The Bitcoin mining business has always been a race against physics, finance, and time. Hashrate rises, difficulty adjusts, and margins compress with every burst of competition. But in late 2025, a sharper warning cut through the usual noise: Marathon Digital’s CEO Fred Thiel argued that Bitcoin miners must own—and master—their power ahead of the next halving, or risk being swept out of the industry altogether. In his view, survival hinges on energy control, smarter offtake strategies, and selective expansion into AI-ready data center infrastructure where it actually makes economic sense.

That message lands at a precarious moment. The 2024 halving cut block rewards to 3.125 BTC, and the next one—projected around spring 2028—will slash them again to 1.5625 BTC, mechanically compressing miner revenue per block. Timing estimates vary by block cadence, but most trackers cluster around March–April 2028 at block height ~1,050,000. For operators, that means fewer new coins, more reliance on transaction fees, and ruthless focus on energy cost per kWh and capital efficiency.

Thiel’s thesis isn’t a one-off headline. Earlier in 2025, MARA warned that miners still drawing power from grid-attached sources at retail-like rates face a “reckoning” after the 2028 halving because unit energy costs won’t stand up to halved rewards and intensifying competition. Since then, Marathon has continued pushing toward energy integration and infrastructure optionality to buffer that risk.

Why “Own the Power” Has Become the Prime Directive

Energy has always been a miner’s largest variable cost, but the post-2024 halving era made it the entire strategic center of gravity. When rewards drop by half, even a sub-cent variance in power pricing becomes existential. That’s why you increasingly see miners:

-

acquiring or partnering on behind-the-meter generation,

-

inking long-dated power purchase agreements (PPAs) with curtailment economics,

-

colocating near stranded energy and flare gas sources, and

-

participating in demand response and capacity markets as grid-balancing resources.

In plain terms, owning power (or locking down quasi-ownership economics) transforms miners from price takers into energy arbitrageurs. Thiel’s blunt formulation—control energy or get crushed—reflects the math miners face as rewards halve again in 2028.

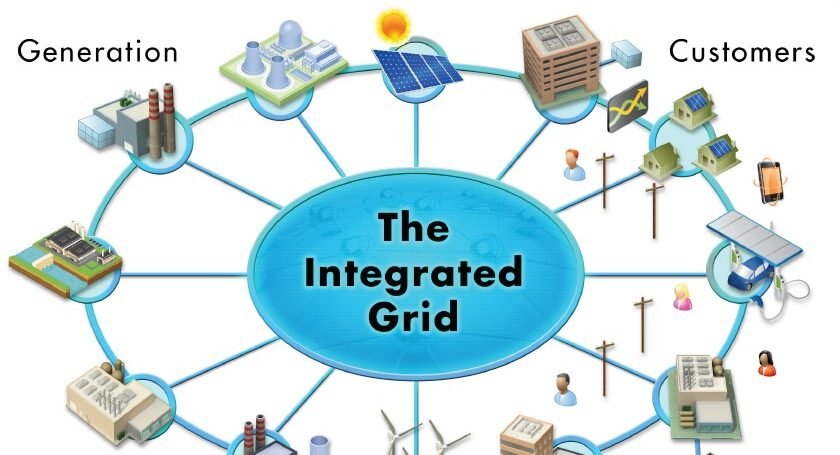

Grid Dependence vs. Energy Integration

Grid dependence exposes miners to peak pricing, congestion, and policy risk. By contrast, energy integration—equity stakes in generation, tolling deals, or private wires—lets operators convert fuel into hashes at predictable, low all-in rates. MARA’s shareholder communications in 2025 explicitly flagged this divergence, noting that grid-reliant miners could be structurally unprofitable post-2028 unless they secure lower-cost energy or diversify revenues.

Curtailment and Flexible Load as a Feature

A miner that can throttle up and down in seconds converts volatility into a margin advantage. In power markets, flexibility has value. With demand response, miners can sell back capacity during stress events, essentially getting paid not to consume. That payment stream, layered atop block rewards and fees, can make the difference between solvent and stranded—especially after the next halving reduces block subsidy again. This is the operational logic behind the “own or deeply integrate with power” mandate that Thiel is pushing across the industry.

The Next Halving’s Clock Is Ticking

Halvings are deterministic protocol events, but the calendar date isn’t fixed; it rides the network’s realized block time. As of November 2025, widely used trackers estimate ~861 days to go, pointing to March–April 2028 for the next subsidy cut. The reward will fall from 3.125 BTC to 1.5625 BTC, automatically halving subsidy revenue per block at whatever the price happens to be that day. History shows price can lag, so planning for a lean margin period is prudent.

