For years, the public story around Bitcoin mining sounded simple: specialized computers compete to secure the network, miners earn rewards, and profitability rises or falls with Bitcoin’s price. That story still matters, but it’s no longer the whole picture. A growing number of operators—and voices like the Abundant Mines CEO—are emphasizing a bigger shift: Bitcoin mining is increasingly becoming an infrastructure play. In other words, the competitive advantage is moving away from “who has the newest machines” and toward “who controls reliable energy, efficient facilities, and flexible capacity.”

This evolution is easy to understand once you look at how the market has matured. Early on, miners could gain an edge by hunting for cheap electricity, setting up quickly, and scaling hardware as fast as possible. Today, Bitcoin mining is more crowded, more professional, and more tightly connected to energy markets. Hardware remains important, but the winners are often those who can secure long-term power contracts, build resilient data center infrastructure, manage heat and uptime, and respond dynamically to grid conditions. That is classic infrastructure thinking: stable inputs, engineered systems, predictable operations, and long-horizon planning.

The Abundant Mines CEO’s framing—“Bitcoin mining shifts to infrastructure”—captures what many insiders have felt for a while. Mining sites are no longer just rooms full of machines. They’re becoming energy hubs with industrial-grade electrical gear, network redundancy, sophisticated cooling, and operational teams that look more like utility partners than hobbyist technicians. The mission is not merely to run ASICs; it’s to convert energy into digital security at scale, with the reliability and discipline associated with critical facilities.

This article explores what it really means when Bitcoin mining shifts to infrastructure, why this transition is happening now, and what it changes for miners, investors, energy providers, and the communities hosting these facilities. Along the way, you’ll see why phrases like power purchase agreements, grid balancing, high-performance computing, and demand response are becoming as central to Bitcoin mining as hash rate and block rewards.

The Abundant Mines CEO perspective: mining as the “next energy-native industry”

When an executive argues that Bitcoin mining is shifting to infrastructure, they are usually pointing to a practical reality: margins are increasingly determined by “non-negotiables” like power availability, facility uptime, and operating discipline. The Abundant Mines CEO perspective is that miners who treat their operations like long-lived infrastructure—rather than opportunistic deployments—will be better positioned across cycles.

In this view, the mining business resembles other capital-intensive industries that convert an input into a standardized output. The input is energy and operational capacity; the output is verifiable computational work that supports the Bitcoin network. What makes Bitcoin mining different is that it can be ramped up or down faster than many industrial loads, which allows well-run operations to become valuable partners to power markets. That flexibility is increasingly a defining feature of modern Bitcoin mining—and it makes infrastructure thinking unavoidable.

Another key idea in the “infrastructure shift” narrative is that mining is not just about producing Bitcoin. Mining infrastructure can also be positioned as a foundation for adjacent workloads, including high-performance computing (HPC), AI inference at the edge, or other forms of compute that can share facility footprints, power delivery, security, and cooling systems. Not every mining company will move in that direction, but the mindset is spreading: build the site like a modular infrastructure platform, not a single-purpose rig.

Why Bitcoin mining is shifting to infrastructure now

Market maturity and tighter competition

As the industry matures, Bitcoin mining becomes less forgiving. When fewer players existed, operational inefficiencies could hide behind price rallies. In a more competitive market, inefficiency gets exposed quickly. That’s why top miners increasingly focus on infrastructure fundamentals: power pricing, redundancy, cooling efficiency, and maintenance processes. The more competitive the space becomes, the more Bitcoin mining resembles a race to secure and optimize infrastructure rather than simply accumulate hardware.

Volatility and the need for resilience

Bitcoin’s price cycles have always been a feature, not a bug. But large-scale operations can’t rely on good luck. They need resilience across booms and downturns. Infrastructure thinking supports that resilience through long-term power structures, site ownership or durable leases, engineered uptime, and disciplined cost control. When Bitcoin mining is treated as infrastructure, it can be financed and managed like infrastructure, which can reduce fragility during adverse market conditions.

The energy sector’s growing influence

Energy is not just a line item; it’s the strategic core. In many regions, electricity markets have become more complex due to renewable integration, congestion, and shifting demand patterns. This complexity creates opportunities for flexible loads that can participate in demand response and other grid programs. Modern Bitcoin mining can act like a controllable industrial load, aligning operations with real-time pricing or grid needs. As energy becomes more central, the infrastructure shift accelerates because miners must behave like long-term energy customers and partners.

