The cryptocurrency market has continued to demonstrate remarkable resilience in 2025, with Bitcoin maintaining intense buying pressure despite global economic uncertainty reaching unprecedented levels. Despite mounting geopolitical tensions, inflationary pressures, and regulatory challenges across multiple jurisdictions, Bitcoin has emerged as a digital asset that attracts institutional and retail investors seeking portfolio diversification and hedge against traditional financial market volatility.

Current Market Dynamics and Price Analysis

Bitcoin’s price trajectory in mid-2025 reflects a complex interplay of technical indicators, institutional adoption, and macroeconomic factors. Recent market analysis reveals that Bitcoin has experienced significant volatility while maintaining overall bullish sentiment among institutional investors. The cryptocurrency has demonstrated its ability to attract dip buyers during oversold conditions, particularly when technical indicators such as the Relative Strength Index (RSI) signal potential entry points for value-oriented investors.

The digital asset’s performance during global economic turbulence has reinforced its reputation as a potential store of value, similar to gold but with the added benefits of digital portability and programmable scarcity. Market participants have observed that Bitcoin’s correlation with traditional financial markets remains dynamic, sometimes moving independently during periods of extreme uncertainty while occasionally following broader risk-on or risk-off sentiment in global markets.

Institutional Adoption Driving Long-Term Demand

Institutional buying pressure has become a cornerstone of Bitcoin’s price stability and growth potential throughout 2025. Major financial institutions, hedge funds, and publicly traded companies continue to allocate portions of their treasuries to Bitcoin, viewing it as a strategic hedge against currency debasement and inflation. This institutional adoption has created a more mature market structure, characterized by improved liquidity and reduced volatility, compared to Bitcoin’s early years.

The introduction and expansion of Bitcoin Exchange-Traded Funds (ETFs) have further legitimized cryptocurrency investment for traditional portfolio managers and retail investors through familiar investment vehicles. These regulated investment products have experienced substantial inflows, resulting in consistent demand that supports Bitcoin’s price floor during market corrections. The presence of institutional-grade custody solutions and compliance infrastructure has removed many barriers that previously prevented large-scale Bitcoin adoption.

Corporate treasuries have increasingly recognized Bitcoin as a legitimate asset class for preserving purchasing power over extended periods. Companies operating in countries experiencing currency instability or high inflation rates have found Bitcoin particularly attractive as a means of protecting shareholder value and maintaining financial flexibility across international operations.

Technical Analysis and Price Predictions

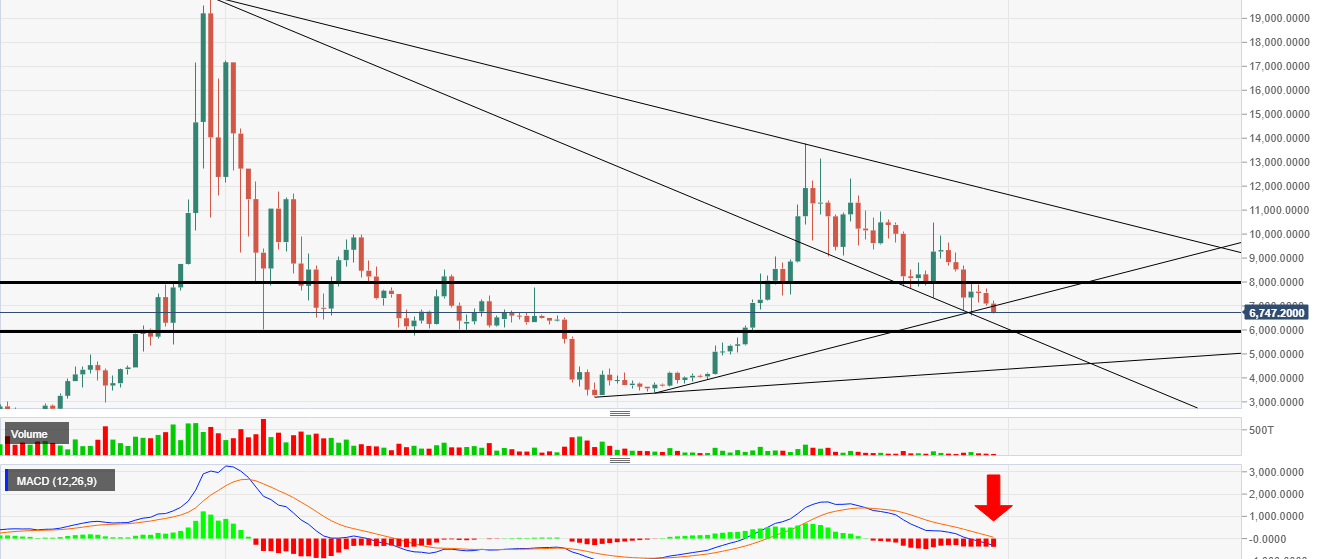

From a technical analysis perspective, Bitcoin’s chart patterns in 2025 indicate continued bullish momentum, despite the periodic corrections typical of cryptocurrency markets. Support levels around key psychological price points have held firm during market stress, indicating strong underlying demand from long-term holders and accumulation by institutional investors. Resistance levels continue to be tested and broken as new capital enters the market through various investment channels.