Fees, Ordinals, and Realistic Assumptions

Transaction fees can spike, but they’re volatile and hard to underwrite. No CFO should budget survival around speculative fee markets or short-lived inscription/ordinal booms. The conservative base case is simple: by 2028, miners will earn half the current subsidy, difficulty will likely be higher, and efficiency (J/TH) will have improved across the fleet. The winners are those who reach that date with the lowest levelized cost of energy (LCOE), newer rigs, and cheap, reliable electrons. Thiel’s warning is effectively a capital planning memo to the whole sector.

How Leading Miners Are Rewriting Their Playbooks

The industry’s largest operators are already reshaping their capital stacks and footprints around energy optionality. Marathon itself has telegraphed strategies that include expanding computing capacity while diversifying into energy to reduce exposure to third-party pricing. The direction of travel is unmistakable: fewer pure “rent-your-electricity” models, more hybrid miner-operator-powerco structures.

From Mining Farms to Energy-Aware Data Centers

As AI inference and high-performance computing (HPC) workloads proliferate, some miners are exploring dual-use or mixed-use sites that can allocate capacity across and AI clients where load profiles, uptime, and thermal envelopes align. Thiel explicitly framed AI pivots as one survivability path—though not a silver bullet. AI capex is steep, customers are discerning, and power density plus network egress and cooling requirements add complexity. But for miners who already control low-cost power and can engineer liquid cooling or immersion systems, the data center adjacency can create a resilience flywheel.

New Iron, New Economics

Every cycle, a new generation of ASICs resets the efficiency curve. Operators using older rigs face rising watts per terahash, making them more sensitive to energy price spikes. Owning power doesn’t excuse aging hardware; it complements a disciplined fleet refresh strategy. The combination—cheap power plus efficient rigs—lets miners ride out price drawdowns while competitors capitulate. That’s the same consolidation dynamic we saw after prior halvings, only sharper this time given scale, public-company scrutiny, and tighter capital markets. (See Marathon’s own 2025 results commentary for how scale and diversification balance post-halving pressures.)

The Economics of Power: PPAs, Fuel Mix, and Market Design

Bitcoin mining has migrated to where power is cheapest and most flexible. That increasingly means sites proximate to renewables with curtailment, hydro during shoulder seasons, and gas where offtake stabilizes otherwise stranded production. The common thread: contractual paths to sub-$0.03–$0.04/kWh power on average, with the ability to curtail profitably.

Long-Dated PPAs and Optionality

A well-structured PPA can lock in forward prices and hedge commodity exposure, but rigid take-or-pay terms can backfire in volatile markets. Miners now push for optional curtailment, sharing mechanisms, and market participation rights—turning their facilities into grid-stabilizing flexible loads. That flexibility can be monetized, reducing effective energy cost and smoothing cash flows into 2028 and beyond. Thiel’s “own or integrate deeply” mantra is as much about financial engineering as turbines and transformers.

Behind-the-Meter vs. Grid-Attached

Behind-the-meter setups (on-site generation tied directly to the farm) can erase transmission and distribution charges and improve uptime control. Grid-attached sites can still work—if they secure industrial tariffs or interruptible rates—but MARA’s early-2025 warning suggested that retail-like grid pricing is a red flag for 2028 viability. If you can’t get off the treadmill of rising grid costs, you’ll be mining on borrowed time.

Regulatory, ESG, and Community Realities

Policy risk matters. Regions with transparent interconnection queues, stable zoning, and clear rules for demand response create durable moats. On ESG, narratives have matured: miners absorbing excess renewable generation or monetizing flare gas can net-reduce emissions versus curtailment or venting. What communities want, consistently, is honesty about noise profiles, water use, waste heat reuse, and local power pricing effects. Smart miners now plan community benefit frameworks and heat offtake projects—schools, greenhouses, or district heating—to anchor goodwill and long permits.

Fees Are Rising, But Don’t Bet the Mine on Them

The 2024 cycle reminded everyone that transaction fees can spike with new on-chain behaviors (e.g., inscriptions). But fee markets can be fickle. Designing a business that only works when mempools are congested is risky. Survival planning should assume low-ish fees, with upside optionality if on-chain demand surprises to the upside. That conservative stance is precisely why Thiel and others keep hammering the energy control theme: costs are controllable; fees are not.

What “Ownership” Looks Like in Practice

Ownership doesn’t always mean owning a gas plant or a wind farm outright. The point is to own the economics:

Equity Slices and Tolling

A minority stake in a generation asset, combined with a tolling agreement, can deliver the same cost certainty as outright ownership without bloating the balance sheet. The miner pays a predictable conversion fee from fuel to electrons and can stop hashing or sell power when the grid price is rich.

