Every crypto cycle seems to compress time. What used to take years now unfolds in months, and Bitcoin’s 2025 rollercoaster has been a perfect example. The year began with optimism, fueled by Bitcoin halving narratives, institutional inflows, and renewed retail interest. As prices surged and headlines screamed about new milestones, the belief that Bitcoin could only go up returned in full force.

But the crypto market is unforgiving. Periods of euphoria are often followed by brutal corrections. As macroeconomic pressures, regulatory uncertainty, and shifting risk appetite began to weigh on digital assets, the same Bitcoin price that had climbed so quickly started to stumble. Volatility remained, but the tone changed: fear replaced greed, and questions about sustainability replaced confident speculation.

By late 2025, many analysts were asking a sobering question: could Bitcoin’s 2025 rollercoaster end on a low instead of the explosive year-end rally traders have come to expect from previous cycles? While no one can predict the future with absolute certainty, there are strong reasons to believe that a cautious outlook may be more realistic than dreams of another immediate parabolic bull run.

In this article, we will explore the main forces behind Bitcoin’s wild 2025 ride, the structural factors that could pressure the BTC price into year-end, and what it all might mean for investors trying to navigate this unpredictable landscape. We will also consider scenarios where the market stabilizes or even sets the stage for the next cycle, even if the current year closes on a disappointing note.

Understanding Bitcoin’s 2025 Rollercoaster

From Halving Hype to Reality Check

The story of Bitcoin in 2025 really started with expectations around the latest Bitcoin halving, the event where block rewards are cut in half. Historically, halving cycles have been associated with powerful bull runs as reduced supply meets growing demand. In the months leading up to and following the halving, narratives about digital gold, scarcity, and institutional adoption dominated the conversation. As usual, a wave of new and returning investors piled in, hoping to ride the next Bitcoin bull run. Prices responded with sharp moves upward, and social media buzzed with talk of six-figure bitcoin. This was the first big climb on the 2025 rollercoaster.

However, markets rarely repeat history in a perfectly predictable way. While the halving reduced new supply, it did not occur in a vacuum. Global economic conditions, monetary policy shifts, and competing investment opportunities all influenced how far the BTC price could run. As these real-world factors reasserted themselves, Bitcoin’s relentless climb began to falter. The result has been a year marked by sudden spikes, painful dips, and a growing sense that 2025’s Bitcoin cycle might not follow the script investors were hoping for.

Volatility as a Core Feature, Not a Bug

It is important to remember that Bitcoin volatility is not an anomaly; it is one of the asset’s defining characteristics. The same volatility that produces spectacular gains also produces deep drawdowns. In 2025, that volatility has been amplified by a mix of speculative leverage, algorithmic trading, and constant news-driven sentiment shifts. On the way up, this volatility felt exciting and liberating. Traders boasted about overnight gains and rapid liquidations of short positions.

On the way down, however, leveraged longs were wiped out, and cascading liquidations accelerated sell-offs. The rollercoaster nature of Bitcoin is exhilarating when the trend is your friend, but emotionally draining when it turns against you. This context is essential for understanding why Bitcoin’s 2025 rollercoaster may end on a low. Volatility is a double-edged sword, and when combined with structural and macroeconomic headwinds, it can push prices down just as dramatically as it once pushed them up.

Macro Headwinds: The Invisible Hands Pushing Bitcoin Lower

Interest Rates, Liquidity and Risk Appetite

One of the most important factors shaping Bitcoin’s performance in 2025 has been the global macro environment. In a world where interest rates rise or remain elevated, risk assets—from tech stocks to cryptocurrencies—often face pressure. When investors can earn respectable yields from bonds, money markets or traditional savings products, the appeal of volatile assets like Bitcoin tends to diminish for conservative capital.

High or sticky interest rates also impact liquidity. When borrowing costs are elevated, fewer traders and institutions are willing to deploy leveraged strategies in the crypto market. Reduced leverage and tightening liquidity can weaken buying pressure and exacerbate downward moves when selling begins.

As risk appetite cools, the narrative around Bitcoin as a speculative asset becomes more dominant than its narrative as an inflation hedge or store of value. This shift in perception can drive capital out of BTC and into safer or more predictable holdings, contributing to a year-end environment where Bitcoin’s 2025 rollercoaster is more likely to end on a cautious, if not outright bearish, note.

