Crypto Brokerage ETH Forecasts is once again at the center of the digital-asset conversation, as market chatter says the bank is preparing to launch a crypto brokerage offering tailored to professional and institutional clients. The move, if finalized, would place Standard Chartered more directly into the trade-execution and liquidity layer of the market—an area where big players increasingly want the comfort of bank-grade controls, clearer governance, and a more familiar operational model. At the same time, the bank’s research narrative has been closely watched after it lowered its Ethereum outlook in prior forecasts, reflecting a more cautious stance on how Ethereum captures value as the network scales.

Taken together, the reported crypto brokerage plan and the reduced ETH forecasts tell a coherent story about where the industry is heading. Institutions are leaning into digital assets as an asset class, but they are also demanding mature market infrastructure. That means compliant onboarding, robust risk management, tighter execution standards, reliable settlement pathways, and stronger transparency around exposure. A bank-backed crypto brokerage fits this institutional checklist, even if a research desk remains selective about the upside of a single asset such as Ether.

This article explores what a Standard Chartered crypto brokerage could realistically look like, why a global bank would choose to expand deeper into the trading stack, how this lines up with institutional demand, and what the ETH forecast cuts imply about Ethereum’s evolving economics. Along the way, we’ll connect the dots between prime brokerage services, liquidity and custody choices, and the shifting narrative around Ethereum scaling, Layer-2 growth, and long-term value capture.

The reported Standard Chartered crypto brokerage move: what it signals

The phrase “Standard Chartered said to launch crypto brokerage” matters because it implies more than a casual interest in crypto. A crypto brokerage offering is not merely a marketing label; it suggests an intent to provide a structured gateway for clients who want to trade and manage exposure at scale. In traditional finance, brokerage services thrive on trust, operational reliability, and consistent execution standards. In crypto, that same need exists, but it’s often fragmented across multiple venues, technology providers, and counterparties.

If Standard Chartered launches a crypto brokerage, the primary signal is institutional commitment. The bank would be positioning itself not only as a participant in crypto markets but also as a service provider that can potentially unify parts of the workflow. For institutions, that workflow includes trade execution, exposure reporting, operational controls, and connectivity to custody and settlement arrangements that reduce counterparty and operational risk.

This is also a signal about market maturity. A crypto brokerage becomes more viable as regulation becomes clearer, institutions become more active, and demand increases for service providers that can bridge familiar TradFi processes with the unique market structure of crypto. Standard Chartered stepping forward would reflect a broader shift: crypto is moving from an experimental corner of finance to a market that increasingly resembles professionalized capital markets infrastructure.

