Altcoin Rally Ahead every major crypto bull run, there is a moment when the narrative quietly shifts from “Bitcoin only” to “altcoins are waking up.” That shift rarely begins on social media or price charts; it usually starts with deeper market data. Today, many traders are watching one thing in particular: the biggest altcoin indicator pushing to new highs and hinting that Ripple’s XRP, BNB, and Solana (SOL) could be on the verge of a parabolic move.

In simple terms, capital is rotating. After strong periods of Bitcoin dominance, liquidity tends to spread into the wider market. When that happens, high–quality large-cap altcoins with strong ecosystems, deep liquidity and clear narratives often lead the way. XRP, BNB and Solana check all of those boxes. They are not just speculative tokens; they sit at the center of payments, exchange infrastructure and high-performance smart contract platforms. When the altcoin market heats up, attention and capital naturally flow toward them first.

At the same time, key metrics such as altcoin market cap, altcoin dominance, trading volumes and on-chain activity have begun to shift in favor of the broader altcoin sector. For experienced market participants, these are classic early signs that an altcoin season may be forming. That does not guarantee instant profits or a straight line upward, but it does create a powerful backdrop where the probability of parabolic rallies in leading altcoins is significantly higher.

Altcoin Rally Aheadthis article, you will learn what the biggest altcoin indicator actually is, why it matters for XRP, BNB and Solana, and how these three assets could behave if the market truly enters a new phase of altcoin mania. We will also discuss risks, strategy considerations and the key signals you should watch if you are preparing for the next potential leg of this cycle.

The Biggest Altcoin Indicator: What It Is and Why Traders Care

Altcoin Market Cap and Altcoin Dominance

When traders talk about the biggest altcoin indicator, they are usually referring to the combination of total altcoin market capitalization and altcoin market dominance. Total altcoin market cap measures the combined value of all cryptocurrencies except Bitcoin. Altcoin dominance tracks what percentage of the entire crypto market is made up of these altcoins instead of Bitcoin. When both of these measures are rising together, it tells a powerful story. It means not only that money is coming into crypto, but that a growing share of that money is choosing altcoins over Bitcoin.

Historically, strong surges in altcoin dominance and altcoin market cap have preceded or accompanied some of the most intense altcoin rallies, where assets like XRP, BNB and Solana outperform Bitcoin for weeks or even months. If Bitcoin is the tide that lifts the harbor, the altcoin indicator shows whether that water is pouring into the smaller boats. When the tide is high and the smaller boats start to rise faster than the largest ship, it is often the signal that a more aggressive altcoin cycle is unfolding.