Regulatory Pressure and Policy Uncertainty

Another macro force weighing on Bitcoin in 2025 has been regulatory pressure. Around the world, governments and regulators have continued to debate and refine their approaches to cryptocurrency regulation. Some jurisdictions have moved toward clearer frameworks, while others have taken a more aggressive stance, emphasizing consumer protection, anti-money laundering measures and oversight of trading platforms.

For investors, ongoing policy uncertainty can create hesitation. The fear of sudden restrictions, tax changes or enforcement actions can discourage large capital allocators from entering or expanding positions in Bitcoin. Even rumors or proposed rules can trigger waves of selling as traders react to perceived threats.

In combination with macroeconomic factors, this regulatory overhang adds another layer of resistance to a sustained Bitcoin bull market. Instead of powering to fresh highs into the end of the year, sentiment may remain subdued, increasing the likelihood that Bitcoin’s 2025 rollercoaster levels out or even dips as the calendar turns.

Structural Challenges Inside the Crypto Market

Competition From Altcoins and New Narratives

While Bitcoin remains the largest and most recognizable cryptocurrency, it now competes with a broad range of altcoins, stablecoins and innovative blockchain projects. In 2025, capital has not flowed exclusively into BTC. Many investors have preferred layer-1 ecosystems, DeFi tokens, real-world asset platforms and AI-themed crypto projects that promise faster growth and more direct utility.

This competition means that even when the broader crypto market shows signs of life, Bitcoin does not automatically capture the majority of new inflows. As narratives shift toward utility-driven networks and high-yield DeFi opportunities, some capital that might once have gone into Bitcoin has migrated elsewhere.

When the altcoin market is strong, Bitcoin can, paradoxically, lag while still serving as a kind of anchor for the sector. In 2025, if attention remains fragmented and speculative energy continues to chase new trends, BTC may struggle to stage the kind of dominant rally needed to erase earlier losses—raising the odds that the year ends with Bitcoin trading below investor expectations.

