Best altcoin to buy in January can feel like trying to hit a moving target. Crypto markets shift fast, narratives rotate even faster, and new projects can appear promising before they’ve proven anything in the real world. At the same time, established networks can look “cheap” on price alone while facing competitive pressure, token unlocks, or slowing growth. That’s why a side-by-side comparison of fundamentals, token economics, adoption signals, and market positioning matters more than hype.

In this January-focused matchup, we’re comparing three very different profiles: Digitap ($TAP), a newer contender that’s trying to carve out its own niche; Polkadot (DOT) priced around $2.10, a long-running interoperability ecosystem with serious engineering roots; and Uniswap (UNI) priced around $5.30, one of the most recognized names in DeFi and decentralized exchange infrastructure. Each of these could plausibly be framed as the best altcoin to buy in January, but for very different reasons—and with very different risk levels.

This article breaks down what you’re really buying with each token: the use case, demand drivers, competitive moat, and the catalysts that can matter in a fresh-month portfolio decision. Along the way, you’ll see Bold LSI phrases like altcoin investment, crypto portfolio diversification, DeFi token, layer-0 network, and decentralized exchange naturally woven into the discussion so the content stays readable while still being search-friendly. Prices mentioned (DOT at $2.10 and UNI at $5.30) are treated as a snapshot for the comparison, not a prediction.

January Market Context: Why “Best Altcoin to Buy in January” Depends on Timing

January is often a psychologically important month in markets because it tends to reset positioning. Traders reassess risk, rotate capital, and hunt for themes that could dominate the next quarter. In crypto, those themes might include layer-1 and layer-0 ecosystems, DeFi, on-chain liquidity, real-world adoption, or emerging app tokens. That’s why the “best altcoin to buy in January” question is rarely answered by a single metric like “cheap price” or “big brand.”

For a January decision, investors typically balance three forces. First is narrative momentum—what the market wants to talk about right now. Second is fundamentals—what can sustain interest after the initial wave fades. Third is liquidity and accessibility—because the best thesis in the world is harder to play if entry, exits, and market depth are thin. If you’re aiming for crypto portfolio diversification, you also care about whether an asset behaves like a high-beta trade (more volatile but potentially higher upside) or a steadier blue-chip altcoin.

Digitap ($TAP), Polkadot (DOT), and Uniswap (UNI) each map to a different part of that triangle. $TAP tends to lean into the “newer narrative” category; DOT leans into the “infrastructure fundamentals” category; UNI leans into the “liquidity and DeFi backbone” category. The best altcoin to buy in January for you will likely depend on whether you prioritize early-stage upside, long-term ecosystem bets, or cashflow-adjacent network effects like trading activity.