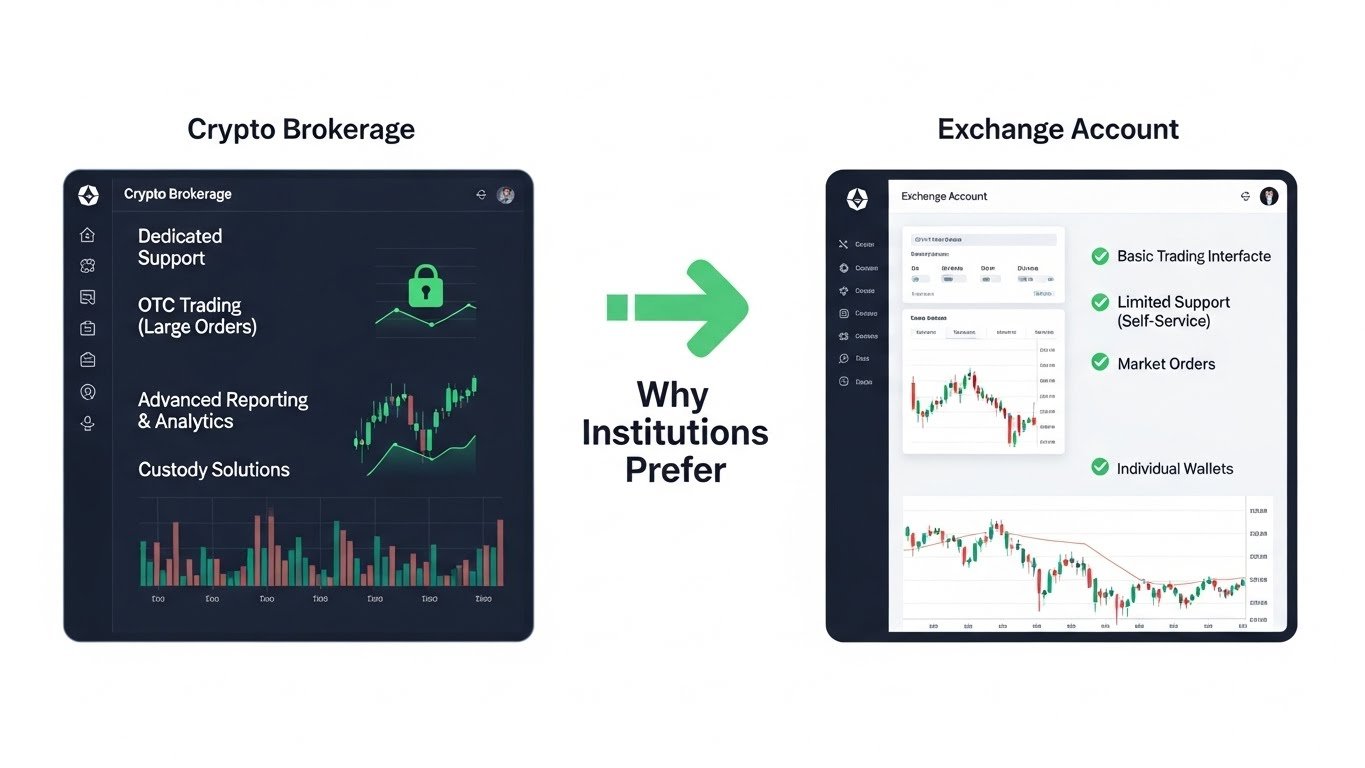

Why institutions want a crypto brokerage, not just an exchange account

Retail users can often trade with minimal friction, but institutional users operate under a different set of constraints. A crypto brokerage appeals to institutions because it can reduce operational complexity and provide a governance-friendly structure for exposure.

Institutions care about predictable onboarding, KYC and compliance alignment, trade and post-trade reporting, and controls that satisfy auditors and investment committees. They also care about liquidity access that is robust during volatility. A crypto brokerage can act as an institutional wrapper that makes these requirements easier to meet.

Another key driver is counterparty risk. Institutions increasingly prefer to limit the number of counterparties they rely on. Instead of managing multiple exchange relationships, multiple wallets, multiple credit lines, and multiple settlement processes, they want an integrated provider that can coordinate these moving parts. A bank-backed crypto brokerage can be appealing because banks already specialize in managing client relationships, providing risk frameworks, and operating under stringent compliance standards.

How a bank-led crypto brokerage could work in practice

A bank-led crypto brokerage typically aims to combine execution, connectivity, and risk controls into one coherent service. The goal is not just to let a client click “buy” or “sell,” but to provide an institutional-grade environment for exposure management.

A Standard Chartered crypto brokerage could focus on core assets first, then expand. It could begin with high-liquidity markets where institutions already concentrate activity, and then broaden to additional products as regulatory clarity and client demand support it. The strength of a bank offering is often in consistency and controls: trade confirmations, reconciliation support, and well-defined governance around how assets move, how collateral is handled, and how risk is measured.

This is where prime brokerage concepts become relevant. In traditional markets, prime brokerage is an ecosystem of services that supports trading at scale: financing, margin, collateral optimization, and operational support. In crypto, those needs exist too—sometimes even more intensely because of market fragmentation and 24/7 trading. A crypto brokerage that incorporates prime brokerage features could attract clients who want the convenience of a single relationship to manage multiple components of the trading lifecycle.

Prime brokerage in crypto: the institutional “missing layer”

Execution and liquidity aggregation

In a fragmented market, best execution can mean the difference between a clean fill and costly slippage. A crypto brokerage can provide execution pathways that are more sophisticated than a single-venue approach. For institutions, accessing deep liquidity matters because trade sizes are larger and market impact can be meaningful.

A Standard Chartered crypto brokerage could attempt to provide aggregated access across liquidity sources, combining exchange liquidity with OTC trading pathways where appropriate. This helps institutions manage large orders with less market impact and more predictable execution outcomes.

Financing, margin, and capital efficiency

Financing is often what turns a broker into a prime broker. Institutions routinely need leverage, shorting capability, or balance-sheet efficiency. A crypto brokerage that offers financing could become a core service hub for hedge funds, market makers, and other professional traders.

That said, financing in crypto is delicate because risk management must be strong. A bank’s brand is tied to prudence. If Standard Chartered builds financing into its crypto brokerage, it would likely emphasize conservative collateral policies, robust monitoring, and a tightly controlled product set that aligns with institutional risk standards.

Custody connectivity and settlement controls

Institutions frequently separate trading from custody to reduce risk. They prefer assets held with trusted custody providers, sometimes with multi-signature controls and institutional governance. A crypto brokerage can integrate with custody arrangements so trades can settle efficiently without forcing clients to leave large balances on trading venues.