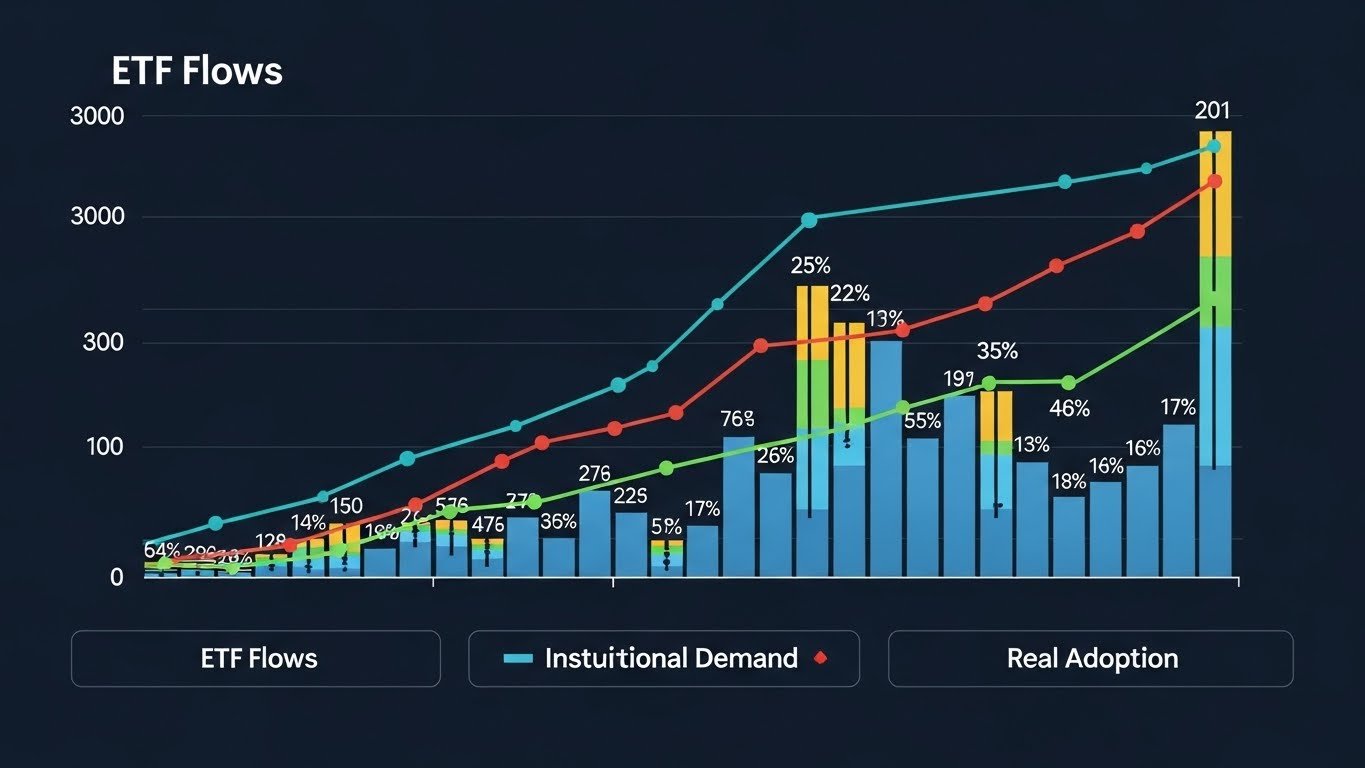

ETF Flows, Institutional Demand and Real Adoption

On the positive side, Bitcoin ETFs and institutional products have legitimized BTC in the eyes of many traditional investors. However, these channels also change the way demand flows into and out of the asset. ETF inflows and outflows are heavily influenced by macro factors, portfolio rebalancing strategies and risk models rather than purely by crypto-native narratives. In 2025, if ETF inflows slow or reverse due to broader market caution, they may act as a drag rather than a tailwind on the Bitcoin price.

At the same time, real-world adoption—such as merchant acceptance, cross-border payments or corporate treasuries holding BTC—continues to grow but may not be expanding fast enough to offset speculative outflows during periods of fear. The combination of institutional hesitation, subdued ETF demand and competition from alternative digital assets creates a structural environment where a soft or bearish year-end for Bitcoin is entirely plausible, even if the long-term case for digital assets remains intact.

Sentiment, Psychology and the End-of-Year Effect

From FOMO to Fatigue

One of the most overlooked drivers of Bitcoin’s 2025 rollercoaster has been human psychology. In the early stages of a rally, FOMO (fear of missing out) pushes people to buy aggressively. Every dip is seen as a buying opportunity, and social media becomes filled with bold predictions and celebratory posts. But after months of chop, failed breakouts and sudden reversals, that same crowd can turn to fatigue and apathy. Traders who bought high and saw their positions underwater may be less eager to re-enter the market.

Newcomers who experienced heavy losses may leave altogether, reducing the pool of marginal buyers that typically fuel big year-end moves. By late 2025, many market participants may simply be tired. This emotional exhaustion can be just as powerful as fear or greed, and it often shows up as low trading volumes, shallow liquidity and a lack of conviction in either direction. In such an environment, a decisive rally is hard to sustain, and a slow drift lower becomes increasingly likely.

Tax-Loss Harvesting and Portfolio Rebalancing

Another psychological and practical factor that can weigh on Bitcoin toward the end of the year is tax-loss harvesting and portfolio rebalancing. Investors who incurred losses on BTC or other crypto assets may choose to sell positions before year-end to realize those losses for tax purposes. At the same time, professional managers often rebalance portfolios, trimming volatile holdings to align with risk targets.

If a significant number of investors engage in year-end selling, it can create additional downward pressure on the Bitcoin price, especially in already fragile market conditions. While these flows are not always massive, they can be enough to tilt the balance when sentiment is weak and buyers are hesitant.

Together, these psychological and structural tendencies contribute to the idea that Bitcoin’s 2025 rollercoaster may end on a low, not because the asset is fundamentally broken, but because the emotional and practical dynamics of the market favor caution over aggression as the year closes.

Could a Low End to 2025 Set the Stage for the Next Cycle?

The Role of Accumulation and Long-Term Holders

While a low year-end Bitcoin price can feel discouraging for short-term traders, it may actually be constructive for the long-term health of the network and its investor base. Historically, extended periods of sideways or downward movement have often been times when long-term holders quietly accumulate BTC at lower prices. During these phases, weak hands and short-term speculators exit, while high-conviction investors increase their positions.