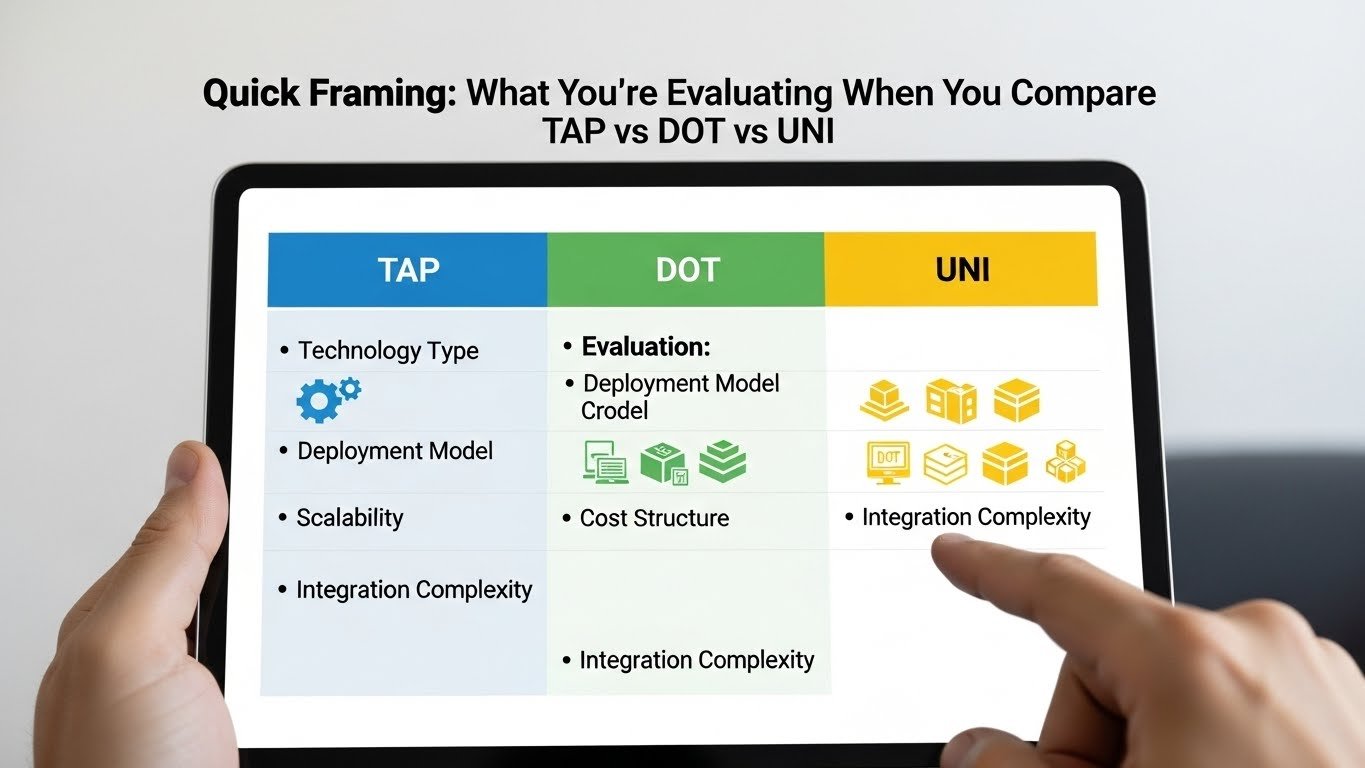

Quick Framing: What You’re Evaluating When You Compare TAP vs DOT vs UNI

Before diving into each project, it helps to clarify what counts as “best” in a realistic investing sense. A serious altcoin investment comparison usually comes down to demand drivers and token value capture. Demand drivers include utility, speculation, governance influence, staking incentives, integrations, and user growth. Value capture asks: if the ecosystem succeeds, does the token benefit directly through fees, staking demand, governance premiums, or required usage?

The second lens is competitive positioning. Does the project have a clear moat, or can competitors copy the idea easily? This matters a lot for new tokens that sound exciting but operate in crowded sectors.

The third lens is risk. Newer projects can offer explosive upside, but they also carry execution risk, liquidity risk, and narrative risk. Established tokens can still deliver strong returns, but they may require larger capital inflows to move significantly and can face slow-burn headwinds.

With that in mind, let’s break down each contender for the best altcoin to buy in January.

Digitap ($TAP): The High-Upide Newcomer Profile

Digitap ($TAP) represents the type of token many investors look for when they ask for the best altcoin to buy in January: a newer asset with potential runway if it captures attention and delivers a working product. Early-stage tokens can outperform when they align with a compelling narrative, build community momentum, and show tangible adoption signals. But they can also underperform if the product roadmap stalls or if liquidity dries up.

A key reason investors consider newer tokens like $TAP is asymmetry. In a good scenario, a new token can grow from a small base—meaning even moderate adoption can translate into large percentage moves. In a bad scenario, the downside can be severe, especially if token distribution is concentrated or if the market loses interest. That’s why the “best” label should always be tied to your risk tolerance and timeframe.

What Makes $TAP Attractive in January Narratives

January often brings renewed appetite for “fresh stories.” Traders who spent the previous month rotating among major caps sometimes start the new month looking for under-the-radar projects that haven’t already run. Digitap can benefit from that dynamic if it presents a clear value proposition and consistent messaging. From an SEO and investor viewpoint, $TAP sits in the emerging altcoins category: the segment that tends to move quickly when sentiment turns positive.

If Digitap is positioning itself around usability, onboarding, payments, gaming, or an app-driven ecosystem, the main question becomes whether $TAP is essential within that system. The more the token is required—whether for fees, access, staking, or incentives—the stronger the potential for sustained demand. If the token is purely speculative without meaningful utility, the price action can become entirely narrative-driven, which is less reliable for anyone seeking the best altcoin to buy in January based on fundamentals.

Token Utility and Value Capture: The Make-or-Break Test

For $TAP to graduate from “interesting” to “best altcoin to buy in January,” it needs credible value capture. In plain terms: if Digitap grows, does $TAP gain structural demand? That demand can come from required network fees, staking requirements, governance influence in a growing protocol, or a reward model that encourages holding rather than constant selling.

At the same time, early-stage projects must manage token emissions and distribution carefully. Overly aggressive incentives can create short-term hype but long-term sell pressure. A healthier structure tends to balance onboarding rewards with scarcity and clear, durable reasons to hold. If you’re evaluating Digitap as an altcoin investment, it’s worth focusing less on marketing and more on whether the token has a measurable role in real usage.

Risks Unique to Newer Tokens Like $TAP

The upside of $TAP is tied to execution, and so are the risks. Liquidity can be thinner, spreads can be wider, and price swings can be sharper. Newer tokens also face credibility gaps: users and integrators often wait for product proof, audits, and sustained traction. Finally, newer communities can be more sentiment-sensitive, which means the token can rally hard and then retrace just as fast.

