Crypto market has matured a lot, but one thing hasn’t changed: people still lose money because they chase narratives without doing structured work. The difference between a lucky trade and a repeatable investing process often comes down to Best altcoins research Bitcoin—the kind that combines fundamentals, market structure, token economics, on-chain behavior, and real ecosystem progress. In 2026, that research is no longer just about reading a whitepaper and checking a chart. It’s about understanding whether an ecosystem can attract developers, retain users, and generate sustainable activity without relying on constant hype.

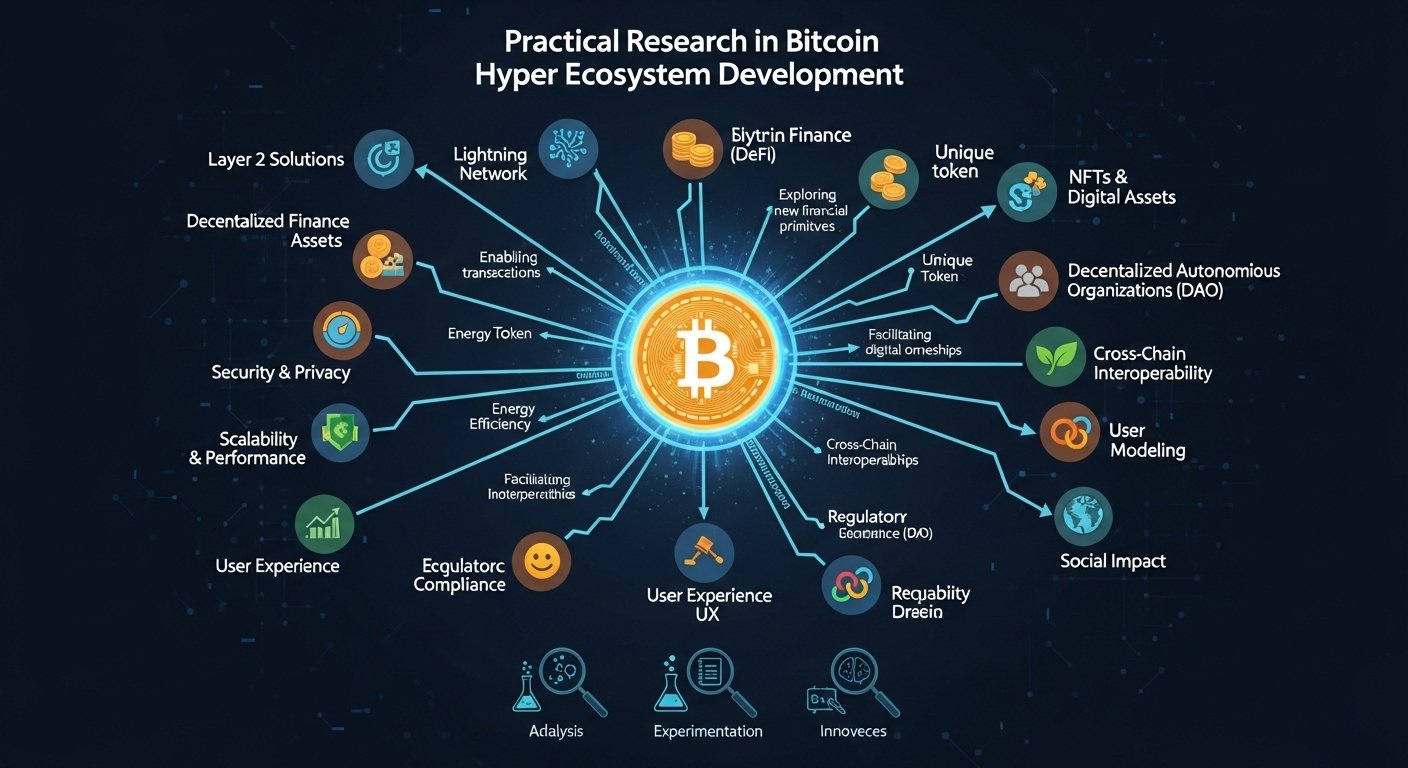

That’s why best altcoins research includes Bitcoin Hyper ecosystem development as a serious lens for evaluating opportunities. “Ecosystem development” isn’t a buzzword if you measure it correctly. It means tangible infrastructure, consistent releases, developer tooling, liquidity formation, community participation, and integrations that create real utility. If the Bitcoin Hyper ecosystem is building products, attracting builders, and expanding use cases, that development becomes a data stream—one you can incorporate into how you compare altcoins, size risk, and pick time horizons.