From ASIC race to energy strategy: what “infrastructure” actually means

It’s about power first, hardware second

Hardware is still crucial in Bitcoin mining, but it is increasingly commoditized. You can buy similar machines as your competitors, sometimes even from the same shipment batches. The real differentiation often comes from power strategy: securing low-cost energy, reducing downtime, optimizing electrical delivery, and minimizing losses from heat and inefficiency. In an infrastructure model, the facility and power systems become the primary asset, while the ASIC fleet becomes a replaceable layer that can be refreshed over time.

The rise of engineered facilities and standardized operations

When Bitcoin mining shifts to infrastructure, you see a move toward standardized designs, scalable electrical architectures, and consistent operational playbooks. That includes industrial switchgear, transformers sized for expansion, network redundancy, fire safety planning, and remote monitoring that looks like what you’d expect in traditional data center infrastructure. This approach can reduce downtime, improve repair cycles, and make performance more predictable.

Mining sites as energy conversion assets

A mature mining facility can be thought of as an energy conversion plant. It converts electricity into hash rate, and hash rate contributes to network security. But the key is that the facility is engineered to do this conversion efficiently and reliably. That’s infrastructure thinking. It prioritizes long-term performance and predictable operating behavior—qualities that investors and energy partners tend to reward.

Power, contracts, and the new competitive moat in Bitcoin mining

Power purchase agreements and long-term procurement

One of the clearest signs that Bitcoin mining has shifted to infrastructure is the growing focus on power purchase agreements (PPAs) and structured energy procurement. Spot pricing might be attractive during certain periods, but long-term power strategy reduces uncertainty. A miner that can lock in predictable rates, hedge exposure, and structure flexible terms is building an advantage that can last beyond a single market cycle.

Curtailment as a feature, not a failure

In older models, curtailing machines felt like lost revenue. In infrastructure-focused Bitcoin mining, curtailment can be strategic. If the grid is stressed and power prices spike, shutting down can be the most rational economic move. In some markets, miners can also be compensated for reducing load through grid balancing or demand response programs. That flexibility can turn a mining facility into an asset that supports grid stability rather than competing with it.

Location strategy: where the grid and economics meet

The best mining locations are not only those with cheap electricity. They also have stable interconnection, supportive policy environments, adequate cooling conditions, and reliable service providers. Infrastructure-style Bitcoin mining places heavier weight on these details. Over time, that pushes the industry toward fewer but more sophisticated sites—industrial projects built with an eye toward decades of operation.

Cooling, uptime, and the “data centerization” of mining

Cooling is now a strategic lever

Cooling is not just comfort; it is performance and lifespan. As Bitcoin mining scales, thermal management becomes essential. More operators are moving beyond basic air cooling toward advanced approaches like immersion and engineered airflow systems. These investments can reduce failure rates, stabilize performance, and improve energy efficiency. The more you invest in cooling systems, the more the facility starts to resemble data center infrastructure, reinforcing the idea that Bitcoin mining is becoming an infrastructure business.

Uptime and maintenance as core competencies

In infrastructure-style Bitcoin mining, uptime is a financial strategy. Every hour offline is lost output, but it can also be lost credibility with partners. That’s why advanced operations emphasize spare parts inventory, standardized repairs, predictive monitoring, and layered redundancies. This shift favors teams that operate like industrial plant managers, not just hardware enthusiasts.

Network and security maturity

As facilities grow, security and networking become foundational. Large mining sites need robust connectivity, DDoS resilience, physical access controls, and monitoring. These may sound like “IT topics,” but they’re increasingly infrastructure essentials. In a mature Bitcoin mining model, security and networking are engineered into the facility rather than bolted on.

The economics behind the infrastructure shift

Capex is rising, but so is durability

Infrastructure is expensive. Building high-capacity electrical delivery, engineered cooling, and reliable site systems demands capital. Yet this capital can create durability. A well-built facility can house multiple hardware generations, adapt to changing economics, and maintain value as a platform. That helps explain why Bitcoin mining is trending toward longer-term infrastructure investment rather than short-term deployments.

Financing is becoming more infrastructure-like

As the sector professionalizes, miners seek financing structures that resemble infrastructure deals, sometimes blending equipment financing, project financing, and energy-linked agreements. The more predictable the cash flows and operating behavior, the easier it is to attract capital. This is a feedback loop: infrastructure approaches create predictability, which supports financing, which supports better infrastructure.