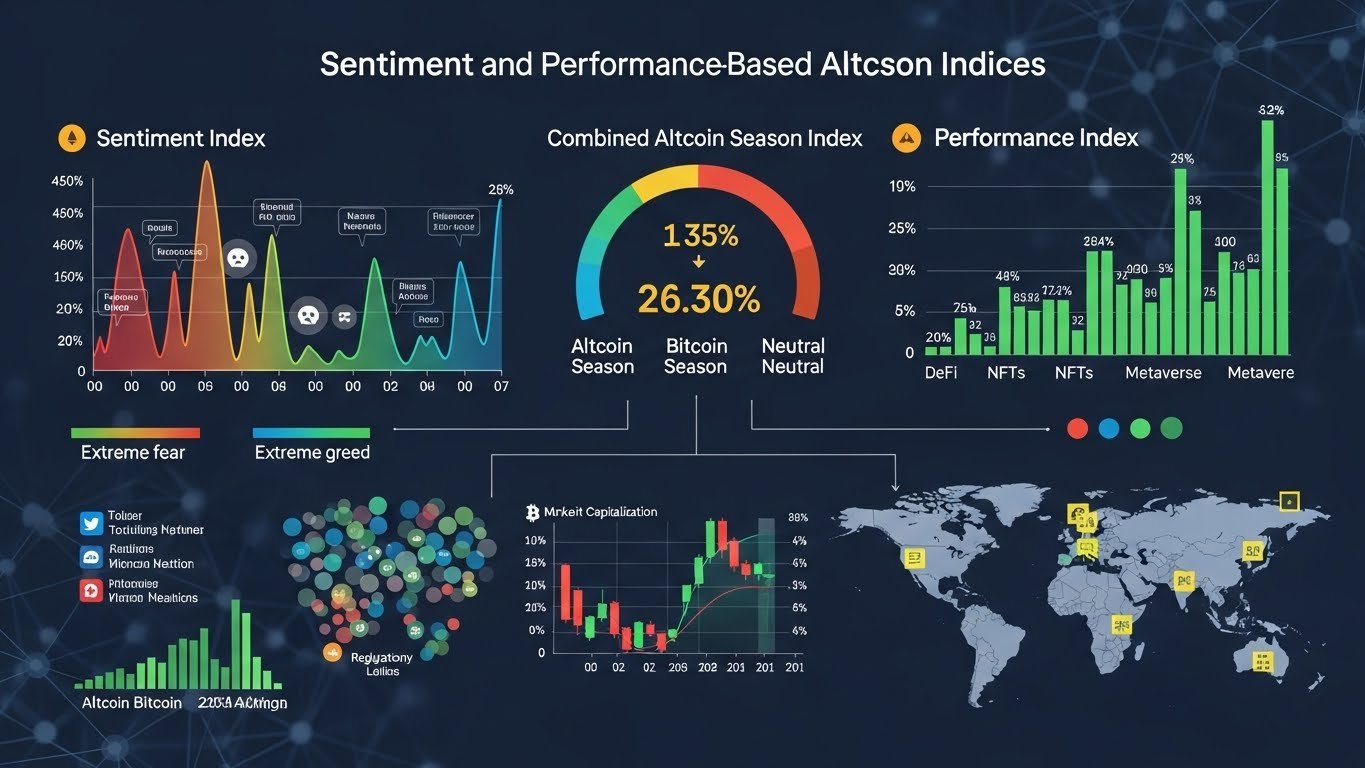

Sentiment and Performance-Based Altcoin Season Indices

Another way to track the health of the altcoin market is through altcoin season indices and performance trackers. These tools compare how a basket of major altcoins performs against Bitcoin over a given period. When a large majority of altcoins outperform Bitcoin, the index flashes that an altcoin season is underway. When Bitcoin is outperforming most altcoins, the cycle is still Bitcoin-led.

These indices are not perfect, but they offer another lens on the same phenomenon: increasing risk appetite. As more traders rotate out of the relative “safety” of Bitcoin into higher-beta altcoins, it often signals growing confidence in the market as a whole. XRP, BNB and SOL tend to be among the first beneficiaries of that renewed appetite, because they combine brand recognition with substantial liquidity and deep markets. When the biggest altcoin indicator hits new highs, and altcoin season indices move from neutral to strongly bullish, it creates a fertile environment for parabolic moves in leading altcoins.

Why Altcoin Cycles Often Favor Large-Cap Leaders First

Liquidity, Market Depth and Institutional Capital

The first wave of an altcoin rally rarely begins in obscure micro-caps. Large players need deep order books, derivatives markets and reliable access. That is exactly what Ripple’s XRP, BNB and Solana provide. Their high liquidity allows institutional desks, funds and sophisticated traders to deploy meaningful capital without excessive slippage.

Because these assets are listed on most major exchanges and supported by futures and options markets, they are natural entry points into the altcoin market for larger investors. When the altcoin indicator breaks out, these assets often act as the “big three” of the rotation trade. The result is a dynamic where they move earlier and sometimes more steadily than lower-cap tokens, setting the tone for the rest of the altcoin sector.

Narrative Strength and Real-World Utility

The other reason large-cap leaders tend to dominate early is narrative. Markets are driven by stories, and each of these tokens has a clear one. XRP is associated with cross-border payments and bank-grade liquidity solutions. BNB is the backbone token of a massive exchange and DeFi ecosystem. Solana is widely seen as a high-performance layer-1 that can support Web3 at scale.

