DEFT Class Action Lawsuit Lawsuits Against DeFi Technologies Inc. – DEFT has become a critical topic for investors who purchased or held DEFT shares during a volatile period for the company. Securities class actions often move quickly, and missing a key deadline can limit an investor’s options or ability to participate meaningfully in the legal process. For this reason, understanding the scope of the lawsuit, the timeline involved, and what the deadline actually represents is essential.

DeFi Technologies Inc., trading under the ticker DEFT, operates in the rapidly evolving digital asset and decentralized finance space. As expectations around growth, arbitrage strategies, and revenue projections increased, so did investor scrutiny. When financial results and disclosures later failed to align with earlier optimism, legal action followed. The resulting DEFT securities class action lawsuit alleges that certain statements made by the company and its leadership were misleading, ultimately causing financial harm to shareholders.

This article provides a comprehensive, easy-to-understand breakdown of the Deadline In Class Action Lawsuits Against DeFi Technologies Inc. – DEFT, including what the lawsuit claims, who may be affected, how the legal process works, and what investors should consider before the deadline passes. The goal is to offer clarity without legal jargon, allowing readers to make informed decisions.

What is the DeFi Technologies Inc. (DEFT) class action lawsuit?

A securities class action lawsuit is filed when investors believe a company violated federal securities laws by providing inaccurate, incomplete, or misleading information that affected the stock price. In the case of DeFi Technologies Inc., the lawsuit centers on alleged misrepresentations related to the company’s business performance, revenue outlook, and execution of its proprietary trading strategies.

The complaint asserts that during the alleged class period, DeFi Technologies presented an overly optimistic picture of its operational efficiency and growth prospects. According to the claims, these statements did not fully account for increasing competition, structural limitations in digital asset arbitrage, and delays in executing revenue-generating strategies. When corrective information was later disclosed, DEFT’s stock price reportedly declined, resulting in losses for investors.

The DEFT class action lawsuit seeks to recover damages on behalf of affected shareholders and to hold the company accountable under securities law.

Why securities class actions matter to investors

Securities class actions serve two main purposes. First, they provide a mechanism for investors to collectively pursue claims that might be impractical to litigate individually. Second, they promote transparency and accountability in public markets by discouraging misleading corporate disclosures.

For DEFT investors, the lawsuit represents an opportunity to potentially recover losses linked to alleged disclosure failures while also reinforcing disclosure standards in the digital asset sector.

The deadline in class action lawsuits against DeFi Technologies Inc. – DEFT

The most important date associated with this case is the lead plaintiff deadline, which is the primary focus when investors search for the Deadline In Class Action Lawsuits Against DeFi Technologies Inc. – DEFT. This deadline marks the final day on which an eligible investor may file a motion asking the court to appoint them as lead plaintiff in the case.

The lead plaintiff plays a central role in the litigation by representing the interests of the entire class, working with legal counsel, and making strategic decisions on behalf of all shareholders involved. Because of this responsibility, courts typically select the investor or group of investors with the largest financial interest who can adequately represent the class.

Missing this deadline does not automatically exclude an investor from the lawsuit, but it does eliminate the possibility of serving as lead plaintiff.

What the DEFT deadline actually means

The DEFT class action deadline is not the same as a settlement claim deadline. At this stage, no settlement has been reached, and no compensation is being distributed. Instead, this deadline determines who may step forward to guide the lawsuit.

Investors who do not seek lead plaintiff status may still remain part of the class if the court certifies it later. However, the lead plaintiff deadline is the first major procedural milestone, making it an important moment for shareholders to assess their position.

Why this deadline matters even for passive investors

Even if you have no intention of becoming a lead plaintiff, the Deadline In Class Action Lawsuits Against DeFi Technologies Inc. – DEFT should still command attention. It signals that the lawsuit is moving forward and that investors should begin organizing documentation, monitoring case developments, and understanding their potential rights.

Many investors first become aware of class actions after a lead plaintiff is appointed, so being proactive now can prevent confusion later.

Who may qualify as a class member in the DEFT lawsuit?

Eligibility generally depends on whether an investor purchased or acquired DEFT securities during the defined class period. While the final class definition will be determined by the court, the proposed class period typically spans from mid-2025 to late-2025, covering the timeframe during which the allegedly misleading statements were made.

To qualify as a potential class member, an investor usually must demonstrate that their purchase occurred during this period and that they suffered a financial loss linked to the alleged misconduct.