Efficiency and scale now matter more than hype

In earlier stages, narrative could outrun fundamentals. Today, Bitcoin mining investors and partners are more likely to demand evidence of efficiency, uptime, and disciplined expansion. That pushes companies toward operational excellence—again, a hallmark of infrastructure industries.

Bitcoin mining and the energy transition: conflict or collaboration?

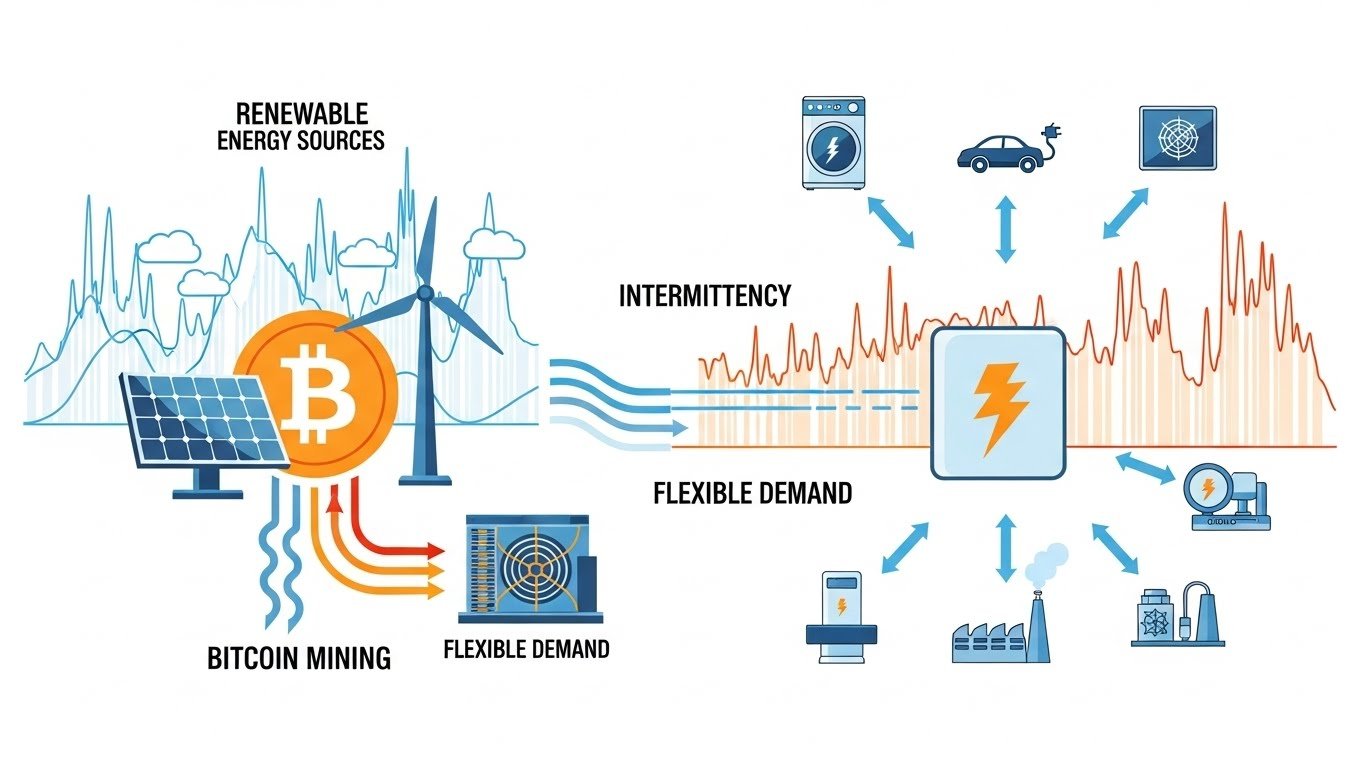

Bitcoin mining Renewables, intermittency, and flexible demand

Renewable energy introduces variability. Wind and solar output can fluctuate, creating periods of surplus and scarcity. Flexible loads help manage that variability, and Bitcoin mining can be remarkably flexible. When surplus exists, mining can absorb it; when scarcity hits, mining can reduce load. This potential collaboration is one reason the Abundant Mines CEO framing resonates: if mining behaves like infrastructure, it can integrate with energy systems more responsibly.

Waste energy and stranded power debates

Some mining projects focus on using energy that would otherwise be wasted—like curtailed renewable output or underutilized generation. While not every “waste energy” claim is equally strong, the broader point remains: infrastructure-focused Bitcoin mining tends to align with energy realities. It tries to locate where power is underutilized, transmission is constrained, or load flexibility is valuable.