Private Wires and Microgrids

Where feasible, a private wire or microgrid protects miners from congestion pricing and gives real-time control over load. Couple that with on-site storage and you can arbitrage intraday spreads—hash when power is cheap, export when it’s dear.

Data Center Readiness

If you pursue AI/HPC revenue, design from day one around redundant power, cooling topology (air, liquid, or immersion), fiber diversity, and physical security. Any AI adjacency must pay its own way; it’s an option on top of a lowest-cost Bitcoin core, not a replacement for it. Thiel’s point was not “become an AI company,” but that optionality may help smooth halving shocks if, and only if, your power advantage is real.

Capital Markets: How to Finance the Pivot

Debt that assumed perpetual high BTC price and flat energy costs is a liability now. Lenders want to see:

-

contracted, low-cost power for the full asset life;

-

newer-gen ASICs with strong J/TH;

-

credible curtailment and grid services revenues; and

-

management teams with power market fluency.

Public miners that can articulate a cohesive power strategy have traded at premiums in past cycles because the market discounts their downside less. Marathon’s 2025 updates showed how even scaled miners juggle profitability swings post-halving while still investing in capacity and energy diversification—a reminder that balance-sheet strength and energy strategy are now inseparable.

The Hard Truth Heading Into 2028

The next halving is not a surprise. It is the most predictable shock in Bitcoin. If you believe Bitcoin mining remains a viable industry long term, then it follows that the lowest cost, most flexible power wins. That is the common denominator in Thiel’s argument and in the market’s evolving behavior since 2024. Operators who still rely on retail grid power without flexibility will likely see margins vaporize as rewards halve, difficulty rises, and capital becomes pickier. Those who control or cleverly contract their energy—and who can curtail, arbitrage, and optionally serve AI/HPC—will be positioned to buy rigs and sites from distressed competitors when the cycle turns again.

What Miners Should Do Now

First, audit your real delivered cost—all-in, including interconnection, demand charges, and curtailment penalties. Second, explore behind-the-meter options and PPAs with flexible terms. Third, stress-test your model at 1.5625 BTC/block with conservative fee assumptions and higher difficulty. Fourth, decide whether AI/HPC adjacency is truly accretive given your power, cooling, and network profile.

And finally, line up capital partners who understand power markets, not just Bitcoin tickers. None of this is glamorous, but it is executable. The miners who take these steps now will welcome 2028 as a consolidation catalyst, not a countdown to closure. That is the strategic core of the “own power—or die trying” thesis.

Conclusion

Bitcoin doesn’t owe miners a margin. The protocol keeps halving, difficulty keeps responding, and only the most energy-intelligent operators endure. Fred Thiel’s warning is a distillation of the cycle’s hard math: control your energy—or at least the economics of your energy—or prepare to be outcompeted as the 2028 halving arrives. For miners willing to get serious about power ownership, flexible contracts, and prudent expansion into data-center-grade infrastructure, the next halving is less an executioner than a filter. Those who pass that filter will be the ones buying assets at pennies on the dollar during the shakeout that follows.

FAQs

Q: What exactly did Marathon’s CEO say about miners and power?

In November 2025, Marathon Digital CEO Fred Thiel argued that miners need to own or tightly control their power ahead of the next halving and that pivoting some capacity toward AI/HPC can help, provided the energy economics are strong. The message: miners clinging to expensive, grid-only electricity risk being forced out post-2028.

Q: When is the next Bitcoin halving and how much will rewards drop?

Trackers currently point to March–April 2028, when the block reward is expected to fall from 3.125 BTC to 1.5625 BTC at roughly block 1,050,000. Dates float with realized block time, but the 2028 window is the consensus range.

Q: Why are miners that rely on grid power especially vulnerable?

Because retail-like or inflexible grid pricing leaves miners exposed to peak tariffs and policy shifts. MARA warned in early 2025 that grid-dependent miners will face a reckoning after the next halving unless they secure cheaper, more flexible energy or diversify revenue.

Q: Does branching into AI or HPC solve halving risk?

Not by itself. AI/HPC requires different SLAs, cooling, and network design, plus significant capex. It can be accretive for miners that already control cheap, reliable power and can meet data center standards. Thiel positioned AI as one path to resilience—not a universal fix.

Q: What is the single most important KPI to watch heading into 2028?

Your effective cost per kWh, net of curtailment revenues and grid services, alongside your fleet’s J/TH efficiency. If your all-in LCOE isn’t sustainably low, a 1.5625 BTC/block world compress margins beyond safety. The companies moving to own or economically control power are explicitly solving for that.

Also Read: Bitcoin Ethereum & XRP Rally What Driving the Rebound