That doesn’t disqualify Digitap from being the best altcoin to buy in January, but it does mean $TAP is typically better suited for investors who are comfortable with volatility and who actively monitor developments rather than “set and forget.”

Polkadot (DOT) at $2.10: Infrastructure, Interoperability, and the Layer-0 Thesis

Polkadot is a more established bet, and DOT’s appeal usually comes from its infrastructure thesis. Often described as a layer-0 network, Polkadot aims to support multiple specialized chains that can interoperate. For investors who prefer foundational platforms over single-application tokens, DOT can be a candidate for the best altcoin to buy in January—especially if you believe infrastructure narratives are set to rotate back into focus.

At around $2.10 in this comparison, DOT may also look “discounted” relative to prior market cycles. But price alone isn’t a thesis. The real question is whether Polkadot’s ecosystem momentum, developer activity, and interoperability value proposition can translate into user growth and sustained demand for the token.

Why DOT Still Matters: The Interoperability Angle

Interoperability is a perennial problem in crypto. Users don’t want fragmented liquidity and separate identities across chains, and developers often want to build without locking into one ecosystem. Polkadot’s approach—supporting multiple chains under a shared security and coordination model—targets that challenge directly.

For January, DOT can benefit from a “back to fundamentals” trade where investors rotate from hype-driven microcaps into established networks with deep technical foundations. If market sentiment shifts toward resilience and long-term viability, DOT’s positioning can look strong. That’s why some investors see DOT as a more conservative candidate for the best altcoin to buy in January, especially for a diversified portfolio.

DOT Demand Drivers: Staking, Governance, and Ecosystem Growth

DOT’s demand can come from staking participation, governance influence, and the broader need for DOT in network operations. In many infrastructure networks, staking reduces circulating supply and can create a baseline level of holding demand. Governance can also create a “premium” if the ecosystem is active and decisions matter.

However, for DOT to outperform meaningfully, the ecosystem needs to translate technology into adoption. The most bullish DOT narratives usually involve growth in parachain activity, real applications bringing users on-chain, and sustained developer momentum. If those pieces align, DOT can plausibly be framed as the best altcoin to buy in January for infrastructure-focused investors.

The Main Risk for DOT: Ecosystem Attention and Competition

Polkadot competes in a crowded world of modular chains, rollups, and interoperability solutions. Even if its technology is strong, attention and liquidity can still flow elsewhere. DOT investors should watch whether ecosystem activity and usage metrics grow consistently rather than spiking only during brief narrative cycles.

DOT can be a strong crypto portfolio diversification pick, but it may not behave like a fast-moving newcomer. In a month like January, that can be a benefit (stability) or a drawback (slower upside), depending on your goals.

Uniswap (UNI) at $5.30: DeFi’s Liquidity Giant and the DEX Backbone

Uniswap is one of the most recognized brands in crypto, and UNI sits at the center of the decentralized exchange narrative. If you believe on-chain trading, liquidity provisioning, and DeFi infrastructure will keep expanding, UNI can be a compelling choice for the best altcoin to buy in January—especially during periods when traders rotate back into the most battle-tested protocols.

At around $5.30 in this comparison, UNI’s appeal is less about being “cheap” and more about being embedded in the flow of on-chain activity. When markets heat up, trading increases, liquidity moves, and DeFi attention rises. Uniswap often sits close to that action.

UNI’s Core Strength: Network Effects and Liquidity

DeFi protocols with real users and deep liquidity tend to develop network effects. Users go where liquidity is best; liquidity goes where users are. That feedback loop can help the leading decentralized exchange maintain relevance even as competitors emerge.

For January positioning, UNI can work as a “DeFi beta” asset—one that can benefit if decentralized trading volumes rise. If market sentiment improves and traders become more active, UNI’s narrative tends to strengthen. That’s why UNI is frequently mentioned when people search for the best altcoin to buy in January within the DeFi category.

Token Value Capture: The Question UNI Investors Always Ask

The most important nuance with UNI is token value capture. Uniswap as a protocol can be hugely used, but the degree to which UNI accrues direct economic value depends on governance decisions and how the ecosystem evolves. That doesn’t make UNI weak; it just makes it different. UNI can function as a governance and ecosystem exposure token rather than a simple “fee goes to holders” model.

In practice, UNI’s performance often tracks a mix of DeFi sentiment, regulatory headlines, protocol innovation, and broader crypto market cycles. For many investors, that blend is exactly the point: UNI offers a concentrated bet on the durability of DeFi and on-chain liquidity.

