DeFi Technologies Valour Price moves dominate the digital-asset conversation. When markets climb, headlines celebrate surging assets under management (AUM). When volatility hits, the same metric can shrink quickly, creating the impression that a business is stalling—even if it’s quietly winning new clients and attracting fresh capital. That mismatch between market prices and underlying adoption is exactly why flow-based metrics have become so important for evaluating companies operating at the intersection of crypto and traditional finance.

This is the lens through which DeFi Technologies is framing Valour’s performance in 2025. Instead of asking readers to judge success through end-of-period AUM alone, DeFi Technologies highlights a more direct indicator of demand: net inflows. In 2025, Valour recorded estimated net inflows of $138.2 million, the highest annual total on record. That total reflects $116.2 million through the end of Q3 and an estimated $22.0 million in Q4. The company also emphasizes an additional consistency marker: Valour has never recorded a month of net outflows, suggesting steady accumulation rather than episodic, hype-driven spikes.

The headline matters because net inflows are harder to attribute to “market weather.” When prices rise, AUM tends to rise, even with minimal new buying. When prices fall, AUM can contract, even if new buyers are arriving. Net inflows, by contrast, are fundamentally about behavior—whether investors are allocating new money, whether distribution is expanding, and whether product-market fit is improving. In that sense, record inflows can be interpreted as evidence of core business momentum that persists beyond AUM price volatility.

Why net inflows matter more than AUM price volatility

AUM is a useful number, but it can be an unreliable narrator in crypto-linked markets. AUM blends two forces: investor flows and asset prices. In traditional equity or bond funds, price movement typically exists, but the swings are often smaller than the dramatic up-and-down cycles common in digital assets. In crypto, a large drawdown can make AUM look weak even when a platform is successfully acquiring new investors. Likewise, a fast rally can inflate AUM in a way that overstates organic growth.

That’s why DeFi Technologies leans on net inflows as a clearer sign of demand. Net inflows isolate the net new capital moving into products after accounting for redemptions. If net inflows are positive, new money is coming in. If net inflows are consistently positive, that suggests the platform is building trust, expanding reach, and offering products investors want to hold through different market moods.

In practical terms, net inflows can also be a better way to understand distribution effectiveness. A product platform can invest in new listings, improve access through broker channels, and expand its product shelf. Those actions often show up first in net inflows, not in AUM, especially if the market is range-bound or volatile.

Net inflows vs AUM: what each metric actually tells you

AUM answers a snapshot question: “How much value is held in the platform right now?” It’s a balance at a specific moment, and in crypto it’s extremely sensitive to price. Net inflows answer a behavior question: “How much net new capital did investors allocate over time?” That’s why net inflows can be more informative about the strength of the business engine.

For DeFi Technologies, emphasizing net inflows is also a way to communicate resilience. If the company can demonstrate continued inflows through varying price conditions, it strengthens the argument that Valour’s traction is not purely a byproduct of a bull market. It’s a sign of sticky demand for regulated crypto exposure through familiar investment rails.

DeFi Technologies and Valour’s record net inflows in 2025

The reported 2025 estimated net inflows of $138.2 million are presented as the highest annual total on record for Valour. Breaking the figure into quarterly components—$116.2 million through Q3 and an estimated $22.0 million in Q4—adds important context. It suggests that demand was not confined to a single “hot” quarter, but persisted across the year.

This is the kind of flow pattern that can meaningfully influence how analysts think about the durability of an ETP platform. In a space where investors often rotate quickly between narratives, consistent inflows can imply broader participation: retail investors seeking convenience, advisers allocating within managed accounts, and institutions looking for regulated access to digital assets.

The company also reported an AUM figure of approximately $989.1 million as of September 30, 2025. That number is relevant, but it’s also exactly the kind of metric that can fluctuate with market moves. The inflow story provides a second dimension—one that can show traction even when AUM is being tugged around by price.

