Every cycle in crypto feels like a new story, yet the plot often repeats itself. Prices explode higher, social media fills with wild predictions, new coins appear daily and trading volume surges. Then, almost without warning, the mood changes. Rallies fade, volatility cools, and portfolios that once looked unstoppable start drifting lower or moving sideways for weeks at a time. That is the moment when traders quietly admit what they already feel: winter is coming, and the crypto season slides into a dormant phase as Bitcoin and altcoins retreat from their recent highs.

This transition from euphoria to exhaustion is not just about price. It is about psychology, liquidity, regulation, macroeconomics and market structure all shifting at once. When Bitcoin price stops making new highs and the altcoin market begins to bleed, activity across the entire ecosystem slows. Search interest falls, new retail money dries up, and even die-hard enthusiasts check their portfolios less often. Many call this the beginning of a crypto winter, a period where the market seems to freeze in place while everyone waits for the next big narrative.

Yet a dormant phase is not just a punishment for late buyers. It is also a reset, a time when noise fades and real builders quietly work in the background. Understanding what this phase means, why Bitcoin and altcoins retreat, and how to navigate it can turn a discouraging market into a strategic opportunity.

Understanding the dormant phase in the crypto market

A dormant phase in crypto is not always dramatic. There is no single candle that declares, “The bull run is over.” Instead, the shift shows up in small changes that accumulate. Daily charts that once showed strong green candles start printing more doji and slow drifts. Trading volumes shrink. The number of new addresses and on-chain activity may flatten. The intense excitement around new projects fades into a quieter background hum.

This is the moment when crypto season slides into a dormant phase. It is less about a crash and more about a slow cooling. Bitcoin might still be up massively compared to previous years, but the energy that pushed it higher is no longer present. Altcoins that had been riding the wave begin to lag. Where they once outperformed BTC, they now underperform on both rallies and dips.

In practical terms, a dormant phase is a period when risk appetite has shifted. Speculators are tired, early investors are taking profits and fewer new participants are arriving to absorb the supply. It is a pause between major trends, a sideways or downward stretch in which market sentiment turns from greed to caution and sometimes to boredom.

Why Bitcoin and altcoins retreat after a hot season

One of the central questions traders ask is why Bitcoin and altcoins retreat at all when the fundamental story of crypto seems stronger than ever. The answer lies in understanding that markets do not move only on fundamentals. They move on expectations, liquidity and emotions.

During a strong bull market, Bitcoin price tends to run far ahead of fundamental growth. Expectations become extreme. People project recent gains into the future, assume every dip is a buying opportunity and stretch leverage to chase more upside. Every narrative, from institutional adoption to halving cycles to macro hedges, is interpreted through an optimistic lens.

Eventually, the market reaches a point where even good news no longer pushes prices much higher. That is usually a sign that most buyers who wanted in are already positioned. When early holders decide to lock in profits, their selling meets a weaker wall of demand. Price begins to slip. At first, traders call it a healthy correction. Over time, they realize that the pattern has changed. Rallies are smaller, dips last longer, and the overall direction stops being clearly up.

Altcoins intensify this effect. When the season is hot, capital flows down the risk curve into smaller tokens, chasing high returns in the altcoin market. Once Bitcoin starts to lose momentum, that capital usually reverses. Traders rotate back from high-risk tokens into BTC, into stablecoins, or out of crypto entirely. As this rotation unfolds, it is common to see altcoins retreat faster than Bitcoin, with deeper drawdowns and slower recoveries.

Macro factors that cool the crypto season

The idea that winter is coming in crypto is not only an internal phenomenon. Global events exert pressure too. Interest rates, inflation, regulatory statements and geopolitical tensions all influence the way investors view risky assets. When central banks talk about keeping rates higher, or when inflation surprises to the upside, broader markets tend to reprice risk. Stocks wobble, speculative sectors fall out of favor, and investors move toward safer assets. Crypto, being one of the most volatile asset classes, is especially vulnerable in those moments. The same liquidity that once fed a Bitcoin rally now starts flowing into government bonds or money-market instruments instead.

