The cryptocurrency market is once again navigating a period of heightened uncertainty as Dogecoin slides alongside Bitcoin, dragging the broader memecoin sector lower while traders reassess their appetite for risk. After weeks of choppy price action and fading momentum, market participants appear to be rotating away from speculative assets and into safer positions, triggering a synchronized pullback across major digital currencies. This shift has placed memecoins, long seen as high-beta plays on investor sentiment, squarely in the spotlight.

Dogecoin, the original memecoin and a frequent bellwether for retail enthusiasm, has historically thrived during periods of exuberance. However, when macroeconomic pressures mount and Bitcoin price action weakens, Dogecoin often mirrors that decline with amplified volatility. The current environment reflects exactly that dynamic, as traders pare back exposure to risk-heavy tokens and wait for clearer signals from global markets.

This article explores why Dogecoin slides alongside Bitcoin during risk-off phases, how memecoins are uniquely affected by changing sentiment, and what this trend means for investors navigating an increasingly complex crypto market. By examining technical factors, macroeconomic influences, and behavioral patterns among traders, we can better understand the forces shaping the latest downturn and what may lie ahead.

The Current Crypto Market Landscape

Bitcoin’s Role as the Market Anchor

Bitcoin remains the dominant force in digital assets, setting the tone for nearly every other cryptocurrency. When Bitcoin price weakens or enters a consolidation phase, liquidity often drains from smaller and more speculative tokens. This relationship explains why Dogecoin slides alongside Bitcoin so consistently during downturns.

At present, Bitcoin’s movement reflects caution rather than panic. Lower trading volumes and tighter ranges suggest that traders are waiting for macro clarity before committing fresh capital. This indecision tends to weigh heavily on memecoins, which rely more on sentiment and momentum than on fundamentals. As Bitcoin stalls, the broader crypto market follows suit, reinforcing a feedback loop of reduced risk-taking.

Risk-Off Sentiment Takes Hold

The phrase “traders pare risk bets” captures the prevailing mood across financial markets. Rising interest rates, persistent inflation concerns, and uncertainty around global growth have pushed investors toward safer assets. In such an environment, high-volatility cryptocurrencies become less attractive, particularly those without strong utility narratives. Dogecoin, despite its strong community and brand recognition, falls into this category. As risk-off sentiment spreads, traders often liquidate positions in memecoins first, accelerating declines. This behavior underscores how sentiment-driven assets can amplify broader market trends, especially when confidence wanes.

Why Dogecoin Slides Alongside Bitcoin

Correlation in Times of Stress

Although Dogecoin began as a joke, its price action has become increasingly correlated with Bitcoin over time. During bullish cycles, Dogecoin may outperform due to speculative inflows, but during downturns, that same correlation works against it. When Bitcoin shows weakness, Dogecoin slides alongside Bitcoin as traders anticipate reduced liquidity and weaker demand. This correlation is partly structural. Many trading pairs are denominated in Bitcoin, and institutional flows often move in tandem across major assets. When Bitcoin loses momentum, capital exits the entire market, affecting Dogecoin disproportionately due to its higher volatility.

The Psychology of Memecoin Trading

Memecoins thrive on narratives, humor, and community-driven hype. However, these strengths can quickly become vulnerabilities when market psychology shifts. Fear and uncertainty tend to override optimism, leading traders to abandon speculative positions en masse. As Dogecoin slides alongside Bitcoin, the psychological impact is compounded. Retail traders, who make up a significant portion of Dogecoin’s holder base, are more likely to react emotionally to price declines. This can trigger cascading sell-offs that deepen losses and reinforce negative sentiment across the memecoins sector.

Memecoins Under Pressure

From Euphoria to Caution

The memecoin market is particularly sensitive to changes in sentiment. During periods of euphoria, tokens like Dogecoin can see explosive gains fueled by social media buzz and celebrity endorsements. Conversely, when traders pare risk bets, these same tokens often experience sharp corrections. The current downturn illustrates this volatility. As Dogecoin slides alongside Bitcoin, other memecoins have followed suit, reflecting a broader retreat from speculative plays. This pattern highlights the cyclical nature of memecoin investing, where rapid gains are often followed by equally rapid pullbacks.

Liquidity and Market Depth Challenges

Another factor exacerbating declines is liquidity. Memecoins generally have thinner order books compared to major cryptocurrencies. When selling pressure increases, prices can drop quickly due to limited buy-side support. This dynamic explains why Dogecoin slides alongside Bitcoin but often falls further in percentage terms. Reduced liquidity also makes memecoins more vulnerable to sudden sentiment shifts. As traders exit positions, slippage increases, amplifying volatility and reinforcing the perception that memecoins are high-risk assets best avoided during uncertain times.

