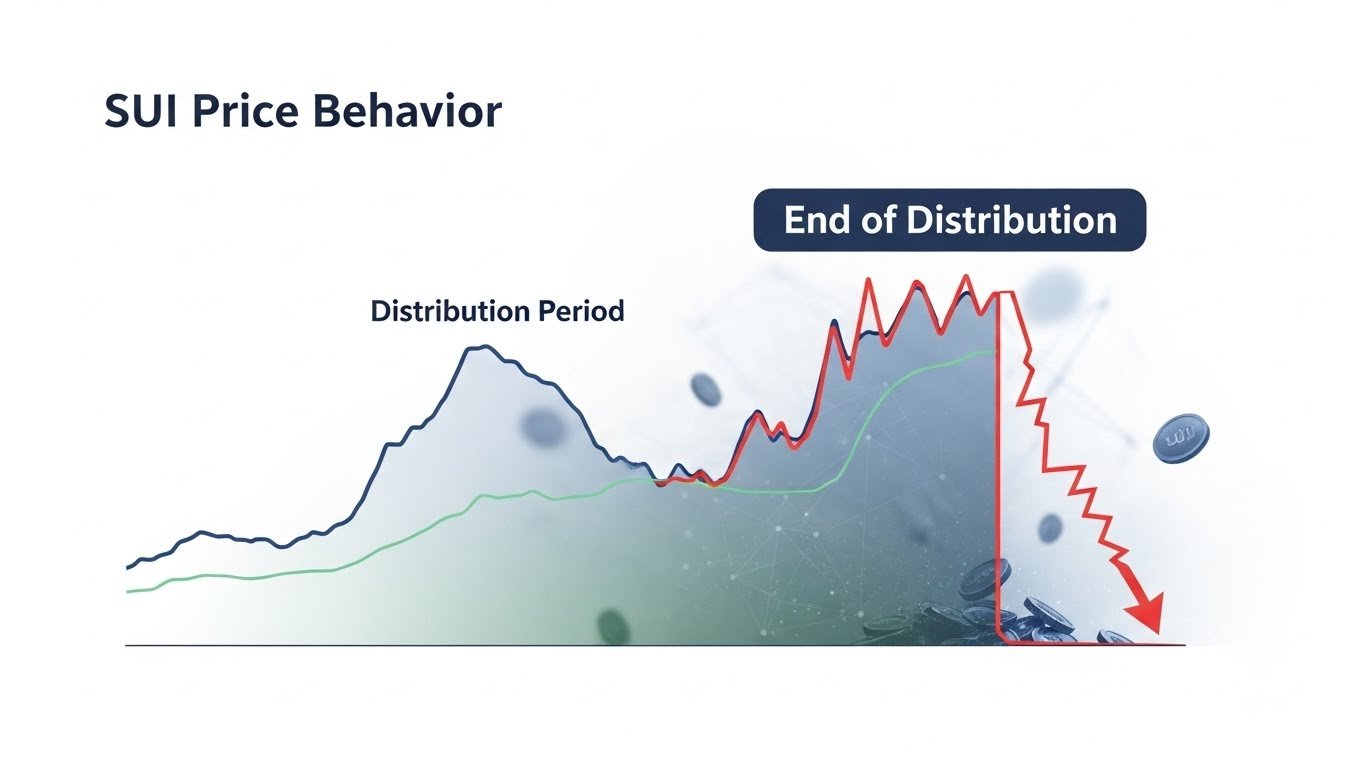

How the end of distribution can appear in SUI price behavior

For SUI, the end of distribution often looks like stabilization after repeated selloffs. If dips stop making meaningful new lows and rebounds become more consistent, the market may be shifting toward accumulation. Traders also watch whether prior resistance zones flip into support, a sign that supply has been absorbed.

Because SUI has been linked with discussions about wedge-like structures and rebound potential in some technical commentary, it’s frequently on watchlists when the broader altcoin market turns constructive.

What would confirm a rebound across top altcoins

Market structure confirmation without chasing hype

A rebound thesis becomes more credible when multiple top altcoins show the same improved behavior at once. If LINK, SEI, and SUI all begin holding higher lows while reclaiming key range levels, it suggests the altcoin complex may be moving out of distribution together. That’s important because altcoins often trade as a basket during risk-on phases.