Regulatory headlines can also accelerate the slide into a dormant phase. Announcements about lawsuits, exchange restrictions, stricter KYC rules or uncertainty around stablecoins can make new investors hesitate. Even long-term supporters might reduce exposure temporarily while they wait for clarity. When those doubts overlap with tired price action and fading momentum, the result is a slow, grinding retreat that reinforces the idea that the crypto market has entered a hibernation period.

On-chain signals of a dormant market

The dormant phase is visible not only on price charts but also on the blockchain itself. When excitement peaks, on-chain data shows rising transaction counts, high fees, intense transfer volume and a surge in new addresses. These metrics tell a story of enthusiastic adoption and speculative activity.

As Bitcoin and altcoins retreat, these on-chain signals often soften. Fewer new addresses are created each day. Existing holders move coins less frequently. Long-term holders may move their BTC into cold storage and simply wait. Network fees drop because there is less competition for block space. Activity in DeFi protocols may decline as yields fall and risk appetite cools.

Some of these changes are healthy. When speculative congestion clears, real usage becomes easier and cheaper. A quieter blockchain can be a better environment for builders and genuine users. But the same data also confirms that the crypto season has lost its previous intensity and has indeed slid into a more dormant phase.

The psychology of a crypto winter

From a human perspective, the shift into crypto winter is often harder to handle than the dramatic drawdowns. Violent crashes at least feel decisive. Prices fall quickly, liquidations run their course, and the market eventually stabilizes. A dormant phase, by contrast, feels like waiting in fog.

Traders check charts and see nothing but choppy sideways action. Each small rally sparks a burst of hope that “this is the start of the next leg,” only to fade a few days later. This repeated pattern of disappointment eats away at confidence. Some participants quietly leave the market, telling themselves they will return when things “look better.” Others stay but reduce position sizes or stop engaging actively.

The emotional journey follows a familiar arc. Euphoria turns into denial when Bitcoin price first starts to slide. Denial slowly becomes frustration as weeks of weak action accumulate. Eventually, many people accept that the season has changed. This acceptance is what truly marks the beginning of a crypto winter, where expectation cools and the market becomes dominated by patient, long-term participants rather than short-term momentum chasers.