Macro Forces Shaping Trader Behavior

Interest Rates and Global Markets

Macroeconomic conditions play a crucial role in shaping crypto market trends. Central bank policies, particularly those of the Federal Reserve, influence risk appetite across asset classes. Higher interest rates tend to strengthen traditional investments like bonds, drawing capital away from speculative markets. In this context, Dogecoin slides alongside Bitcoin as part of a broader repricing of risk. Traders who once sought outsized returns in crypto are now prioritizing capital preservation, leading to reduced exposure to volatile assets like memecoins.

Inflation and Economic Uncertainty

Persistent inflation and uneven economic growth have added to market anxiety. While Bitcoin is often touted as an inflation hedge, its short-term price action remains sensitive to macro data. When inflation reports or economic indicators surprise to the downside, risk assets typically sell off. This environment leaves little room for speculative enthusiasm. As Dogecoin slides alongside Bitcoin, the message is clear: traders are responding to real-world economic pressures by scaling back risk, even in markets traditionally driven by optimism and innovation.

Technical Analysis and Market Structure

Key Support and Resistance Levels

Technical factors also contribute to Dogecoin’s decline. As prices break below key support levels, algorithmic trading systems and stop-loss orders can accelerate selling. When Dogecoin slides alongside Bitcoin through important technical thresholds, it often triggers additional downside momentum. Bitcoin’s own technical structure plays a role here. A failure to reclaim critical resistance levels can signal weakness, prompting traders to reduce exposure across correlated assets. This interconnectedness underscores how technical analysis shapes behavior in the crypto market.

Volume Trends and Momentum Indicators

Declining trading volumes often precede extended periods of consolidation or decline. In the current market, lower volumes suggest waning interest and reduced conviction among traders. Momentum indicators reflect this caution, reinforcing the narrative that risk appetite is diminishing. As Dogecoin slides alongside Bitcoin amid weakening momentum, it highlights the importance of volume and trend confirmation. Without renewed buying interest, prices may continue to drift lower until a catalyst emerges.