Confirmation often comes down to a simple sequence: base formation, reclaim, retest, continuation. When distribution is still active, the “retest” stage fails more often because sellers use it as a second chance to exit. When distribution fades, retests tend to hold, and that’s where confidence grows.

Volume, liquidity, and positioning as hidden drivers

Crypto markets can move on positioning more than most people realize. If a market is heavily shorted near resistance and the level breaks, liquidations can fuel fast rallies. If a market is overleveraged long and support breaks, the drop can be brutal. That’s why a true “end of distribution” signal is often a combination of price behavior and healthier positioning.

Although retail traders focus on the candle chart, institutional-style thinking focuses on liquidity: where do forced buyers exist, where do forced sellers exist, and how quickly can the market move if either side gets trapped? This is especially relevant for top altcoins like SEI and SUI that can be more sensitive to derivatives flows.

The biggest risks that can invalidate the rebound thesis

Distribution can “pause” and then restart

One of the most frustrating truths in crypto is that distribution can look like it’s ending—then a macro shock hits and selling returns. That’s why it’s smarter to think in probabilities. The market can show early accumulation behaviors and still fail if overall risk sentiment turns negative.

Token unlocks, narrative fatigue, and liquidity drain

Altcoins face structural risks that BTC does not. Token unlock schedules can reintroduce supply even after selling pressure fades. Narrative fatigue can also kill demand, especially if the market moves on to a new theme. And if liquidity drains from the market—whether from tighter financial conditions or risk-off rotation—many top altcoins struggle regardless of setup quality.

Overconfidence in “signals” without context

Wyckoff-style language is useful, but it can also become a trap if traders label every range as distribution and every bounce as accumulation. The point isn’t to force a narrative. The point is to read behavior and stay flexible. If LINK, SEI, or SUI breaks key supports and fails to reclaim them, the “end of distribution” story weakens, even if the long-term fundamentals remain interesting.

Conclusion

The phrase “Top Altcoins Signal the End of Distribution” captures a real market dynamic: when persistent sell pressure fades, rebounds become more likely—especially in liquid names with strong narratives. LINK stands out as infrastructure with institutional-friendly storytelling around oracles and RWAs. SEI is watched for liquidity-driven moves where positioning can flip quickly. SUI remains a key Layer-1 to monitor after deep pullbacks, especially if ecosystem signals and market structure keep stabilizing.

Still, the best SEO headline is not a guarantee of market direction. “End of distribution” is a process, not a single candle. If these top altcoins continue to build higher floors, reclaim key levels, and hold support on retests, the rebound case strengthens. If they fail those steps, the market may still be working through distribution. The opportunity is real—but so is the need for discipline.

FAQs

Q: What does “end of distribution” mean for top altcoins?

It usually means the market may be exhausting the supply that kept prices capped, often described in Wyckoff-style market-cycle terms. When distribution fades, price can transition toward accumulation, making rebounds more likely.

Q: Why are LINK, SEI, and SUI considered top altcoins for a rebound watchlist?

They’re liquid, widely followed, and tied to strong narratives—LINK around oracle infrastructure and RWAs, SEI around high-performance trading themes, and SUI around scalable Layer-1 execution and ecosystem development.

Q: Can a rebound happen even if the broader market is weak?

It can, but it’s harder. Altcoins often move as a basket in risk-off conditions, and even top altcoins can struggle if liquidity drains. That’s why many traders look for confirmation through reclaimed levels and successful retests.

Q: What is the biggest risk when trading an “end of distribution” setup?

False signals. Distribution can appear to end and then restart if macro sentiment turns negative, unlock-related supply increases, or momentum fades. Using market structure and retests as checkpoints helps reduce overconfidence.

Q: Are these rebound signals financial advice?

No. This is educational market commentary. Crypto assets are volatile, and top altcoins can experience sharp drawdowns even after promising setups. Always manage risk and consider professional advice for your situation.

Also Read: Real-Time Altcoin News and Analysis Expert Insights &amp Market Trends