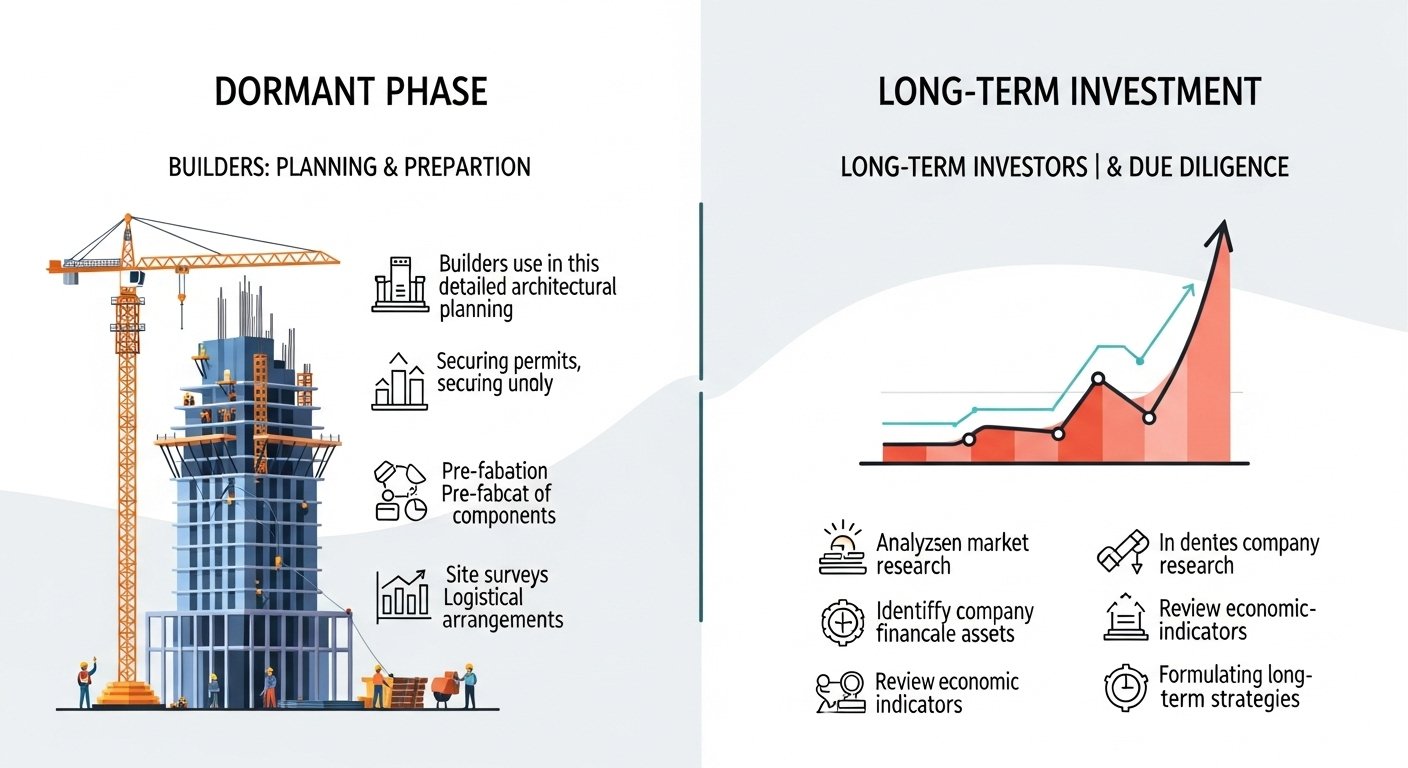

How builders and long-term investors use the dormant phase

While a dormant phase feels negative to traders focused on daily price moves, it can be surprisingly productive for builders and long-term investors. When the noise of speculative mania quiets down, serious projects find more room to breathe. Teams can develop products, refine tokenomics and test protocols without the constant distraction of extreme volatility.

For long-term holders, a period where Bitcoin and altcoins retreat can also be an opportunity. Instead of chasing vertical candles, they can focus on accumulating positions at more reasonable valuations. The key is approaching this carefully, with realistic time horizons and clear risk management. The fact that winter exists does not guarantee that every project will survive until the next spring.

However, history shows that many of the strongest gains in later cycles come from assets and protocols that were quietly built and accumulated during the most boring phases of the previous one. When the next wave of adoption arrives, those positions suddenly look visionary. In that sense, a dormant crypto season is less a dead end and more a training ground for the next generation of winners.

Navigating a market where winter is coming

For traders and investors, the important question is not whether the crypto season has cooled, but how to behave when it has. A market sliding into hibernation demands different strategies from one that is rallying every week. Short-term traders may need to adjust their expectations. Volatility tends to compress during dormant phases, making it harder to find strong trends. Range trading, mean-reversion strategies and strict risk management become more relevant than blind trend-following. The goal shifts from hitting home runs to preserving capital and staying sharp for the eventual return of volatility.

Longer-term participants, meanwhile, can use the time to deepen their understanding. Instead of refreshing price feeds every hour, they can study crypto fundamentals, read whitepapers, follow development updates and track real-world use cases. When Bitcoin and altcoins retreat, the market’s signal-to-noise ratio improves. With fewer distractions, it becomes easier to distinguish between projects with genuine adoption potential and those that only thrived in hype-driven environments.

The role of patience when crypto season turns cold

Perhaps the hardest skill in a crypto winter is patience. In a fast-moving, twenty-four-hour market, doing less feels unnatural. Many traders equate activity with progress, even if that activity is just reacting emotionally to minor moves. Yet some of the most successful participants in past cycles were those who learned to sit through long, quiet stretches without losing discipline.

Patience does not mean passivity. It means acting deliberately rather than impulsively. It might involve setting specific accumulation ranges for Bitcoin or high-conviction altcoins, deciding in advance how much capital to deploy and under what conditions. It might mean accepting that not every month will bring profit and that some months are meant for rebuilding, learning and planning.