Expert analysts project significant price appreciation potential for Bitcoin throughout 2025, with some forecasts suggesting the cryptocurrency could reach new all-time highs driven by the effects of the halving cycle and growing global adoption. These predictions are based on a fundamental analysis of supply and demand dynamics, historical price patterns, and the evolving regulatory landscape, which appears increasingly favorable toward cryptocurrency innovation.

The convergence of multiple bullish factors, including improved regulatory clarity in key markets, technological advancements in the Bitcoin ecosystem, and ongoing institutional adoption, creates a compelling case for sustained price appreciation over the medium to long term. However, market participants must remain aware of potential volatility and the importance of risk management in cryptocurrency investments.

Global Economic Uncertainty as a Catalyst

The ongoing global economic uncertainty has paradoxically strengthened Bitcoin’s investment thesis rather than undermining it. Traditional safe-haven assets such as government bonds and gold have faced challenges due to negative real yields and concerns about fiscal sustainability in major economies. In this environment, Bitcoin’s fixed supply schedule and decentralized nature have attracted investors seeking alternatives to traditional monetary systems.

Geopolitical tensions and trade disputes have highlighted the vulnerabilities of traditional financial systems and currency arrangements, leading to increased interest in neutral, borderless digital assets. Bitcoin’s ability to function independently of any single government or central bank has become increasingly valuable as international relations become more complex and unpredictable.

Central bank digital currencies (CBDCs) and monetary policy experiments in various countries have also contributed to the adoption of Bitcoin, as individuals and institutions seek to maintain financial sovereignty and privacy. The contrast between Bitcoin’s transparent, rule-based monetary policy and the discretionary nature of traditional monetary systems has become more apparent during periods of economic crisis.

Market Sentiment and Investor Behavior

Current market sentiment toward Bitcoin reflects a maturation of the cryptocurrency ecosystem and a better understanding of digital asset fundamentals among professional investors. The Fear and Greed Index and other sentiment indicators suggest that while there may be periods of excessive optimism or pessimism, the overall market has developed more stable pricing mechanisms and reduced susceptibility to emotional trading decisions.

Long-term holders continue to accumulate Bitcoin during market corrections, demonstrating confidence in the cryptocurrency’s long-term value proposition. This behavior creates natural support levels and reduces the likelihood of sustained bear markets compared to Bitcoin’s earlier development phases. The growing sophistication of cryptocurrency derivatives markets has also provided professional traders with more tools for risk management and hedging strategies.

Retail investor participation has evolved from speculative trading toward more strategic, long-term investment approaches. Educational resources and improved user interfaces for cryptocurrency exchanges have made Bitcoin more accessible to mainstream investors while reducing the technical barriers that previously limited adoption.

Regulatory Environment and Policy Implications

The regulatory landscape for Bitcoin continues to evolve in ways that generally support long-term adoption and price appreciation. Major jurisdictions have moved toward comprehensive regulatory frameworks that provide clarity for institutional investors while protecting consumer interests. This regulatory development has reduced uncertainty premiums in Bitcoin pricing, enabling more conservative institutional investors to consider cryptocurrency allocations.

Taxation policies regarding cryptocurrency holdings and transactions have become more standardized across developed markets, reducing compliance burdens and enabling more sophisticated tax planning strategies for Bitcoin investors. The recognition of Bitcoin as a legitimate asset class by tax authorities has further legitimized its role in professional portfolio management.

International cooperation on cryptocurrency regulation has improved, reducing the risk of fragmented regulatory approaches that could limit Bitcoin’s utility as a global digital asset. This coordination has been significant for institutional investors operating across multiple jurisdictions, which require consistent regulatory treatment.

Technology Development and Network Fundamentals

Bitcoin’s underlying technology continues to evolve and improve, supporting higher transaction throughput and lower costs through layer-two solutions, such as the Lightning Network. These technological improvements enhance Bitcoin’s utility as both a store of value and a medium of exchange, broadening its appeal to different types of users and use cases.

Network security remains robust, with hash rate reaching new all-time highs and mining operations becoming more geographically distributed and energy-efficient. The increasing professionalization of Bitcoin mining has created more stable network fundamentals, reducing concerns about centralization and energy consumption that previously limited institutional adoption.

The development of Bitcoin-related financial products and services continues to expand, creating an ecosystem that supports a range of investment strategies and use cases. From custodial services to lending platforms to derivatives trading, the infrastructure supporting Bitcoin investments has reached a level of sophistication comparable to that of traditional financial markets.

Risk Factors and Considerations

Despite the positive outlook for Bitcoin, investors must consider several risk factors that could impact price performance and market dynamics. Regulatory changes in major markets could create short-term volatility, even if the long-term trend remains supportive of cryptocurrency adoption. Technology risks, including potential security vulnerabilities or scalability challenges, require ongoing monitoring and assessment.

Market manipulation risks, while reduced compared to Bitcoin’s early years, still exist and can create significant short-term price movements. The concentration of Bitcoin holdings among early adopters and large institutions creates potential for sudden supply changes that could impact pricing dynamics.

Macroeconomic factors such as changes in interest rates, inflation expectations, and global economic growth could influence Bitcoin’s attractiveness relative to traditional assets. Competition from other cryptocurrencies and digital assets may also affect Bitcoin’s market share and pricing power over time.