Understanding the class period

The class period is central to any securities lawsuit. It represents the window during which the market price of a security is alleged to have been artificially inflated due to misleading information. For DEFT, this period aligns with optimistic business updates followed by disappointing financial disclosures.

Investors who bought shares before or after this timeframe may not be included unless the complaint is amended or expanded.

Allegations at the core of the DEFT securities lawsuit

At the heart of the DeFi Technologies Inc. class action are claims that the company overstated its ability to capitalize on digital asset arbitrage opportunities while underestimating competitive and structural challenges in the market.

According to the allegations, DeFi Technologies emphasized the effectiveness of its proprietary DeFi Alpha strategy, presenting it as a consistent and scalable revenue driver. However, the complaint claims that market conditions had already begun to shift, reducing the availability of profitable arbitrage opportunities.

When the company later disclosed weaker financial results and significantly reduced revenue expectations, investors reacted negatively, and the stock price reportedly fell. The lawsuit argues that these disclosures revealed risks that should have been communicated earlier.

The role of revenue guidance and investor expectations

Revenue guidance is particularly influential in growth-oriented sectors like digital assets. When guidance is revised downward sharply, it often signals deeper operational or market challenges. In this case, plaintiffs allege that earlier guidance did not fairly reflect the risks the company faced, leading investors to make decisions based on incomplete information.

How the DEFT class action lawsuit process works

Understanding the litigation process helps investors see where the DEFT class action deadline fits into the broader picture.