Still, no ecosystem is automatically “good” just because it’s growing. Growth can be inorganic, incentivized, or short-lived. Smart investors focus on the quality of growth: are apps sticking? Are users returning? Is liquidity deepening? Are developers building beyond copy-paste projects? Best altcoins research includes Bitcoin Hyper ecosystem development because it gives you a broader map of where innovation is clustering and where capital and talent might be heading next. But the key is to combine that map with discipline: avoid overreacting, confirm signals across multiple angles, and treat every thesis as something you test, not something you believe.

In this guide, you’ll learn how to build a repeatable approach to best altcoins research, how to evaluate ecosystem development without falling for vanity metrics, and how to connect those insights to the Bitcoin Hyper ecosystem development narrative in a way that improves decision-making. The goal isn’t to “find the next 100x” with guesswork. The goal is to build a research engine that can survive volatility and consistently identify high-quality opportunities.

Understanding why best altcoins research has changed

Best altcoins research used to be simpler because the market was smaller and the narratives were fewer. A new smart contract chain, a new DeFi primitive, or a new exchange token could rally hard with minimal scrutiny. Now, the space is crowded. Many projects look similar on the surface, and marketing is more professional than ever. That means shallow checks are no longer enough.

What’s changed most is that investors have more data, but also more noise. A project can look active on social platforms while having minimal real usage. A token can have high volume but thin liquidity. A protocol can show impressive TVL that disappears the moment incentives end. This is exactly why best altcoins research includes Bitcoin Hyper ecosystem development: it pushes your process beyond a token-by-token view and toward a network-level view. Ecosystems provide context—how capital flows, where developer attention sits, and what kind of products are being shipped.

The shift from “token picks” to “ecosystem reading”

In modern markets, tokens don’t move in isolation. Sector rotations happen quickly. Liquidity follows themes. The strongest runs often cluster inside ecosystems where builders and users compound momentum. So instead of asking only “Is this token undervalued?” better questions are: What ecosystem is it part of? What infrastructure does it rely on? What liquidity venues support it? What communities are actually using it?

This is where best altcoins research becomes more like venture-style analysis. You’re not only assessing a token, you’re assessing a product, a distribution channel, and a growth loop. When you include Bitcoin Hyper ecosystem development in your research, you’re essentially checking whether the environment around a token makes success more likely.

What “Bitcoin Hyper ecosystem development” means in practical research

Ecosystem development sounds abstract until you break it into measurable realities. The Bitcoin Hyper ecosystem development lens can be applied by looking at how the ecosystem grows across builders, products, and liquidity. If development is real, you should observe consistent progress in multiple areas, not just marketing or a single flagship app.

Builder activity and shipping cadence

One of the most reliable long-term indicators is whether teams ship improvements at a steady pace. Best altcoins research includes Bitcoin Hyper ecosystem development by tracking whether updates are frequent, meaningful, and aligned with a coherent roadmap. Shipping cadence matters because crypto products compete in public. If an ecosystem is stalled, users feel it quickly. If it’s shipping, it often attracts more builders, which accelerates growth.

Look for developer tooling improvements, documented changes, and consistent releases. Even without naming specific tools, the principle is the same: ecosystems with better tooling reduce friction for builders, which increases the number and quality of apps.

Real users versus incentivized users

Many ecosystems can “buy” activity through incentives. Incentives aren’t inherently bad; they can bootstrap liquidity and user bases. But best altcoins research focuses on what happens when incentives fade. If Bitcoin Hyper ecosystem development is driving organic adoption, you should see communities forming around products, repeat usage, and a stable base of users who are there for utility rather than rewards.