When traders search for altcoins that might go parabolic, they are not just buying random tickers; they are buying stories they believe other traders will also believe. In a rising altcoin tide, projects with strong narratives and visible ecosystems attract disproportionate attention. That is precisely why these three assets are frequently at the center of discussions whenever the altcoin indicator lights up.

Ripple’s XRP: Repricing After Years of Uncertainty

The Evolving Regulatory Landscape Around XRP

For a long time, Ripple’s XRP was overshadowed by regulatory uncertainty in key markets. Legal disputes and classification debates weighed heavily on its price and its perception among institutional investors. As more clarity emerges and market participants better understand where XRP stands, the token is gradually stepping out from under that cloud. This shift matters because markets hate uncertainty more than almost anything.

When regulatory pressure eases or rules become clearer, previously sidelined capital can re-enter. Combined with a rising altcoin market, this can trigger a repricing event where XRP rapidly adjusts to a new equilibrium that reflects reduced legal risk and improved sentiment. If the biggest altcoin indicator continues to show strength while regulatory questions around XRP remain on a more stable path, the result could be a powerful alignment of fundamentals and market structure that supports a parabolic XRP rally.

XRP’s Role in Cross-Border Payments and Liquidity

Beyond regulation, XRP’s core value proposition has always centered on facilitating fast, low-cost cross-border transactions. Ripple’s solutions aim to help banks, payment providers and fintech platforms move value more efficiently than traditional correspondent banking systems. In a world that is increasingly digital and global, this payments narrative is compelling.

During altcoin cycles, tokens with clear real-world use cases often attract investors who are looking for more than pure speculation. XRP’s integration into payment corridors and its role in on-demand liquidity offerings give it a tangible place in the broader financial landscape. When combined with a strong altcoin indicator and rising sector-wide enthusiasm, this utility-driven story can fuel sustained interest, allowing XRP to participate fully if the market enters a truly parabolic phase.

BNB: The Engine Token of a Massive Crypto Ecosystem

BNB as Gas, Collateral and Utility Within the Ecosystem

BNB has evolved from a simple discount token for trading fees into a multi-purpose asset at the center of a huge ecosystem. On BNB Chain, BNB functions as gas for transactions, collateral in DeFi protocols, a stake in governance and a key asset for launchpads and token sales. On centralized platforms, it is used for reduced trading fees, staking products and various incentive programs.

This broad utility means that when altcoin activity increases, demand for BNB often rises naturally. More transactions, more yield strategies and more new projects all translate into more tokens being used for gas, staking or collateral. Because BNB is also heavily integrated into trading products, increased volatility and volume in the wider market can further boost its profile. In periods when the biggest altcoin indicator hits new highs, BNB is often positioned as one of the most obvious plays on rising usage, speculation and DeFi growth, making it a prime candidate for parabolic upside.

Token Burns, Scarcity and Long-Term Value

Another key piece of BNB’s story is its burn mechanism. Over time, parts of the BNB supply are permanently removed from circulation, creating a gradually shrinking total supply. As network and exchange usage grow, this combination of rising utility and decreasing supply can create a powerful scarcity effect.

Altcoin Rally Ahead market, especially during an altcoin season, scarcity narratives become particularly attractive. Traders begin to price in future supply reductions while demand accelerates in the present. If the altcoin indicator remains strong and new waves of users enter the ecosystem, BNB’s tokenomics could help amplify any parabolic move that begins from a technical or sentiment catalyst.