The importance of “no months of net outflows”

Saying Valour has never had a month of net outflows is a bold consistency claim, and it speaks directly to the thesis of business momentum beyond AUM price volatility. In many crypto-linked products, flows can be highly seasonal and sentiment-driven. A “never negative” monthly pattern suggests a steady baseline of accumulation.

For DeFi Technologies, that consistency can also support operational planning. Businesses that depend on sporadic, hype-driven spikes often struggle to invest confidently in product development, compliance, and distribution. A steadier inflow cadence can enable more deliberate execution—launching new products, entering new markets, and refining monetization strategies.

Consistency also matters psychologically. For investors evaluating DeFi Technologies, a stable inflow pattern can feel like evidence of a growing franchise rather than a market-timing trade.

Valour’s diversified ETP shelf and why product breadth supports inflows

In digital assets, concentration risk can be a silent killer. If a platform’s success depends on one or two flagship products tied to a single asset, flows can evaporate the moment the narrative changes. Valour’s approach is built around breadth: by the end of 2025, Valour offered 102 listed ETPs, positioning the shelf as a highly diversified regulated product lineup.

Why does that matter for net inflows? Because different investors want different exposures. Some want major assets like Bitcoin and Ethereum. Others want thematic exposure to smart contract platforms, layer-1 ecosystems, or specific DeFi tokens. Some want volatility; others want structured access through familiar wrappers. A broad shelf increases the chance that when one segment cools, another remains attractive.

For DeFi Technologies, product breadth can also improve distribution conversations. Brokers, platforms, and advisers often prefer to integrate providers that can serve many needs rather than a single niche. A diversified shelf becomes a commercial asset: it helps win listings, strengthens partnerships, and encourages portfolio-style allocations that can be more stable than single-asset speculation.

Regulated ETPs as a bridge between traditional finance and digital assets

One of the strongest tailwinds for platforms like Valour is the growing preference for regulated wrappers. Many investors—especially those managing client money—want exposure to digital assets without dealing with wallets, private keys, or direct exchange accounts. Regulated ETPs can provide a “bridge” by delivering crypto investment exposure through familiar exchange-traded formats.

This is central to how DeFi Technologies positions Valour: a capital markets gateway that allows investors to access digital assets in a framework that aligns more closely with compliance expectations. When combined with broad product choice, regulated wrappers can significantly expand the addressable audience for digital-asset exposure.

DeFi Technologies’ “platform economics” and monetization beyond management fees

Another reason DeFi Technologies emphasizes momentum beyond AUM price volatility is that Valour is not presented as a simple fee-only product business. The company highlights scalable platform economics, including monetization potential in the range of approximately 5%–7% blended yield from management and staking, plus potential upside from trading, internal IP, node operations, and MEV.

This “stacked monetization” concept matters because it can reshape how investors model the business. In traditional asset management, management fees often trend downward due to competition. In digital assets, the economics can be different if staking and other on-chain mechanisms can be captured in a compliant way. If Valour’s product structures allow it to earn from both fees and staking rewards, the platform may generate more revenue per unit of AUM than a conventional low-fee product provider.

How staking yield can reinforce resilience beyond AUM price volatility

Staking is a core feature of many proof-of-stake networks. Conceptually, it’s closer to a native yield mechanism than a speculative bet. If a platform can capture staking-related economics, it can create a revenue stream that is tied not only to AUM size but also to the composition of assets held and the yield characteristics of those networks.

For DeFi Technologies, staking yield becomes part of the “business momentum beyond AUM price volatility” narrative. Even if market prices swing, yield mechanisms can provide additional stability—though they also depend on network conditions, regulatory constraints, and product design.

The key takeaway is not that staking eliminates volatility—it doesn’t. The takeaway is that the business can have more levers than just “AUM times fee rate,” which can be particularly valuable in a volatile category.

