Kelly Criterion Betting. Bet sizes were optimized for long-term wealth maximization using the Kelly criterion, a mathematical method that transformed gambling and investing. Adjustments for transaction costs and psychological aspects are necessary for the formula’s practical implementation in volatile markets, such as cryptocurrency, where optimal bet sizes are calculated based on winning probabilities.

This article will define the Kelly Criterion Betting, describe its operation, discuss its potential applications in cryptocurrency trading, compare it to the Black-Scholes model, and outline its advantages and disadvantages.

What is Kelly’s Criterion for Betting?

Mathematically, the Kelly criterion determines the optimal size of a series of bets in gambling and investment. The basic premise is to maximize the rate of long-term capital growth while decreasing the likelihood of short-term financial losses. The possible profit-to-loss ratio and the probability of winning or losing a bet are factored into the algorithm.

Distributing funds among wagers by the benefit or edge of each bet and the odds offered is the core principle of the Kelly criterion. According to the Kelly criterion, assigning some money to the edge allows one to optimize growth while limiting risk.

If you want to maximize your expected logarithm of wealth and have the best long-term growth rate, then you need to use a good Kelly ratio. It must be noted that while the Kelly criterion offers a perfect solution in theory, practical considerations may need modifications to account for factors like psychological considerations, uncertainty in estimation, and transaction costs.

History of the Kelly Criterion

In 1956, while working at Bell Laboratories, John L. Kelly Jr. developed what would become known as the Kelly Criterion. Its first application was to optimize the signal-to-noise ratio in long-distance communications, but its usage soon expanded to gambling and investing.

It wasn’t until the work of mathematician Edward O. Thorp that these areas learned about it, though. In the early 1960s, Thorp revolutionized the gaming business with his book “Beat the Dealer.” He applied the Kelly criterion to blackjack card counting.

In the 1980s, as scholars and investors began to see the formula’s potential for portfolio management and risk optimization, it rose to even greater prominence in the financial world. The Kelly Criterion Betting is a simple yet powerful decision-making tool for maximizing profitability with appropriate risk management. Organizations and people can benefit from it.

How to Use Kelly Criterion in Crypto Trading

When trading cryptocurrencies, you must follow the Kelly criterion to maximize wealth while efficiently controlling risk. The trader must first ascertain the likelihood of various outcomes, such as the potential movement in the price of a cryptocurrency asset, by utilizing market research and indicators. This probabilistic estimate serves as the foundation for all subsequent decision-making.

The trader then formulates a strategy for mitigating risk, detailing the maximum amount of capital they are willing to risk in a single transaction. This process lowers the likelihood of losses and guarantees prudent resource deployment. Due to the market’s inherent volatility and unpredictability, determining p and losing q in cryptocurrency trading requires market research, a comprehensive understanding of market dynamics, historical data analysis, and, occasionally, advanced predictive algorithms.

Once the trader has determined the risk parameters, they can apply the Kelly criterion formula to determine the optimal bet size. They decide how much of the bankroll to wager using the odds, winning probability, and losing probability. A person’s “bankroll” is the sum of all the money available to bet or invest, as it relates to Kelly Criterion Betting.

Given the extreme volatility of the cryptocurrency market, which has the potential to greatly affect the size of bets and the evaluation of risk, volatility research has become crucial. Adjustments to bet sizes and probability are necessitated by the process’s ongoing reevaluation in response to changing market conditions. To get the most out of their methods in the long run, traders must stay vigilant and open to fresh information.

Calculating Kelly Criterion

Assume for the sake of argument that a cryptocurrency trader uses the Kelly criterion to determine the probability that a certain coin would increase in value by 60%. In addition, the odds of 2:1 for the deal mean that the potential return is double the amount wagered (b = 2).