Solana: High-Speed Infrastructure for the Next Altcoin Wave

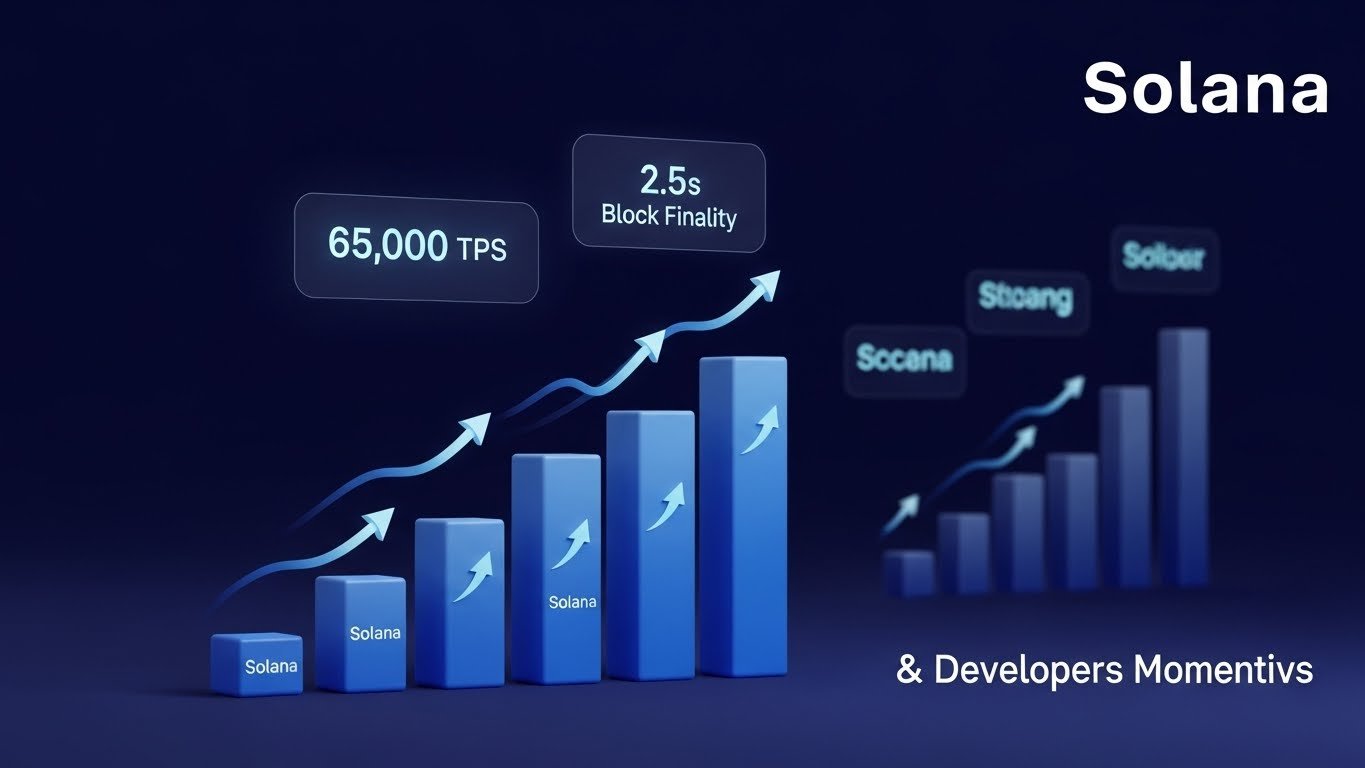

Solana’s Performance Edge and Developer Momentum

Solana (SOL) has emerged as one of the leading high-performance layer-1 blockchains, built to handle large volumes of transactions at minimal cost. Its architecture allows for fast settlement times and high throughput, making it attractive for decentralized exchanges, NFT marketplaces, gaming projects and experimental DeFi protocols. Despite early network congestion and outages in its history, ongoing upgrades have aimed to strengthen Solana’s reliability.

As stability improves, more builders are attracted to the network, expanding the developer ecosystem and the range of applications available to users. In an environment where the altcoin market is expanding and traders are searching for platforms that can support the next generation of Web3 applications, Solana’s positioning as a scalable, user-friendly infrastructure layer makes it a natural beneficiary of rising altcoin indicators.