This is where on-chain analytics and behavioral patterns matter. A healthy ecosystem tends to show retention signals: repeated interactions, sustained transaction patterns, and a diversification of applications beyond a single trend.

Liquidity formation and market structure

Liquidity is the oxygen of altcoins. Without it, price moves become unstable and exits are painful. Best altcoins research includes Bitcoin Hyper ecosystem development by evaluating whether liquidity is deepening across multiple venues and whether the ecosystem supports healthy trading conditions. Liquidity formation isn’t only about volume; it’s about depth, spreads, and resilience during volatility.

If an ecosystem is growing, liquidity should become more distributed and robust. That reduces fragility and can make altcoins inside that environment more investable.

how to do best altcoins research step by step

A strong process balances fundamentals with market reality. You can love a project, but if token structure is broken or the market is illiquid, the trade can still fail. Best altcoins research includes Bitcoin Hyper ecosystem development as one major input, but it should sit inside a broader framework.

Fundamentals that actually matter

Fundamentals are not slogans. They are the measurable ways a project can win. Start with the product: what does it do better than alternatives? Then examine adoption: who is using it and why? Then check sustainability: can it keep users without endless incentives?

Strong fundamentals usually show up as product-market fit signals: growing user demand, integration interest, and a clear reason to exist. If an altcoin is positioned inside a developing ecosystem like Bitcoin Hyper, the ecosystem’s momentum can amplify fundamentals—but it can’t replace them.

Tokenomics and incentive alignment

Tokenomics is where many retail investors get trapped. They focus on market cap without understanding unlock schedules, emissions, or who holds supply. Best altcoins research includes Bitcoin Hyper ecosystem development by comparing token behavior within the ecosystem: do tokens serve a real purpose, or are they mainly reward chips?

Look for token utility that aligns with demand. If users need the token for fees, access, staking, or governance that affects revenue distribution, that’s stronger than vague “future utility.” Also analyze supply dynamics: emissions, vesting cliffs, and concentrations of holdings.

Team credibility and execution risk

Execution beats promises. Evaluate how teams communicate, whether they deliver, and how they respond to issues. Best altcoins research includes Bitcoin Hyper ecosystem development because ecosystems often reveal execution quality: teams building inside thriving ecosystems tend to integrate faster, collaborate more, and ship in response to real demand.

This doesn’t mean every team in a growing ecosystem is good. It means you have more context to judge them. Look for evidence of competence and realistic planning rather than constant hype.

How to compare altcoins using an ecosystem-first approach

Instead of ranking altcoins purely by price performance, compare them by the quality of the environment they live in. This is where best altcoins research includes Bitcoin Hyper ecosystem development in a direct way: if Bitcoin Hyper is expanding, then projects integrated into that environment may benefit from distribution, liquidity access, and user migration.

Category fit inside the ecosystem

Altcoins tend to cluster into categories such as infrastructure, DeFi, gaming, social, and tooling. Compare whether a project’s category actually fits what the ecosystem needs right now. A saturated category might have limited upside unless the project has a strong differentiator. A missing category might offer opportunity if demand exists.

Ecosystem-first thinking helps you avoid “random token picks.” You’re investing in a role within a broader system.

Integration depth and composability

In crypto, composability can accelerate growth because apps can plug into each other. Best altcoins research includes Bitcoin Hyper ecosystem development by checking integration depth: is the project truly embedded, or is it just loosely connected? Deep integration can improve retention, reduce user acquisition costs, and strengthen network effects.

Projects that become default infrastructure—wallet components, liquidity rails, or widely used primitives—often earn durable attention.

Risk management: the part most people skip

The best research still fails if you size risk badly. Even high-quality altcoins can drop sharply in bearish phases. Best altcoins research includes Bitcoin Hyper ecosystem development, but it also includes risk checks that keep you alive when volatility hits.

Liquidity risk and exit planning

Before buying, ask: how do I exit without moving the market? Thin liquidity is a hidden cost. If liquidity is shallow, slippage can erase gains. This is why ecosystem development matters: growing ecosystems often deepen liquidity over time, improving trade quality.