This is a critical advantage for institutions that worry about hacks, operational errors, and platform failures. A well-designed crypto brokerage can create smoother settlement flows that match institutional expectations without sacrificing the security posture institutions demand.

Why Standard Chartered would expand into crypto brokerage now

Timing matters. A Standard Chartered crypto brokerage would be arriving in a market that is both more mature and more demanding than earlier cycles. The institutional market has evolved: participants are more selective, more compliance-driven, and more focused on operational resilience.

There is also a structural business incentive. In maturing markets, infrastructure services often become durable revenue engines. A crypto brokerage can monetize through spreads, service fees, financing costs, and value-added services. This can be attractive for a bank that already has deep relationships with corporates, asset managers, and institutional investors.

Finally, expanding into crypto brokerage can be viewed as a strategic hedge. Even if asset prices remain volatile, market infrastructure demand can grow as institutions adopt crypto for trading, hedging, settlement experimentation, and long-term portfolio allocation.

Lowers ETH forecasts: what’s behind the changed outlook

Standard Chartered’s decision to lower ETH forecasts, in earlier research cycles, reflects the growing complexity of valuing Ethereum. The short version is not simply “ETH is weaker.” The more precise framing is that Ethereum’s economics are changing as scaling solutions gain traction.

Ethereum’s growth story increasingly includes Layer-2 networks that process transactions off the main chain, then settle back to Ethereum. This is beneficial for scalability and user experience, but it complicates the old assumption that more usage necessarily translates into more value captured by the base layer in the form of fees.

If more activity and fee revenue move to Layer-2 environments, then Ethereum mainnet may secure the ecosystem without capturing the same share of transaction fees that earlier models predicted. This can affect valuation assumptions and lead research teams to lower price targets. That’s the underlying logic many analysts have highlighted: Ethereum scaling is a success story, but it also reshapes the fee narrative.

Ethereum scaling and value capture: the Layer-2 factor

The settlement layer thesis versus the fee thesis

Ethereum’s long-term role increasingly resembles a global settlement layer. That’s bullish from a network importance perspective, but it doesn’t automatically answer the question investors ask: how does ETH capture economic value as the ecosystem expands?

Layer-2 growth can reduce mainnet congestion and lower costs for users. But if the bulk of user activity happens on Layer-2 networks, then the direct fees paid to Ethereum mainnet can be lower than earlier expectations. Analysts who lowered ETH forecasts are often reacting to this shift: the network’s utility remains strong, yet fee capture may be distributed differently than in prior cycles.

The counterweight: tokenization and stablecoin settlement

On the other side of the debate are drivers that could still increase Ethereum fee demand over time. Stablecoins and tokenization can create sustained transaction activity, and institutional adoption could expand the set of use cases that settle on Ethereum or on Ethereum-aligned ecosystems.

This is why ETH outlooks can swing. Ethereum’s economics are not static. They depend on how Layer-2s design fee structures, how much settlement demand returns to the base chain, and how much institutional activity increases total network usage.

How the crypto brokerage plan and ETH forecasts fit together

At first glance, it might seem contradictory to expand a crypto brokerage while lowering ETH forecasts. In reality, these actions can be consistent.

A crypto brokerage business is built to serve client activity across assets and strategies. Institutions do not only buy and hold ETH. They trade multiple assets, hedge exposures, manage volatility, and rotate allocations. A crypto brokerage can thrive on the growth of institutional participation regardless of whether a specific asset outperforms.

Meanwhile, research forecasts are directional views on long-term value. Lowering ETH forecasts is a statement about how Ethereum’s evolving economics might affect price potential. It does not mean institutional interest in trading ETH disappears. In fact, more institutional infrastructure can increase trading activity even when fundamental debates remain unresolved.

So the combined headline—Standard Chartered said to launch crypto brokerage, lowers ETH forecasts—can be read as a mature institutional stance: build the rails for institutional activity, while remaining analytical and selective about long-term asset-level valuation.

What a Standard Chartered crypto brokerage could mean for institutional clients

A Standard Chartered crypto brokerage could offer institutions a more familiar framework for engaging with crypto markets. That matters because institutional constraints are often operational rather than ideological. Many firms want exposure, but they want it in a form that aligns with internal policies.

A well-structured crypto brokerage can reduce friction in several ways. It can simplify counterparty management by consolidating relationships. It can improve reporting and controls. It can create more consistent trade workflows and settlement practices. It can also enable institutions to approach crypto as they approach other markets: through governed processes rather than ad hoc systems.

If Standard Chartered’s crypto brokerage offering emphasizes regulated crypto access, compliance clarity, and strong operational design, it could appeal to corporates and asset managers who have hesitated due to operational concerns.