Community impact and the importance of transparency

As Bitcoin mining becomes infrastructure, community expectations rise. Infrastructure projects are expected to communicate clearly about energy use, economic benefits, noise, and environmental considerations. Companies that act like long-term partners—rather than temporary opportunists—are more likely to secure social permission to operate. The infrastructure shift, therefore, includes a cultural shift toward transparency and stakeholder management.

What this shift means for miners, investors, and everyday Bitcoin observers

For miners: the job is changing

If Bitcoin mining shifts to infrastructure, miners need broader capabilities. Beyond procurement and firmware tuning, they need energy expertise, facility engineering, compliance awareness, and sophisticated operations management. The strongest teams increasingly combine electrical engineers, energy traders, network specialists, and experienced site operators.

For investors: due diligence looks different

Investors evaluating Bitcoin mining opportunities increasingly scrutinize power contracts, facility designs, interconnection terms, and uptime history. Hash rate alone is not enough. The infrastructure lens emphasizes durability and operational discipline, which can matter more than short-term output.

For the public: mining becomes less “mysterious” and more industrial

As Bitcoin mining resembles traditional infrastructure, it becomes easier to understand. It’s an industrial process with inputs, outputs, risks, and community impacts. That doesn’t resolve every controversy, but it can reduce confusion. The more mining is treated like infrastructure, the more it is governed by infrastructure expectations.

Risks and challenges in the infrastructure era of Bitcoin mining

Regulatory uncertainty and local policy shifts

Infrastructure attracts scrutiny. Large sites can trigger regulatory review related to energy use, emissions accounting, zoning, and grid reliability. A mining company operating like infrastructure must plan for policy variability and maintain compliance readiness.

Concentration and decentralization concerns

As projects become larger and more capital-intensive, there’s a risk that Bitcoin mining concentrates among fewer operators. The network is designed to be robust, but concentration can still raise questions about resilience and governance dynamics. Infrastructure scale can bring efficiency, yet the ecosystem must continue to value decentralization principles.

Technology cycles and reinvestment needs

Even if the facility is durable, ASIC hardware continues to evolve. Infrastructure-style Bitcoin mining must plan for refresh cycles, e-waste management, and performance optimization. The site may last decades, but the machines won’t. Successful operators treat hardware turnover as a normal lifecycle expense within a larger infrastructure platform.

Conclusion

The idea that “Bitcoin mining shifts to infrastructure,” as highlighted by the Abundant Mines CEO, is more than a catchy line. It reflects an industry reality: the advantage is moving toward those who can secure energy intelligently, operate engineered facilities reliably, and integrate with the grid in a flexible, economically rational way. Bitcoin mining is still about hash rate, but hash rate is increasingly the product of infrastructure excellence—power strategy, cooling systems, uptime discipline, and long-term planning.

In the next phase, the most resilient mining companies may look less like hardware traders and more like infrastructure builders. They will design projects to survive volatility, collaborate with energy markets, and evolve their facilities over time. If that trend continues, Bitcoin mining won’t just be a crypto niche—it will be a mature, energy-native infrastructure sector that competes on reliability, efficiency, and intelligent integration with the real-world grid.

FAQs

Q: What does it mean that Bitcoin mining shifts to infrastructure?

When Bitcoin mining shifts to infrastructure, the focus moves from simply acquiring machines to building long-term assets like power contracts, engineered facilities, and reliable operations that can perform across market cycles.

Q: Why is energy becoming the biggest factor in Bitcoin mining?

Energy costs and availability can determine whether Bitcoin mining is profitable, especially in competitive markets. Power strategy, including pricing structures and grid flexibility, often matters more than minor hardware advantages.

Q: How do demand response and grid balancing relate to Bitcoin mining?

Because Bitcoin mining can rapidly adjust power use, miners can participate in demand response or support grid balancing by reducing load during peak demand, sometimes receiving compensation depending on market rules.

Q: Is Bitcoin mining becoming more like data centers?

Yes. Many large operators are investing in data center infrastructure principles such as redundancy, advanced cooling, security, and standardized maintenance, which improves uptime and predictability.

Q: Does the infrastructure shift make Bitcoin mining more centralized?

It can, because infrastructure projects require capital and expertise. However, the network’s competitive dynamics still allow many operators to participate, and thoughtful policy and market structure can help preserve diversity in Bitcoin mining.

Also More: Bitcoin Mining Shifts to Infrastructure Says Abundant Mines CEO