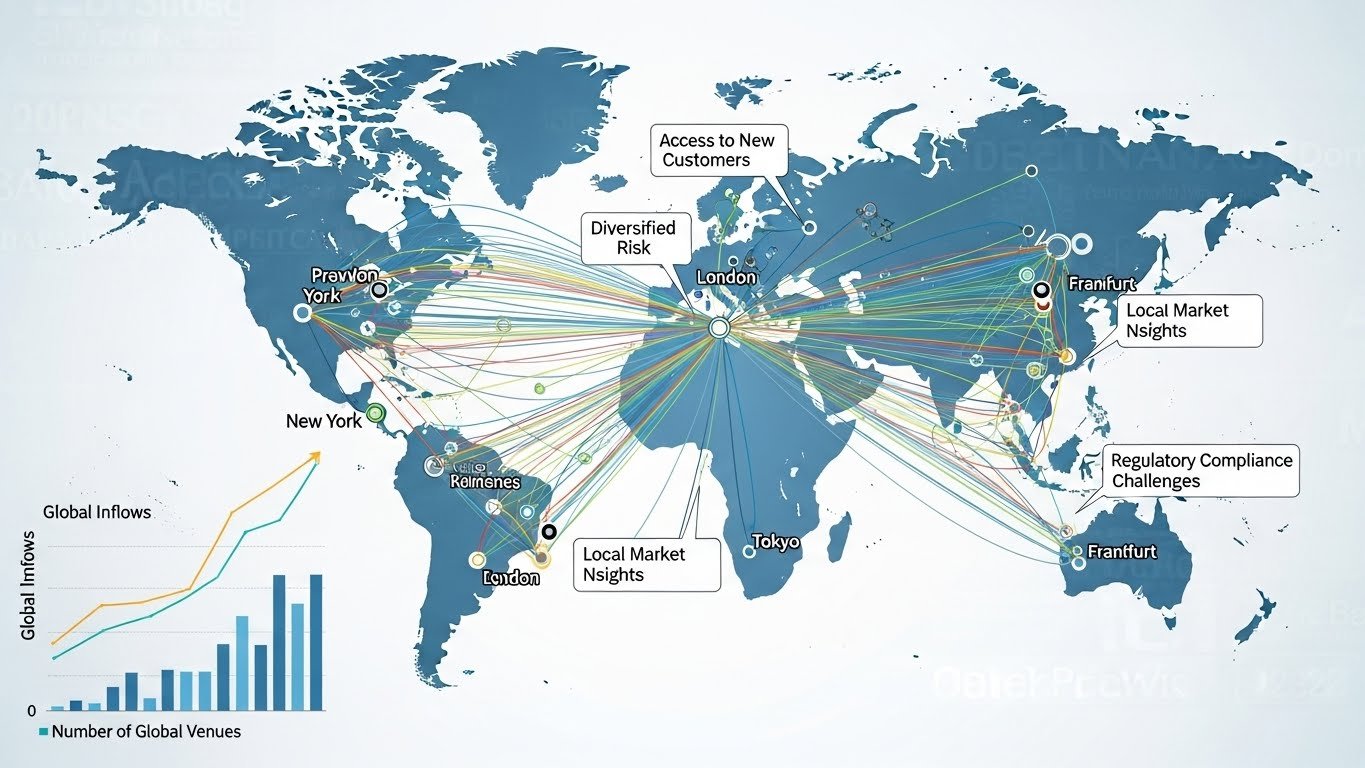

Distribution expansion and why global venues influence inflows

Net inflows don’t appear magically. They’re often the downstream result of access: where products are listed, how easily investors can buy them, and whether the wrapper fits the local market’s preferences. Valour’s expansion across major venues—such as the London Stock Exchange and SIX Swiss Exchange—signals a focus on regulated distribution. The company also described establishing a strategic presence in Brazil through B3.

Listings matter because they reduce friction. The easier it is to buy an ETP through a standard brokerage account, the larger the pool of potential investors. They also matter because they shape who can participate. Certain institutional investors have mandates that limit them to exchange-traded instruments on approved venues. By expanding the venues and jurisdictions where products are available, DeFi Technologies can widen the funnel for new capital.

Why “institutional compatibility” is a major inflow driver

Beyond listings, product structure is a major determinant of institutional participation. The company’s forward-looking focus on more institutionally compatible product types—such as UCITS-style funds, actively managed certificates, exchange-traded notes, and fund-of-funds concepts—signals an effort to match the formats larger allocators prefer.