On-chain data frequently shows coins moving into cold storage, longer holding periods and reduced exchange balances. This pattern suggests that Bitcoin can become more structurally robust even as price action appears unimpressive. If 2025 does end on a low, it may mark the beginning of a new accumulation zone, where patient investors lay the groundwork for the next major bull market. In that sense, a disappointing year-end close might be less a sign of failure and more a signal that the market is resetting for the future.

Lower Prices as a Long-Term Opportunity

For those who believe in the long-term thesis of Bitcoin as digital gold, censorship-resistant money and a hedge against fiat debasement, lower prices can represent opportunity rather than disaster. While no one enjoys seeing the value of their holdings fall, the ability to acquire BTC at discounted levels relative to previous peaks is central to the strategy of many long-term adopters.

If Bitcoin’s 2025 rollercoaster ends near the bottom of its yearly range, disciplined investors may view that as a chance to dollar-cost average into positions, anticipating that future cycles will once again bring higher highs. History does not have to repeat exactly, but Bitcoin has previously rewarded those who were able to think beyond a single calendar year and focus on multi-cycle horizons.

What This Means for Different Types of Investors

Short-Term Traders

For short-term traders, the key takeaway from a potential low end to 2025 is the importance of adaptability. A market that fails to deliver the expected year-end rally requires a different strategy than one that is trending strongly upward. Traders may need to focus more on range-bound strategies, capital preservation and conservative leverage rather than aggressive trend-following. If volatility remains high but direction is uncertain, risk management becomes even more crucial. Stops, position sizing and a willingness to sit out choppy price action can make the difference between surviving a difficult period and being forced to exit the market entirely.

Long-Term Holders and New Entrants

For long-term holders, the possibility that Bitcoin’s 2025 rollercoaster may end on a low is not a reason for panic, but a reminder that cycles are an inherent part of this asset class. Staying focused on fundamentals, such as network security, hash rate, adoption metrics and macro trends, can help keep short-term price moves in perspective. For new entrants, a subdued or bearish year-end might actually be a more rational entry environment than peak euphoria. While nobody can time the exact bottom, entering a market after the hype has faded and prices have corrected significantly can reduce the risk of buying into unsustainable manias.

Conclusion: A Disappointing Finish Doesn’t End the Story

As 2025 draws to a close, it is entirely possible that Bitcoin’s rollercoaster year will end not with fireworks, but with a whimper. Macro headwinds, regulatory uncertainty, structural competition within the crypto market, psychological fatigue and year-end selling pressures all point toward a scenario where Bitcoin’s 2025 rollercoaster may end on a low rather than a euphoric high. Yet, that outcome should be viewed in context. Bitcoin has always been a multi-cycle asset, rising through periods of intense volatility, skepticism and temporary disappointment. A weak finish to 2025 does not negate its long-term potential, nor does it erase the foundational role it plays in the crypto ecosystem.

For traders, this environment demands caution, discipline and realistic expectations. For long-term believers, it may present a chance to accumulate at more attractive levels, while the broader market resets and prepares for the next major narrative. In the end, Bitcoin’s story has never been about a single year. Whether 2025 ends on a low or a high, the forces that gave rise to Bitcoin—questions about money, sovereignty and digital value—are still very much alive. The rollercoaster may slow down for now, but the ride is far from over.

FAQs

Q: Why might Bitcoin’s 2025 rollercoaster end on a low?

Bitcoin’s 2025 rollercoaster may end on a low due to a combination of macro headwinds, elevated interest rates, regulatory uncertainty, competition from altcoins, and year-end tax and rebalancing flows. Together, these factors can dampen risk appetite and reduce buying pressure, making a strong year-end rally less likely.

Q: Does a weak year-end mean Bitcoin’s long-term potential is gone?

No. A weak year-end does not erase Bitcoin’s long-term value proposition as digital gold, a store of value and a decentralized form of money. Bitcoin has gone through multiple boom-and-bust cycles, and long-term growth has historically emerged from periods of consolidation and lower prices as long-term holders accumulate.

Q: How should short-term traders react if Bitcoin closes 2025 near its lows?

Short-term traders should focus on risk management: adjusting position sizes, using stop-loss orders, and avoiding over-leveraged bets in a choppy or bearish environment. Rather than chasing big moves that may not materialize, they may benefit from more conservative strategies or waiting for clearer trends to emerge.