NFTs, DeFi and the “Next Generation” Narrative

Solana’s appeal is not purely technical. It also hosts a vibrant culture of NFT communities, gaming projects and creative experiments that are uniquely native to its ecosystem. These cultural and social layers help attract and retain users, which in turn drives on-chain activity and demand for SOL as a gas and staking token. In previous cycles, Ethereum captured the imagination of investors with the idea of the “world computer.”

Today, many see Solana as part of the next generation of blockchains that make Web3 experiences feel closer to Web2 in terms of speed and ease of use. When the biggest altcoin indicator signals growing risk appetite, investors frequently look to these “next-gen” platforms as high-conviction bets on the future. If altcoin dominance continues to expand and liquidity floods into infrastructure projects, Solana is well placed to experience a parabolic move backed by both speculative interest and genuine network usage.

How Parabolic Altcoin Moves Typically Unfold

From Quiet Accumulation to Violent Breakouts

Most parabolic altcoin rallies follow a recognizable pattern. They begin with a phase of quiet accumulation, where long-term believers and informed traders accumulate positions while price action appears relatively sideways and boring. During this time, the altcoin indicator may already be trending upward, signaling gradual inflows into the sector even before obvious breakouts occur. Once key resistance levels are broken on high volume, momentum traders and algorithms join in, accelerating the move.

News, social media and influencer coverage amplify the trend, drawing in retail traders who do not want to miss out. This is when the parabolic phase often becomes obvious: daily candles expand, volatility spikes and new price targets appear constantly across the market. For XRP, BNB and Solana, such phases have occurred in previous cycles. If the largest altcoin metrics continue to strengthen and these tokens begin to break long-term resistance levels with convincing volume, a similar pattern could emerge again.

Exhaustion, Corrections and the Importance of Timing

Parabolic moves always have a limit. As prices rise rapidly, early entrants take profits, leverage builds up, and eventually buying power is exhausted. Without new capital entering at the same pace, even the strongest uptrends can sharply reverse. Corrections of 30–60 percent are not uncommon in the aftermath of an intense altcoin rally.

This is why the altcoin indicator should be seen as a tool, not a crystal ball. It can help identify the environment where parabolic moves are more likely, but it cannot tell you exactly where the top will be. For traders, managing entries, exits and position sizes is just as important as correctly reading the broader trend.

Strategy and Risk: Riding the Wave Without Drowning in Volatility

Balancing Conviction with Risk Management

The possibility that Ripple’s XRP, BNB and Solana could go parabolic is exciting, but excitement alone is not a strategy. Volatility in the altcoin market can be extreme. Prices can move up faster than most traders expect, but they can also crash just as quickly. A balanced approach involves deciding in advance how much of your portfolio you are prepared to allocate to higher-risk assets, what kind of drawdown you are willing to tolerate and how you plan to respond if the market moves against you.

Altcoin Rally Ahead that might mean smaller positions with wider time horizons. For others, it might involve tighter risk controls and shorter-term trades. The key is to align your strategy with your own risk tolerance, rather than letting fear of missing out drive impulsive decisions when altcoin prices suddenly start to explode.

Time Horizons: Trader vs Long-Term Investor

Short-term traders and long-term investors will view a potential parabolic altcoin move very differently. Traders may focus on technical levels, momentum indicators and intraday trends. Long-term investors may care more about ecosystem growth, developer activity and real-world adoption across multiple market cycles.

For a trader, XRP, BNB and Solana might be vehicles for capturing a portion of a strong altcoin season before rotating back into stablecoins or Bitcoin. For an investor, these same assets could be core holdings that they accumulate during quieter periods and hold through multiple swings, aiming to benefit from structural growth in their ecosystems. Understanding which camp you fall into helps you interpret the biggest altcoin indicator correctly and design a plan that fits your goals.

