With a price increase of 120% this year, Bitcoin outperformed prominent assets such as the Nasdaq 100 and the S&P 500 indexes. The value of Bitcoin fell by 1.81 per cent. From an all-time high of $108,427, Bitcoin has fallen to $97,000 due to the Federal Reserve’s prediction of just two interest rate decreases in 2025.

Bitcoin ETF Flows and MVRV-Z Score: Market Insights

Spot ETF flows demonstrate how the recent Bitcoin downturn affected investors. On Friday, after selling $680 million worth of assets the day before, these funds reportedly lost $276 million. This information comes from SoSoValue. Some investors may have seen this as evidence that Bitcoin’s Growth and Future peaked. The Market Value to Realized Value indicator suggests that Bitcoin is still relatively inexpensive, despite reaching a new record high last week.

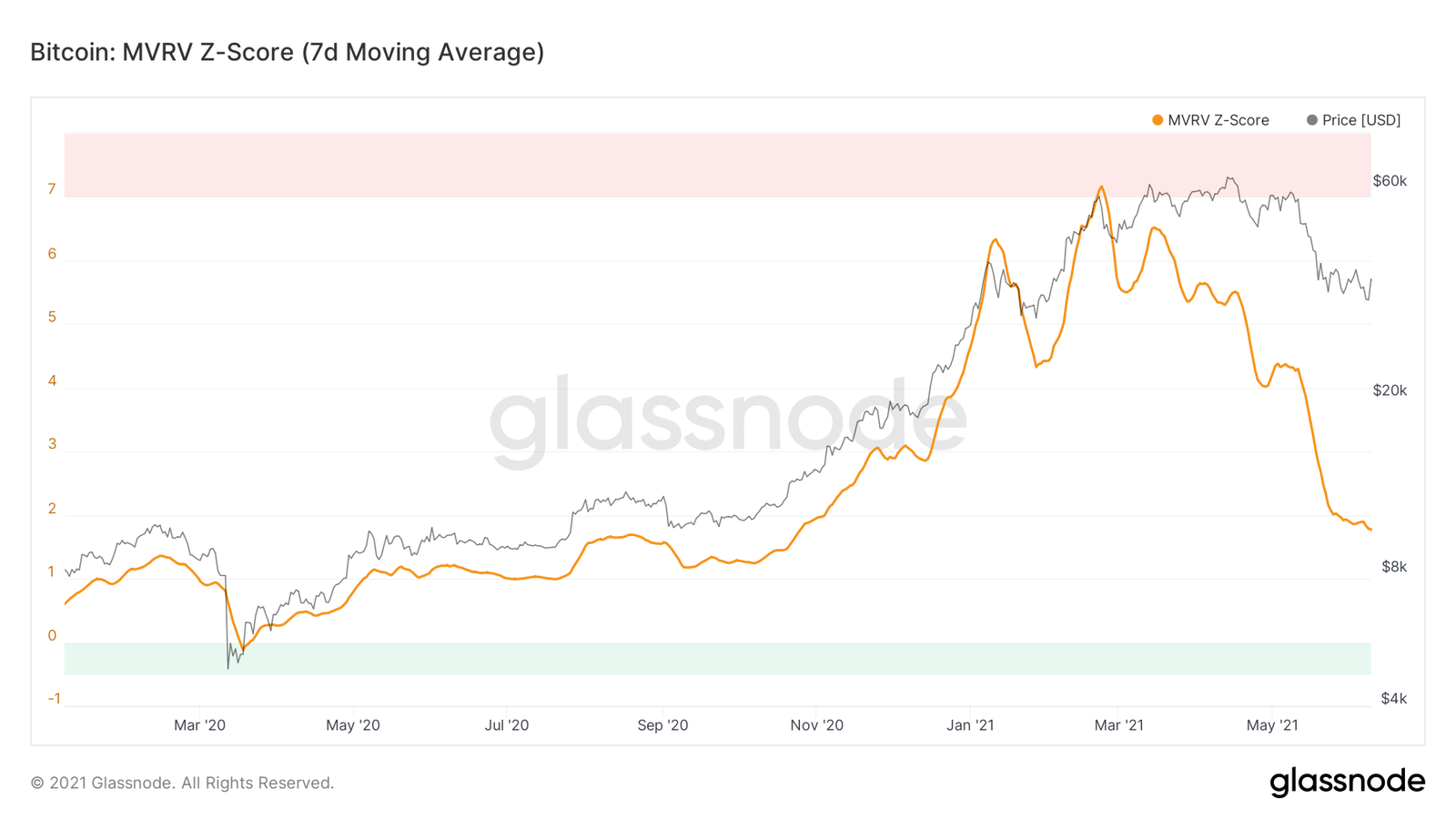

The MVRV-Z score has fallen to 2.84 from 3.3 last week, according to CoinGlass. In the past, an asset was considered inexpensive if its MVRV-Z score was less than 3.7. An essential metric that considers a coin’s market value and relative worth is the MVRV-Z score. To get it, divide the difference between the market value of circulation and the realized market capitalization by the standard deviation.

In March of this year, Bitcoin saw a huge correction with an MVRV score of 3.03; in January of 2021, it had an MVRV score of 7. This score suggests the coin has a favourable chance of substantially recovering in the coming weeks. In this bullish cycle, the cup-and-handle pattern indicates a climb to $122,000, as we mentioned in our most recent Bitcoin forecast.

Bitcoin’s Strong Fundamentals and Positive Market Outlook

Additionally, the coin’s fundamentals are solid. See below for proof that the 2.24 million Bitcoins in circulation are at an all-time low. In September of this year, more than 2.72 million coins were available on exchanges. This trend suggests that more and more Bitcoin prices grow their money in cold storage. These investors include some who have added to the more than $109 billion in assets held by exchange-traded funds (ETFs). Marathon Digital and MicroStrategy are among the several companies that have kept adding Bitcoin to their holdings this year.

There are currently more than 439,000 coins in MicroStrategy’s arsenal. The fact that the market cap of stablecoins has increased to about $210 billion from $122 billion a year ago is another factor that could propel Bitcoin’s price. An increase in the value of stablecoins is typically a positive sign, demonstrating that more and more people are interested in investing in cryptocurrencies.

The yearly inflation rate of Bitcoin, which peaked at nearly 12% in 2015, has been steadily declining and is now at 1.12%. The halving events and increasing mining difficulty rates have caused this inflation rate to decline. Consequently, Bitcoin’s positive MVRV score and favourable fundamentals suggest it will likely push higher in the long run, even though further pullbacks are still probable.

Final Thoughts

Bitcoin has surpassed more conventional assets, such as the Nasdaq 100 and the S&P 500, with a price increase of 120% this year. Although larger economic variables, including the Federal Reserve’s interest rate forecasts, have contributed to Bitcoin’s recent declines, the cryptocurrency’s fundamentals are still strong. The MVRV-Z score and the declining inflation rate are two indicators that point to Bitcoin’s Growth and Future development potential and positive long-term prospects. Despite temporary setbacks, the market should see more bullish momentum in the next months due to reasons such as decreasing supply and rising institutional use.

[sp_easyaccordion id=”3368″]