But don’t assume liquidity will be there. Verify it. Then plan position sizes accordingly.

Narrative risk and timing

Altcoins are narrative-driven, especially in the short term. A token can be fundamentally strong but ignored for months while other sectors pump. Best altcoins research includes Bitcoin Hyper ecosystem development by monitoring whether the ecosystem narrative is expanding or fading. If the ecosystem is gaining attention, related assets may experience tailwinds. If attention rotates away, you may need patience or a different time horizon.

Concentration risk

Many tokens have concentrated holdings. A few wallets or early investors can dominate supply. That creates sudden sell risk. A growing ecosystem can help distribute tokens over time, but early concentration remains a danger. Always treat concentration as a first-class risk variable.

Practical signals that ecosystem development is real

If you want to make best altcoins research actionable, you need signals you can revisit weekly or monthly. Bitcoin Hyper ecosystem development should show consistency across multiple dimensions, not a one-time event.

Steady expansion of applications

A healthy ecosystem tends to grow not only in number of apps but in variety. When you see new categories emerge—beyond the same copycat projects—that’s often a strong sign of real builder interest.

Community-driven momentum

Communities are a proxy for retention. Not follower counts, but actual engagement: discussions, experiments, and grassroots projects. If Bitcoin Hyper ecosystem development is real, it should generate community initiatives that exist independently of official marketing.

Partnerships that produce usage

Partnership announcements are easy. Usage is harder. Best altcoins research includes Bitcoin Hyper ecosystem development by checking whether partnerships result in integrations users actually touch. The strongest partnerships create new user flows, not just headlines.

Common mistakes in best altcoins research

Even smart people fall into predictable traps.

One mistake is treating price action as proof of fundamentals. Price can move for many reasons that have nothing to do with long-term value. Another mistake is ignoring token unlocks and emissions, then acting surprised when supply pressure hits. A third mistake is focusing on a single metric like TVL or volume without asking whether it’s sustainable.

Best altcoins research includes Bitcoin Hyper ecosystem development partly because it reduces these errors. Ecosystem context forces you to look at a fuller picture: builders, users, liquidity, and product development. But the context only helps if you stay skeptical and cross-check signals.

Conclusion

The crypto market rewards curiosity, but it punishes chaos. If you want to improve outcomes, build a repeatable research system that evaluates fundamentals, tokenomics, market structure, and risk. In 2026, best altcoins research includes Bitcoin Hyper ecosystem development because ecosystems shape which projects gain distribution, liquidity, and long-term staying power. When you treat ecosystem development as measurable progress—shipping cadence, organic usage, liquidity depth, and integration quality—you stop guessing and start testing.

The best approach is balanced: use ecosystem growth as a tailwind signal, not as blind faith. Combine it with disciplined token analysis and realistic risk management. When you do that, your research becomes more resilient, your entries become more informed, and your decisions become easier to defend—even when the market is noisy.

FAQs

Q: Why does best altcoins research include Bitcoin Hyper ecosystem development?

Because ecosystem development provides context around builders, users, and liquidity. A growing ecosystem can amplify strong projects and reveal whether growth is organic or purely incentive-driven.

Q: What are the most important factors in best altcoins research?

Focus on product usefulness, adoption and retention signals, tokenomics and unlock schedules, liquidity depth, and the team’s execution record. Ecosystem context helps tie these together.

Q: How can I tell if ecosystem growth is real or just hype?

Look for sustained usage, repeated on-chain activity, expanding app diversity, and integrations that create actual user flows. Short-term spikes without retention often indicate incentive-only growth.

Q: Do I need on-chain analytics for best altcoins research?

It helps, but you can still do strong research by combining public data sources, market structure checks, and consistent tracking of product releases and user behavior. On-chain data strengthens your confidence.

Q: How do I avoid over-optimizing for narratives like ecosystem development?

Treat narratives as hypotheses. Confirm them with measurable progress, keep position sizes rational, and plan exits. Ecosystem development should support a thesis, not replace fundamentals.