What it could mean for Ethereum markets and broader crypto liquidity

Infrastructure changes can reshape markets. A strong crypto brokerage platform can deepen liquidity by enabling more institutional participation. When institutions can execute and manage exposure more efficiently, market depth tends to improve, spreads can tighten, and price discovery can become more robust.

For Ethereum specifically, greater institutional access can support sustained trading activity. Even if ETH forecasts are lower in some research models, ETH remains central to many strategies: ecosystem exposure, DeFi settlement narratives, and the broader role of Ethereum as a programmable settlement layer. A Standard Chartered crypto brokerage could increase the ease with which institutions trade ETH and related markets, which can contribute to liquidity and market professionalism.

At the same time, the ETH forecast debate remains important. Ethereum’s long-term valuation will likely reflect the balance between Layer-2 scaling success and the base layer’s ability to capture value through settlement demand, security provisioning, and economic mechanisms that reward ETH holders.

The role of regulation in shaping crypto brokerage offerings

Regulation is one of the biggest variables considered by institutional clients. A crypto brokerage that operates with clear compliance alignment can become a key bridge between traditional finance and crypto markets.

Institutions typically prefer to engage where rules are clearer, reporting expectations are defined, and service providers have mature controls. Banks are used to operating in that world. That’s why a bank-backed crypto brokerage has potential: it can bring a compliance-first posture that institutions recognize.

However, regulation is also what can limit product scope. A Standard Chartered crypto brokerage may initially focus on simpler, more institutionally acceptable products—often spot trading and vanilla derivatives—before expanding into more complex offerings. Over time, as frameworks mature, the product set can broaden.

Market perception: why this headline is bigger than it looks

This headline resonates because it captures a market transition. Crypto is no longer only about speculative surges and retail momentum. It is increasingly about infrastructure, institutions, and the integration of digital assets into professional market workflows.

A Standard Chartered crypto brokerage would represent a strong institutional signal: major banks see enough durable demand to justify building or expanding the services layer. Meanwhile, the ETH forecast cuts reflect an equally institutional habit: challenge assumptions, revise models, and adapt to new market structure realities such as Layer-2 value distribution.

The combined narrative suggests a more grown-up market. Institutions will participate, but they will do it with frameworks, controls, and selective views on which assets capture long-term value.

Conclusion

Standard Chartered said to launch crypto brokerage services at a time when institutions are pushing the market toward better infrastructure and more professional standards. The bank’s parallel move to lower ETH forecasts, in earlier research cycles, highlights the evolving complexity of Ethereum’s economics as scaling shifts activity across the ecosystem. These two themes are not in conflict. A crypto brokerage is a bet on institutional participation and market maturity, while an ETH forecast revision is a view on value capture and long-term fundamentals.

If Standard Chartered does proceed with a crypto brokerage, it could accelerate institutional comfort by offering a more familiar, controlled gateway to institutional crypto markets. At the same time, Ethereum’s long-term narrative will continue to hinge on how the network balances its role as the settlement anchor with mechanisms that allow ETH to capture a meaningful share of the ecosystem’s growth. In a market moving from hype to infrastructure, both themes matter—and together, they capture the direction crypto is taking.

FAQs

Q: What is a crypto brokerage and how is it different from an exchange?

A crypto brokerage is typically a service layer that helps clients access crypto markets with more structured execution, reporting, and operational support, often designed for institutions. An exchange is primarily a venue where orders are matched, while a crypto brokerage can provide a more integrated client experience.

Q: Why would Standard Chartered launch a crypto brokerage?

A bank may launch a crypto brokerage to meet institutional demand for compliant access, stronger operational controls, and a more familiar trading workflow. It can also diversify revenue by serving market infrastructure needs rather than relying on asset price direction.

Q: Why did Standard Chartered lower ETH forecasts?

Lowered ETH forecasts generally reflect concerns about how Ethereum captures value as Layer-2 networks grow. If activity shifts off the main chain, the fee dynamics and valuation assumptions can change, leading analysts to revise price targets.

Q: Does a lower ETH forecast mean institutions will stop trading Ethereum?

Not necessarily. Institutions often trade ETH for liquidity, hedging, or exposure to the broader Ethereum ecosystem even when long-term forecasts are more cautious. A crypto brokerage can increase trading participation regardless of forecast direction.

Q: What should investors watch next in this story?

Investors should watch how institutional crypto brokerage services evolve, how regulatory clarity expands, and how Ethereum’s economics develop as Layer-2 adoption grows. The interaction between infrastructure maturity and network value capture will shape long-term market outcomes.

Also More: Bitcoin and the Japanese Yen Move Together Like Never Before