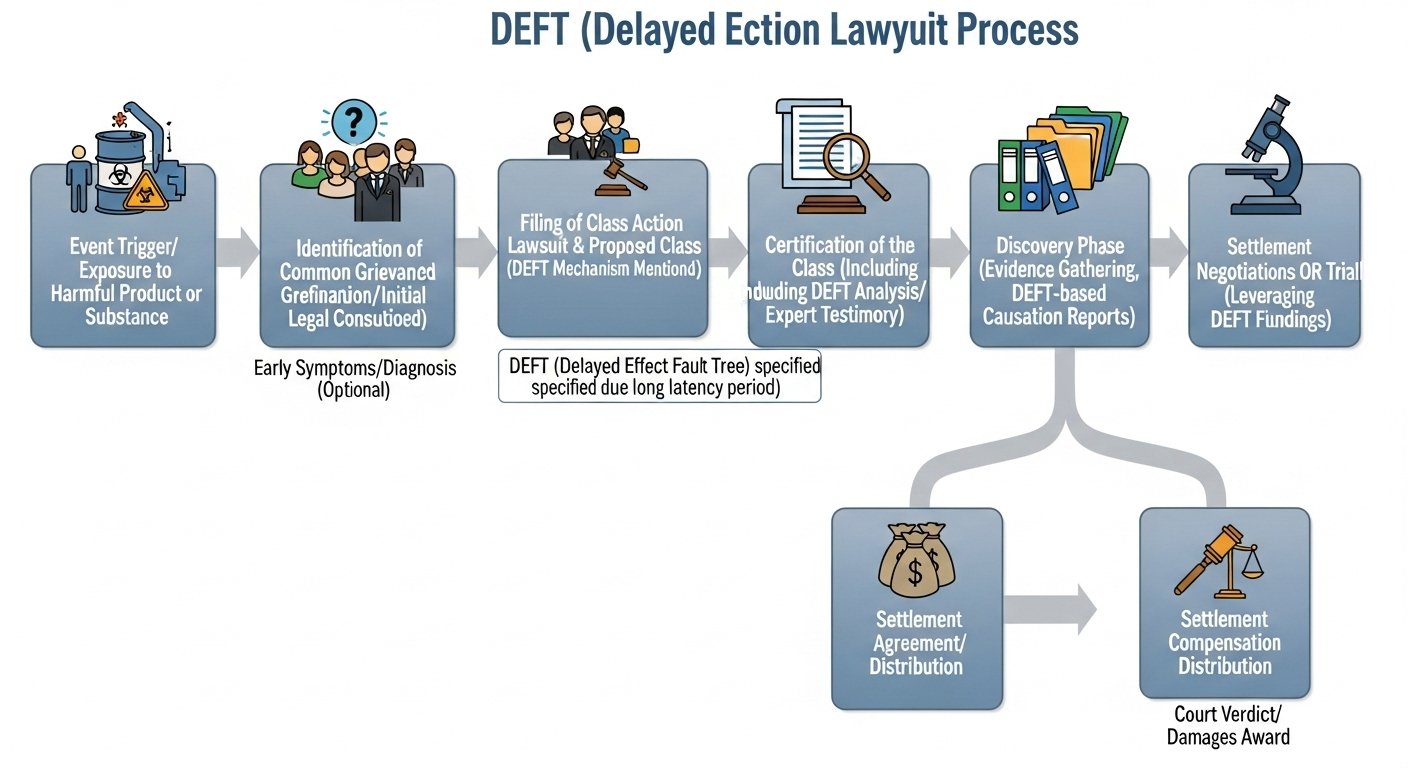

After the lawsuit is filed, investors are notified of the case and the lead plaintiff deadline. Once the deadline passes, the court reviews motions from interested investors and appoints a lead plaintiff. That plaintiff then files a consolidated complaint if necessary, and the defendants respond, often by filing a motion to dismiss.

If the case survives dismissal, it moves into discovery, where evidence is exchanged. Many securities class actions resolve through settlement before trial, although outcomes vary.

What happens after the deadline passes

Once the Deadline In Class Action Lawsuits Against DeFi Technologies Inc. – DEFT has passed, the case becomes more structured. Leadership is established, legal arguments are refined, and the court begins substantive evaluation of the claims.

For investors, this phase typically requires patience. Significant developments may take months or even years, but early awareness ensures investors do not miss future notices.

Lead plaintiff vs. class member: deciding your role

Investors often wonder whether they should actively seek lead plaintiff status or remain passive class members.

When becoming a lead plaintiff may make sense

Lead plaintiff status is often pursued by investors with substantial financial losses who want a direct voice in the litigation. Institutions and high-loss investors may prefer this role to ensure the case is prosecuted aggressively and efficiently.

Serving as lead plaintiff does not usually require paying legal fees upfront, but it does involve a greater level of engagement.

When remaining a class member is appropriate

Most individual investors choose to remain passive class members. This approach requires minimal involvement while still preserving the right to participate in any recovery if a settlement or judgment is reached.

For many, this is the most practical option, especially when losses are relatively modest.

Common misunderstandings about the DEFT lawsuit deadline

Confusion around securities litigation deadlines is common, particularly for first-time participants.

Missing the deadline does not always exclude you

The lead plaintiff deadline primarily affects who may lead the case. Investors who miss it are not automatically excluded from potential recovery if they otherwise qualify as class members.

Losses must be connected to the alleged misconduct

Not all losses qualify. Market-wide downturns or unrelated price movements are generally not compensable. The lawsuit focuses on losses allegedly caused by misleading disclosures.

The case targets the company, not the entire DeFi industry

Despite the name, the lawsuit concerns DeFi Technologies Inc. specifically, not decentralized finance as a whole.

How investors can prepare before the DEFT class action deadline

Preparation does not require immediate legal action. Investors should begin by gathering transaction records, including purchase and sale confirmations and account statements. Understanding when shares were acquired and at what price is essential.

Staying informed about court filings and official notices will also help investors respond appropriately when claim submission deadlines arise later in the process.

Conclusion: Why the DEFT class action deadline should not be ignored

The Deadline In Class Action Lawsuits Against DeFi Technologies Inc. – DEFT represents a pivotal moment in the legal process for affected investors. While it primarily governs lead plaintiff appointments, it also serves as a wake-up call for shareholders to become informed, organized, and proactive.

Whether you intend to pursue an active role or remain a passive participant, understanding the lawsuit’s scope, timeline, and implications puts you in a stronger position. Securities class actions move slowly, but early awareness can make all the difference when important decisions arise.

FAQs

Q: What is the DEFT class action lawsuit about?

The lawsuit alleges that DeFi Technologies Inc. made misleading statements about its business operations and revenue prospects, which allegedly caused investor losses when corrective information was disclosed.

Q: What is the deadline in class action lawsuits against DeFi Technologies Inc. – DEFT?

The deadline refers to the cutoff for investors seeking appointment as lead plaintiff. It is a key procedural date in the lawsuit.

Q: Do I need to file anything to remain part of the class?

In most cases, eligible investors are included automatically if a class is certified, though claim forms may be required later if a settlement is reached.

Q: Can individual investors become lead plaintiffs?

Yes. While institutions often serve as lead plaintiffs, individual investors with significant losses may also seek appointment.

Q: Is there a guarantee of recovery from the DEFT lawsuit?

No. Securities class actions carry risk, and outcomes depend on legal rulings, evidence, and potential settlements.

See More: DeFi Technologies Inc. Class Action Deadline Jan 30, 2026