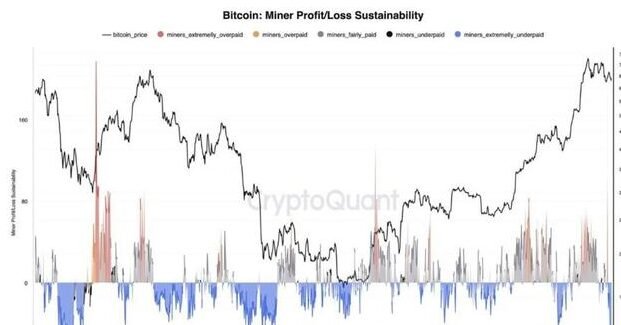

Although Bitcoin’s amazing climb beyond $96,000 in early 2025 has given miners struggling with growing operational difficulties some relief. Although the price surge has raised miner income, it has not been enough to overcome the combined challenges of increasing network complexity, lower block rewards, and rising energy prices.

The recent price boom of Bitcoin has improved mining profitability. JPMorgan claims that, following a 10% rise from November, miners’ average reward income in December 2024 came to around $57,101. These increases are, however, somewhat offset by a notable drop in profitability relative to pre-halving levels. Reduced block rewards from 6.25 BTC to 3.12 BTC per block, the gross revenues of Bitcoin miners remain 43% to 52% below the levels recorded prior to the April 2024 halving event.

Moreover, the price of one Bitcoin hit $105,570 in January 2025, while the cost to mine one has grown to over $33,900. For miners, who saw their margins treble despite rising technical challenges, this arrangement created historic profit prospects. Rising network competitiveness, nevertheless, is putting pressure on profitability. From 600 exahashes per second (EH/s) a year ago, Bitcoin’s hashrate—a gauge of computational capability—has jumped to a range of 700 to 900 EH/s.

Moreover, the price of one Bitcoin hit $105,570 in January 2025, while the cost to mine one has grown to over $33,900. For miners, who saw their margins treble despite rising technical challenges, this arrangement created historic profit prospects. Rising network competitiveness, nevertheless, is putting pressure on profitability. From 600 exahashes per second (EH/s) a year ago, Bitcoin’s hashrate—a gauge of computational capability—has jumped to a range of 700 to 900 EH/s.

Bitcoin Mining Struggles

The price rise in Bitcoin has drawn a flood of fresh miners, hence increasing network difficulty and competition. The revenue/hash ratio, a crucial indicator of miners’ performance, has dropped significantly in response to this growing complexity. Revenue increasingly fails to keep pace with Bitcoin’s market price, leading to a gap that suggests a general struggle for profitability.

Smaller mining operations—especially those utilizing less effective equipment—are increasingly finding it difficult to remain profitable. Since miners can afford to maintain less efficient equipment when the BTC price is at current levels. The higher BTC price has raised questions about miners who have not upgraded their equipment, resulting in them staying online longer rather than shutting down.

Rising Mining Costs

For those who mine Bitcoin, energy consumption still causes great worry. Rising electricity rates and the huge energy requirements of mining activities are compressing profit margins. Miners in some areas are subject to increased government monitoring and possibly higher taxes. For example, a suggested 30% excise tax on miners’ energy consumption has alarmed sector players.

For those who mine Bitcoin, energy consumption still causes great worry. Rising electricity rates and the huge energy requirements of mining activities are compressing profit margins. Miners in some areas are subject to increased government monitoring and possibly higher taxes. For example, a suggested 30% excise tax on miners’ energy consumption has alarmed sector players.

These elements are driving miners to look at other ways to cut expenses and improve profitability. While some are funding more energy-efficient technologies, others are moving operations to areas with lower energy prices. However, these steps may not provide immediate relief and require a significant financial investment.

Mining Meets Innovation

Some Bitcoin miners are spreading their activities into artificial intelligence (AI) and high-performance computing (HPC) in response to the difficulties in conventional mining. This deliberate change enables miners to utilize their existing infrastructure to generate additional income streams. Companies like Core Scientific and Hut 8, for instance, have teamed with artificial intelligence developers to make use of the computational capability of their data centers.

These explorations of artificial intelligence and high-performance computing present certain difficulties. These industries also have a strong demand for computing resources, so the profitability of such businesses could be erratic. Still, diversity provides miners with a possible protection against the volatility of the Bitcoin market.

Bitcoin Mining Sustainability

The scene in which Bitcoin miners operate now is one of complicated interactions of several elements. The fundamental difficulties—such as growing network difficulty. Rising energy costs and regulatory pressure continue to be major obstacles, even if the spike in Bitcoin’s price has given some temporary gains.

Looking forward, several important elements will probably determine the sustainability of mining activities:

Technological Advancements: Investing in more effective mining technology can help lower operating costs and increase profitability.

Energy Efficiency: Miners will have to discover strategies to cut energy usage, maybe by using more effective cooling systems or renewable energy sources.

Regulatory Adaptation: Avoiding possible legal and financial fines will depend mostly on keeping informed about and compliant with changing rules.

Diversification Strategies: Investigating other revenue sources, such as artificial intelligence and high-performance computers, can help lessen reliance on Bitcoin Mining alone.

In essence, although the recent price surge in Bitcoin offers some respite to miners. It is not enough to overcome the more general difficulties the business faces. To guarantee long-term sustainability and profitability, miners will have to change with the times by means of invention, diversification, and strategic planning.