Risks for UNI: Competition, Regulation, and Market Cycles

Uniswap faces constant competition from other decentralized exchanges and aggregators. It also sits in a sector that can be sensitive to regulatory narratives. In addition, DeFi assets can be cyclical: when activity falls, attention and speculative flows can fade quickly.

Even so, UNI is often viewed as one of the more “blue-chip” DeFi tokens. If your version of the best altcoin to buy in January prioritizes established platforms with strong brand recognition, UNI deserves consideration.

Head-to-Head Comparison: Which Is the Best Altcoin to Buy in January?

The cleanest way to decide between Digitap ($TAP), Polkadot (DOT), and Uniswap (UNI) is to match each one to an investor profile and a January thesis.

Digitap ($TAP) typically fits investors chasing asymmetric upside and early-stage narratives. If $TAP is building something that can attract users quickly, January’s “new year, new plays” psychology can amplify interest. But $TAP also carries the highest execution risk, making it less suitable for anyone who wants lower volatility.

Polkadot (DOT) at $2.10 tends to fit infrastructure-focused investors who believe interoperability and modular ecosystems will matter long-term. DOT can be a steadier altcoin investment choice if you want exposure to a foundational network thesis, but it may require patience and a belief in ecosystem growth.

Uniswap (UNI) at $5.30 tends to fit DeFi-focused investors who want exposure to on-chain liquidity and decentralized trading. UNI benefits from brand strength and network effects, but it can also swing with DeFi cycles and policy narratives.

So, what’s the best altcoin to buy in January? It depends on what you want January to do for your portfolio. If you want high-risk, high-reward potential and you’re comfortable monitoring developments, $TAP may be your pick. If you want infrastructure exposure with a longer horizon, DOT may fit. If you want a DeFi cornerstone with strong ecosystem presence, UNI can make sense.

How to Choose the Best Altcoin to Buy in January for Your Strategy

A practical January decision comes down to timeframe and risk management. If you’re making a short-term January trade, you’ll likely care more about catalysts, liquidity, and narrative momentum. If you’re making a long-term January allocation, you’ll care more about product-market fit, real adoption, and token design.

For shorter-term positioning, UNI often provides higher liquidity and easier risk management because it’s widely traded and closely watched. DOT can also be liquid, but its narrative may rotate more slowly. $TAP can move fastest, but that speed can cut both ways.

For longer-term positioning, DOT and UNI offer longer histories and clearer ecosystem footprints. $TAP offers the possibility of outsized upside if it succeeds, but it demands higher conviction in execution. In all cases, the best altcoin to buy in January is the one whose risk profile you can actually hold through volatility without panic-selling.

Conclusion

If you’re searching for the best altcoin to buy in January, you’re really searching for the best match between a token’s narrative, fundamentals, and your personal strategy. Digitap ($TAP) represents the high-upside newcomer category where momentum and execution can create dramatic outcomes. Polkadot (DOT) at $2.10 represents the infrastructure and layer-0 network thesis—less flashy, potentially more durable if adoption grows. Uniswap (UNI) at $5.30 represents the DeFi token cornerstone—tied to liquidity, trading activity, and the long-run relevance of decentralized exchanges.

There isn’t one universal winner. The “best” choice is the one aligned with your timeframe, conviction, and ability to handle volatility. If you want early-stage asymmetry, $TAP may be compelling. If you want infrastructure exposure, DOT can fit. If you want DeFi backbone exposure, UNI remains one of the most recognizable names in the space. Whichever you choose, treat January as the starting line for disciplined strategy—not a one-shot gamble.

FAQs

Q: What makes an altcoin the best altcoin to buy in January?

The best altcoin to buy in January is usually the one that matches current market narratives and has fundamentals to sustain interest after the initial rotation. Liquidity, catalysts, adoption signals, and token utility all matter.

Q: Is Polkadot (DOT) at $2.10 a good value buy?

DOT at $2.10 can look attractive as a value-oriented infrastructure bet, but value depends on ecosystem growth and sustained demand drivers like staking, governance, and real usage—not price alone.

Q: Why do people consider Uniswap (UNI) a strong DeFi option?

UNI is tied to one of the most prominent decentralized exchange ecosystems and benefits from network effects around liquidity. Investors often see it as a way to gain exposure to broader DeFi activity.

Q: Are newer tokens like Digitap ($TAP) too risky for beginners?

They can be riskier due to thinner liquidity, higher volatility, and execution uncertainty. If you’re new, position sizing and research are crucial, because newer tokens can swing sharply in both directions.

Q: Can I buy more than one if I’m unsure which is the best altcoin to buy in January?

Yes—many investors use crypto portfolio diversification by allocating across different categories, such as an emerging token ($TAP), an infrastructure platform (DOT), and a DeFi leader (UNI), to balance upside and risk.

Also More: 4 Altcoins to Consider During Improving Crypto Conditions