This approach can support inflows by aligning with institutional processes: due diligence frameworks, risk controls, and portfolio construction models that may not accommodate direct token holding. If these next-generation product designs gain traction, net inflows could increasingly reflect institutional allocations rather than purely retail-driven interest.

For DeFi Technologies, this could reinforce the idea of durable momentum: institutions tend to allocate more gradually but can be more persistent once a strategy is approved.

Reading 2025 performance as a signal of core business momentum

So what does record net inflows in 2025 actually suggest? It suggests that investors were not merely riding price appreciation; they were adding capital. It suggests that Valour’s platform—its product shelf, its distribution footprint, and its regulated wrapper strategy—was compelling enough to attract allocations across changing market conditions. And it suggests that DeFi Technologies is attempting to be valued not just as a proxy for crypto prices, but as an operating business with repeatable growth drivers.

The most useful way to interpret this, especially for readers who track digital-asset businesses, is to separate three layers:

First, market layer: asset prices rise and fall, changing AUM.

Second, demand layer: investors allocate fresh capital, visible in net inflows.

Third, monetization layer: the platform earns revenue through fees, staking, and other sources.

DeFi Technologies is essentially asking the market to focus on layers two and three when judging momentum beyond AUM price volatility.

What to watch going forward

If you want to evaluate whether DeFi Technologies can sustain and extend this momentum, the most relevant signals are likely to be flow persistence, product innovation, and distribution depth. Continued positive net inflows would suggest that Valour remains relevant to investors. Expanding the product shelf in ways that fit institutional needs could broaden the buyer base. And deeper listings and partnerships across regulated venues can reduce reliance on any single region’s sentiment.

It’s also worth tracking how the platform balances growth with structure. In crypto, speed sometimes wins short-term attention, but regulated markets reward consistent compliance, clear product design, and predictable investor experience. If Valour can maintain inflow consistency while scaling distribution and product variety, the “core business momentum” thesis becomes easier to defend.

Conclusion

AUM can be loud, but it’s not always honest. In digital assets, AUM often reflects price as much as it reflects progress. That’s why DeFi Technologies is spotlighting Valour’s 2025 record estimated net inflows of $138.2 million: it’s a demand-driven metric that helps explain what’s happening underneath market volatility. Paired with a claim of no months of net outflows, a broad shelf of 102 listed ETPs, and a strategy focused on regulated distribution and diversified platform economics—including staking yield and other monetization channels—the inflow record supports a narrative of momentum beyond AUM price volatility.

For readers and investors, the practical takeaway is simple: if you want to understand the trajectory of DeFi Technologies, watch the flow of new capital and the platform’s ability to monetize it—not just the price charts that inflate or compress AUM.

FAQs

Q: What does net inflows mean for DeFi Technologies?

Net inflows refer to the net new capital allocated into Valour’s exchange-traded products over a period, after accounting for redemptions. For DeFi Technologies, net inflows are a strong indicator of investor demand and distribution strength.

Q: Why is AUM price volatility not enough to judge performance?

AUM can rise or fall because the underlying digital assets move in price, even if investor behavior is unchanged. Net inflows help isolate investor allocation behavior, which can better reflect the platform’s real growth.

Q: How can a diversified ETP shelf improve inflows?

A broader lineup can attract different investor preferences and reduce reliance on a single asset narrative. With multiple products available, inflows can come from varied themes across the digital-asset market.

Q: How does staking yield relate to business momentum?

Staking yield can add an additional monetization stream beyond management fees for certain proof-of-stake assets. It can support platform economics and help explain momentum beyond AUM price volatility, depending on product structure and execution.

Q: What should readers track next for DeFi Technologies?

Key signals include sustained net inflows, expansion into additional regulated venues, product structures that improve institutional compatibility, and the company’s ability to scale monetization across fees, staking rewards, and other platform revenue channels.

Also More: Circle USDC Hyperliquid Integration Game-Changer for DeFi