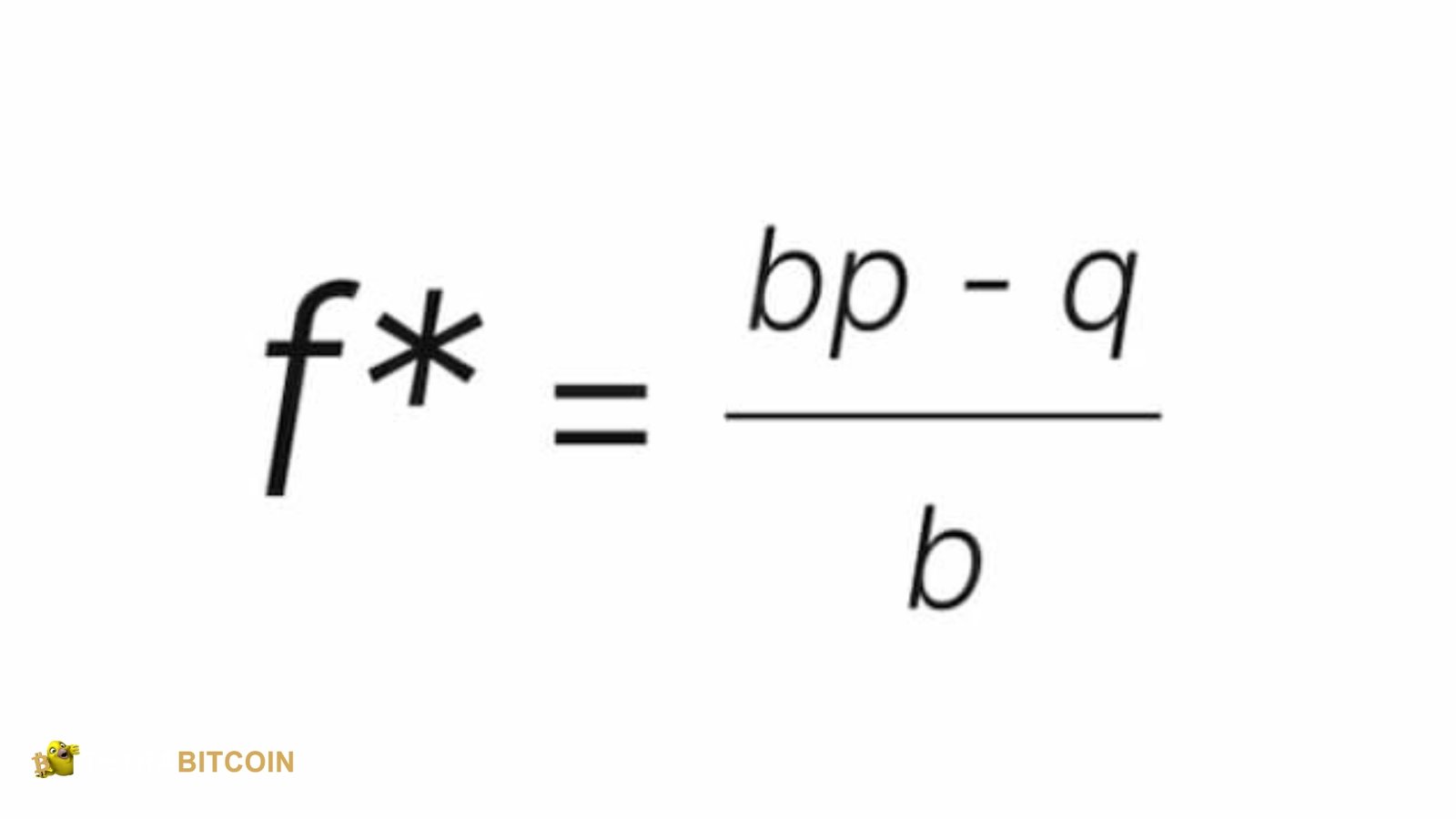

Using the Kelly criterion formula, one can determine the ideal stake size:

f* = (bp-q)/b

- f* represents the fraction of the bankroll to bet

- b is the odds received on the bet

- p is the probability of winning

- q is the probability of losing

f*=2(2×0.6-0.4) = 2(1.2-0.4) = 20.8 = 0.4

The optimal wager size for a trader is 40% of their bankroll, as shown by the estimated f* = 0.4. This indicates that the trader should allocate 40% of their capital towards this particular trade. Portfolio diversification, market circumstances, and individual risk tolerance are other important considerations before making investment decisions.

Remember that the example above only gives a theoretical ideal and may not consider all real-world factors, such as slippage, transaction costs, or the mental toll big bets have on traders. The Kelly criterion provides a good foundation for determining optimal bet sizes, but it should be used with comprehensive risk management strategies and ongoing market analysis.

The Black-Scholes Model vs. the Kelly Criterion

Different from one another, the Black-Scholes model and the Kelly criterion serve unique financial purposes. The theoretical value of European-style options can be calculated using the Black-Scholes model, a mathematical tool. Myron Scholes and Fischer Black created it. It revolutionized the options trading industry by providing a structure for pricing contracts based on factors such as underlying asset price, volatility, time to expiration, and interest rates.

However, when the outcome is uncertain, John L. Kelly Jr. proposed the Kelly criterion to maximize long-term wealth generation by determining the optimal bet size. Since they deal with distinct parts of risk management and bet sizing, the Black-Scholes model and the Kelly criterion are market tools that complement each other.

Advantages of Kelly Criterion in Crypto Trading

Incorporating the Kelly criterion into crypto trading strategies has multiple advantages. Systematically determining the optimal position size for each transaction based on the trader’s edge and risk restrictions allows them to allocate a certain amount of cash to each deal, reducing the likelihood of suffering big losses under volatile market conditions.

The Kelly criterion fosters trading discipline, prioritizing long-term growth over short-term gains. For traders, the key to increasing their total returns is constantly allocating capital according to the perceived edge of each deal.

In addition, the Kelly criterion helps traders avoid overleveraging or underutilizing their money, promoting a balanced and long-term trading approach. This is of the utmost importance in the ever-changing cryptocurrency markets, where prudent risk management is key to achieving long-term success.

Trading techniques and methodologies can be adjusted to fit the Kelly criterion, making it a versatile tool for traders with diverse risk tolerances and market perspectives. The Kelly Criterion Betting is useful for crypto traders looking to improve their risk-adjusted returns and performance consistency.

Limitations of Kelly Criterion in Crypto Trading

While the Kelly criterion provides useful information, it has some restrictions regarding cryptocurrency trading. The Kelly criterion requires an exact computation of probabilities and anticipated returns, which can be challenging in highly unpredictable and volatile cryptocurrency markets. Accurate probability calculations are more difficult because non-financial factors sometimes induce excessive price volatility in crypto assets.

The Kelly criterion does not account for external factors linked to the cryptocurrency industry, such as market sentiment, legislative developments, or technological breakthroughs. These factors could significantly affect the market dynamics and the reliability of the calculations based on the Kelly criterion.

Because the Kelly criterion uses an aggressive position-sizing strategy, traders could lose much money when the market is volatile. Due to the huge and rapid price movements, such drawdowns can quickly drain funds when trading cryptocurrencies, leading to substantial losses.

Additionally, the inflexible Kelly criterion formula may not sufficiently consider various risk appetites and trading styles. Traders with different risk tolerances or tactics may find it too cautious or unrealistic, limiting its use in different trading scenarios.