The Role of Speculation and Social Media

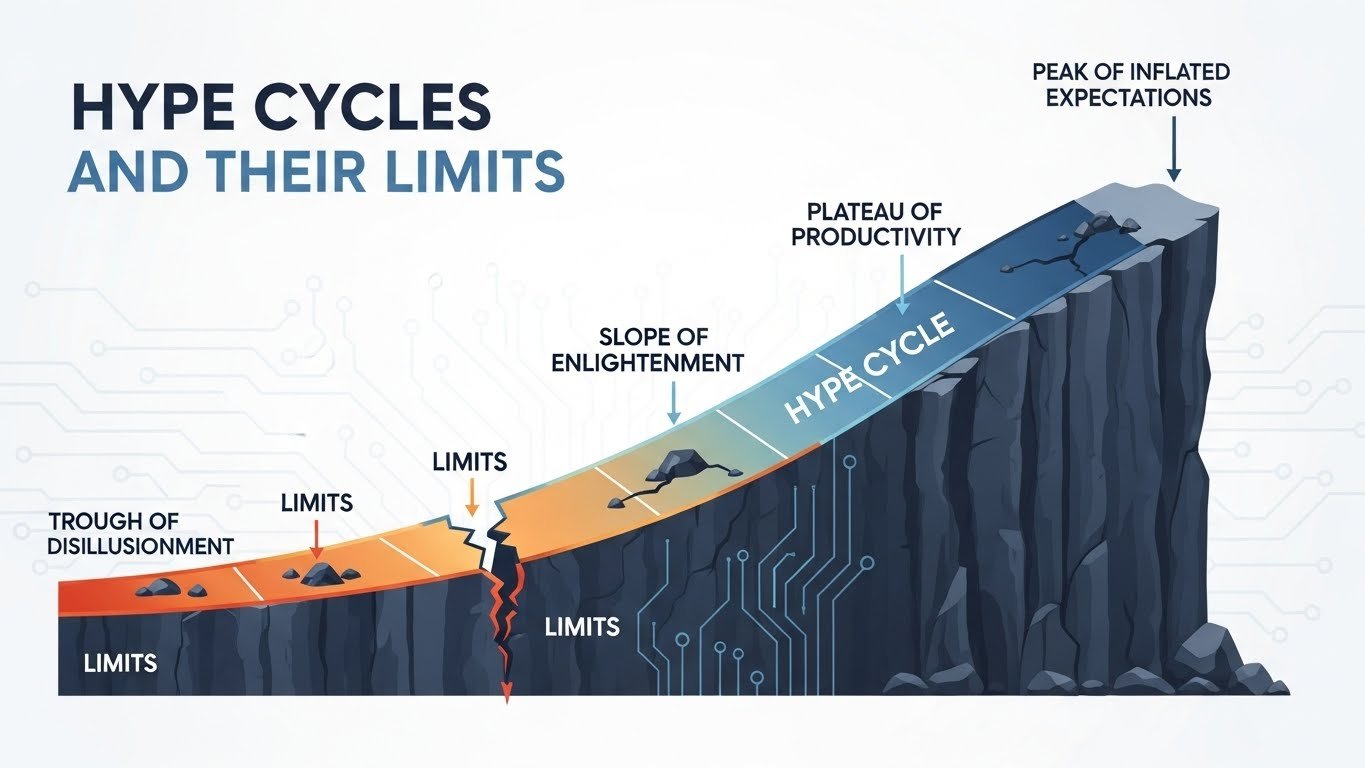

Hype Cycles and Their Limits

Social media has been instrumental in Dogecoin’s rise, amplifying narratives and attracting new investors. However, hype-driven rallies are inherently fragile. When sentiment turns, the same platforms that fueled gains can accelerate losses through fear-driven commentary. The current downturn shows the limits of speculation. As Dogecoin slides alongside Bitcoin, social media buzz has cooled, reflecting a more cautious tone among traders. This shift underscores the importance of sustainable demand over short-term hype.

Retail Versus Institutional Influence

Dogecoin’s investor base skews heavily toward retail participants, making it more sensitive to sentiment swings. Institutional investors, who tend to favor assets with clearer use cases, are less active in memecoins. This imbalance means that when retail enthusiasm fades, there is limited institutional support to stabilize prices. As traders pare risk bets, the absence of large-scale institutional buying contributes to Dogecoin’s vulnerability. This dynamic reinforces why Dogecoin slides alongside Bitcoin but struggles to decouple during downturns.

Long-Term Implications for Dogecoin and Memecoins

Evolution Beyond Speculation

Despite current challenges, Dogecoin’s future is not solely defined by speculation. Ongoing development efforts and integration into payment systems could enhance its utility over time. However, such progress may take years to materially impact price behavior. In the near term, Dogecoin slides alongside Bitcoin as market forces dominate. Long-term holders may view this period as a test of resilience, while short-term traders remain focused on volatility and momentum.

Lessons for Crypto Investors

The latest downturn offers valuable lessons for investors. Understanding correlation, sentiment, and macro influences is crucial when navigating volatile markets. Memecoins, while potentially lucrative, require careful risk management, especially during periods of uncertainty. As Dogecoin slides alongside Bitcoin, it serves as a reminder that diversification and disciplined strategies are essential in the ever-evolving crypto market.

What Could Trigger a Reversal?

Macro Clarity and Policy Shifts

A meaningful reversal may depend on improved macroeconomic clarity. Signs of easing inflation or shifts in monetary policy could restore risk appetite, benefiting Bitcoin and, by extension, Dogecoin. Such developments would likely spark renewed interest in speculative assets. Until then, traders remain cautious. The current environment favors patience over aggressive positioning, particularly in high-volatility segments like memecoins.

Renewed Market Narratives

Narratives matter deeply in crypto. A new use case, partnership, or cultural moment could reignite interest in Dogecoin. However, any rally would need to be supported by broader market strength to be sustainable. As long as Dogecoin slides alongside Bitcoin, isolated catalysts may struggle to overcome prevailing risk-off sentiment.

Conclusion: Navigating a Risk-Off Crypto Environment

The fact that Dogecoin slides alongside Bitcoin as traders pare risk bets reflects a broader shift in market psychology. Heightened macroeconomic uncertainty, tightening financial conditions, and fading speculative enthusiasm have combined to pressure memecoins and the wider crypto ecosystem. While Dogecoin’s community and brand remain strong, its price action underscores the challenges faced by sentiment-driven assets during cautious periods.

For investors, this phase emphasizes the importance of understanding correlation, managing risk, and maintaining a long-term perspective. As the market searches for direction, Dogecoin’s journey offers valuable insights into how sentiment, macro forces, and technical factors intersect in the dynamic world of digital assets.

FAQs

Q: Why does Dogecoin slide alongside Bitcoin during downturns?

Dogecoin is highly correlated with Bitcoin, especially during periods of market stress. When Bitcoin weakens, liquidity often exits the entire crypto market, affecting Dogecoin more due to its higher volatility.

Q: Are memecoins riskier than other cryptocurrencies?

Yes, memecoins are generally considered riskier because they rely heavily on sentiment and speculation rather than utility. This makes them more volatile during risk-off phases.

Q: How do macroeconomic factors impact Dogecoin?

Interest rates, inflation, and global economic uncertainty influence risk appetite. When traders pare risk bets, speculative assets like Dogecoin tend to underperform.

Q: Can Dogecoin recover despite current market conditions?

Recovery is possible if broader market sentiment improves or if Dogecoin gains new utility or narratives. However, sustained gains usually require support from Bitcoin and the overall crypto market.

Q: Should investors avoid memecoins during risk-off periods?

Risk-off periods call for caution. Investors should assess their risk tolerance and consider diversification, as memecoins can experience sharper declines when sentiment turns negative.

See More: Best Altcoin Mining Profitability Calculator News 2025