What to Watch Next for XRP, BNB and Solana

Key Technical and On-Chain Signals

As the altcoin indicator climbs, there are several additional signals to monitor for each of these assets. On price charts, consistent higher highs and higher lows, breakouts above previous cycle highs and sustained volume surges can confirm strengthening trends. On-chain, rising active addresses, growing transaction counts and expanding total value locked in DeFi can show that rallies are supported by real usage rather than pure speculation.

For XRP, watch developments in payment corridors and institutional partnerships. For BNB, observe activity on BNB Chain across DeFi, gaming and new token launches. For Solana, track NFT volumes, DEX trading activity and the pace of new application launches. When both price and fundamentals point in the same direction, the case for a durable parabolic move becomes stronger.

Conclusion

The fact that the biggest altcoin indicator hits new highs is an important clue about where the crypto market may be heading next. Rising altcoin dominance, expanding altcoin market cap and improving sentiment all suggest that the environment is increasingly favorable for major altcoins to outperform Bitcoin. In that environment, Ripple’s XRP, BNB and Solana stand out as prime candidates for a potential parabolic rally.

Each of these tokens combines strong narratives, deep liquidity and active ecosystems. XRP is tied to cross-border payments and institutional liquidity. BNB sits at the heart of a massive trading and DeFi universe. Solana is positioning itself as a high-speed, next-generation infrastructure layer for Web3. If the altcoin cycle continues to strengthen, these stories could attract large flows of capital and significant speculative interest. However, it is crucial to remember that no indicator, no matter how powerful, can guarantee the future.

Altcoin markets remain volatile and can reverse quickly. The goal is not to predict every tick, but to understand the broader context well enough to make informed, risk-aware decisions. If you believe the altcoin cycle is just beginning, XRP, BNB and Solana may deserve a place on your watchlist, and possibly in your portfolio, depending on your risk tolerance and strategy. By combining an understanding of major indicators with disciplined planning, you give yourself the best chance to participate in the upside while staying prepared for whatever the market decides to do next.

FAQs

Q: What exactly is meant by the “biggest altcoin indicator”?

The phrase usually refers to broad measures of the altcoin market, such as total altcoin market capitalization and altcoin dominance relative to Bitcoin. When these climb to new highs, it signals that a growing share of crypto capital is flowing into altcoins, which often precedes or coincides with strong altcoin rallies in major tokens like XRP, BNB and Solana.

Q: Why are XRP, BNB and Solana considered likely to go parabolic?

XRP, BNB and Solana are seen as likely candidates for a parabolic move because they offer a combination of liquidity, strong narratives and real-world utility. XRP is focused on cross-border payments, BNB powers a large exchange and DeFi ecosystem, and Solana serves as a high-performance smart contract platform. When the altcoin indicator shows rising interest in altcoins, these large-cap leaders often attract capital first.

Q: Does a rising altcoin indicator mean it is safe to invest now?

A rising altcoin indicator suggests that market conditions are favorable for altcoins, but it does not guarantee safety or profits. Crypto remains highly volatile, and even in bullish environments, sharp corrections can occur. It is important to conduct your own research, consider your risk tolerance, and use tools such as position sizing and stop-loss orders if you are trading actively.

Q: How can I reduce risk if I want exposure to XRP, BNB and Solana?

You can reduce risk by limiting the percentage of your overall portfolio allocated to altcoins, diversifying across several high-conviction assets, and avoiding excessive leverage. Some investors choose to build positions gradually instead of going all-in at once, which can help manage the impact of short-term volatility. Having a clear plan for when to take profits or cut losses is also crucial in a fast-moving altcoin market.

Q: Are XRP, BNB and Solana only good for short-term trading?

No, these assets can be approached from both a short-term and long-term perspective. Short-term traders may focus on capturing moves during periods when the altcoin indicator signals strong momentum. Long-term investors might hold XRP, BNB and Solana because they believe in the growth of their ecosystems over multiple cycles. The best approach depends on your personal goals, time horizon and comfort with volatility.

See More: Best Altcoins to Buy in December DeepSnitch AI Leads