When winter is coming and the crypto season slides into a dormant phase, patience and perspective become strategic advantages. Traders who understand this are less likely to burn out, less likely to capitulate at the wrong time and more likely to be present and prepared when the next strong trend finally emerges.

Could winter be shorter this time for Bitcoin and altcoins?

One intriguing question is whether future dormant phases will be shorter or milder as the industry matures. The early crypto winters were long and brutal, marked by exchange failures, regulatory uncertainty and minimal institutional interest. Today, the landscape is different. Large financial firms offer custody and trading, regulators in many regions have clearer frameworks and spot ETF products give mainstream investors exposure to Bitcoin without technical hurdles.

These changes do not eliminate volatility, but they can soften some extremes. A wider base of long-term holders may provide more consistent demand. More sophisticated products can help manage risk. At the same time, the presence of leverage, derivatives and algorithmic strategies can still amplify moves in both directions.

It is possible that future dormant phases will look less like total freezes and more like mild winters, with pockets of activity and innovation even when prices stagnate. Still, the core pattern remains: after intense expansions, markets need time to consolidate. Whether short or long, that consolidation period is what traders experience as a crypto season drifting into a quieter, dormant phase.

Conclusion

The headline “Winter Is Coming: Crypto Season Slides Into Dormant Phase as Bitcoin and Altcoins Retreat” may sound dramatic, but it describes a very real and recurring rhythm in digital asset markets. After phases of rapid expansion, speculative excess and euphoric sentiment, the market naturally cools. Bitcoin price stops racing ahead, altcoin markets lag and on-chain activity diminishes. Macro headwinds, regulatory questions and simple exhaustion among traders all contribute to this slowdown.

Yet a dormant phase is not only a time of loss and frustration. It is also a cleansing and rebuilding period. Speculation recedes, weaker narratives fade and serious builders keep working. Long-term investors who understand that crypto winter is part of the cycle can use this period to refine their strategies, study fundamentals and position themselves thoughtfully rather than reactively.

No one knows exactly how long any given winter will last or when the next explosive season will begin. What is clear is that cycles are a defining part of crypto. By accepting this and learning how to navigate the quieter months when Bitcoin and altcoins retreat, traders and investors can transform what feels like an ending into the start of a more mature, informed and resilient phase of their journey in the digital asset world.

FAQs

Q: What does it mean when crypto season slides into a dormant phase?

When the crypto season slides into a dormant phase, it means overall activity and excitement have cooled. Prices move more slowly or drift lower, trading volumes shrink, new user growth slows and speculative hype fades. It is not always a dramatic crash; often it is a gradual shift from a hot bull market to a quieter, more cautious environment.

Q: Why do Bitcoin and altcoins retreat even if the technology is improving?

Markets are driven by more than technology. Even if blockchain adoption and infrastructure are improving, prices respond to liquidity, expectations and macro conditions. After strong rallies, many investors take profits, new money stops rushing in and risk appetite declines. This causes Bitcoin and altcoins to retreat even while long-term fundamentals may continue to develop.

Q: How long can a crypto winter last?

There is no fixed length for a crypto winter. Some dormant phases have lasted many months or even years, while others have been shorter. The duration depends on macroeconomic conditions, regulatory developments, the health of key projects and how quickly confidence returns. What matters most for investors is being prepared for the possibility of extended quiet periods rather than assuming constant gains.

Q: Is a dormant phase always a bad time to invest in crypto?

Not necessarily. For disciplined, long-term investors, a dormant crypto season can offer opportunities to accumulate high-conviction assets at more attractive prices, as long as they manage risk and understand that volatility can continue. It is important to differentiate strong projects from purely speculative ones and to avoid overextending in a market that may remain slow for a while.

Q: How can I stay motivated when Bitcoin and altcoins retreat and the market feels dead?

Staying motivated during a crypto winter requires shifting focus. Instead of obsessing over short-term price moves, it can help to learn more about the technology, follow real adoption stories and refine your investment or trading plan. Setting realistic expectations, practicing patience and remembering that cycles are normal can keep you grounded. Many of the most successful participants built conviction and strategy during the quiet phases rather than during times of peak excitement.

Also Read: Best Crypto to Buy Over Shiba Inu $0.035 Gem