Bitcoin mining is adding new transactions to the blockchain, a decentralized record, and validating existing ones. Cryptographic problems are solved by performing complex mathematical computations; miners receive newly created bitcoins. Miners are the backbone of the Bitcoin network, responsible for keeping it secure and intact. Your hardware, resources, and goals will determine your specific mining procedure. This tutorial will cover Various Bitcoin mining types and their advantages, disadvantages, and current trends as of 2024.

ASIC Mining

Application-Specific Integrated Circuits (ASICs) are hardware devices designed specifically for mining cryptocurrencies. Regarding Bitcoin mining, ASICs are the most powerful option available. Their architecture is optimized for the SHA-256 algorithm that Bitcoin uses, making them highly efficient compared to other types of hardware.

How It Works

ASIC miners are connected to the Bitcoin network and solve cryptographic puzzles. Their high processing power allows them to complete these tasks far quicker than CPUs or GPUs. Popular ASIC models include Bitmain’s Antminer series and MicroBT’s Whatsminer.

Advantages

- High Efficiency: ASICs are specifically designed for Bitcoin mining, resulting in a significant increase in hash rate and efficiency compared to other mining methods.

- Profitability: Due to their efficiency, ASIC miners generally offer a higher return on investment (ROI) for miners who have access to affordable electricity.

Disadvantages

- High Initial Cost: ASIC machines are expensive, with some models costing several thousand dollars.

- Lack of Flexibility: ASICs are purpose-built for mining Bitcoin and cannot be repurposed to mine other coins or perform other computing tasks.

- Rapid Obsolescence: As new and more powerful ASICs are released, older models become less competitive and often unprofitable within a few years.

GPU Mining

While ASIC mining dominates the Bitcoin landscape, Graphics Processing Units (GPUs) were once widely used for mining Bitcoin. Though no longer profitable for Bitcoin, GPUs are still commonly used for other cryptocurrencies like Ethereum Classic, Ravencoin, and Ergo. However, GPUs are not entirely obsolete in the Bitcoin ecosystem; some users still employ them for mining experimental forks or test networks.

How It Works

GPUs are versatile hardware initially designed to render graphics, particularly video games. They can perform multiple types of computations, including mining. Though they lag far behind ASICs in efficiency for Bitcoin mining, GPUs still have a place in the crypto space, especially for altcoins.

Advantages

- Versatility: GPUs can mine various cryptocurrencies, making them a more flexible option for miners looking to switch between coins.

- Lower Initial Investment: Though costly, GPUs are cheaper than ASICs, particularly when buying high-end gaming models like NVIDIA’s RTX series.

- Resale Value: Unlike ASICs, GPUs can be sold or repurposed for gaming or other computational tasks.

Disadvantages

- Low Profitability for Bitcoin: Mining Bitcoin with GPUs is no longer viable due to the network’s high difficulty level and competition from ASIC miners.

- Less Energy-Efficient: Compared to ASICs, GPUs consume more power for less computational output, making them less energy-efficient for Bitcoin mining.

CPU Mining

Central Processing Unit (CPU) mining was the first method used for mining Bitcoin when the cryptocurrency was still in its infancy. In the early days, anyone with a basic computer could mine Bitcoin using their CPU. However, as the network grew and the difficulty increased, CPU mining became obsolete for Bitcoin. Today, CPU mining is still used for lesser-known cryptocurrencies. Still, it is ineffective for Bitcoin due to its low processing power and high energy consumption relative to more specialized hardware.

How It Works

In CPU mining, a computer’s central processor performs the mining operations. This method was viable when Bitcoin’s hash rate was low, but it has since been surpassed by more efficient hardware like GPUs and ASICs.

Advantages

- Low Initial Cost: Most people already own a CPU, making it a low-cost way to get into mining.

- Easy Setup: Mining with a CPU requires minimal technical know-how and setup.

Disadvantages

- Extremely Low Profitability for Bitcoin: CPU mining is not profitable with the current difficulty in Bitcoin mining. The costs of electricity far outweigh any potential rewards.

- Not Scalable: Even with multiple CPUs, the processing power pales compared to ASICs and GPUs, making it a poor choice for serious miners.

Cloud Mining

Cloud mining is a service that allows users to rent mining hardware from a remote data center. This type of mining is convenient for those who want to mine Bitcoin without having to invest in costly equipment or deal with operational challenges like maintenance, electricity, and cooling. Companies like Genesis Mining and Hashflare offer customers cloud mining contracts.

How It Works

In cloud mining, users purchase a mining contract from a provider that mines Bitcoin on their behalf. The user pays a certain amount of hash power upfront, and any Bitcoin mined is credited to their account after deducting fees.

Advantages

- No Hardware Required: Users don’t have to invest in mining rigs or deal with the technicalities of setting up and maintaining hardware.

- Simplicity: The cloud mining provider handles all aspects of the mining operation, including electricity and cooling.

Disadvantages

- Profitability Concerns: Cloud mining contracts are often structured in a way that makes them less profitable than mining directly with your hardware.

- Potential Scams: The cloud mining industry has been plagued by scams, where companies have vanished after taking customers’ money.

- Lack of Control: Users have no control over the mining process and must trust the provider to operate efficiently and honestly.

FPGA Mining (Field-Programmable Gate Array)

FPGA mining arrived as a middle ground between GPUs and ASICs (application-specific integrated circuits). FPGAs are configurable chips programmed to perform specific tasks like solving SHA-256 hashes in Bitcoin mining. They offered higher efficiency than GPUs but were more flexible than ASICs, which are limited to one specific task.

How It Works

Miners program the FPGA chips to optimize Bitcoin mining performance. The advantage of FPGAs is their ability to be reprogrammed for different algorithms, providing flexibility for future mining applications.

Advantages

- Efficiency: FPGAs are more energy-efficient than GPUs while providing a higher hash rate.

- Flexibility: FPGAs can be reprogrammed for different purposes or algorithms, offering versatility that ASICs lack.

Disadvantages

- Programming Skills: FPGAs require technical knowledge to configure and optimize Bitcoin mining.

- High Cost: While not as expensive as ASICs, FPGAs are still costly and require considerable setup time.

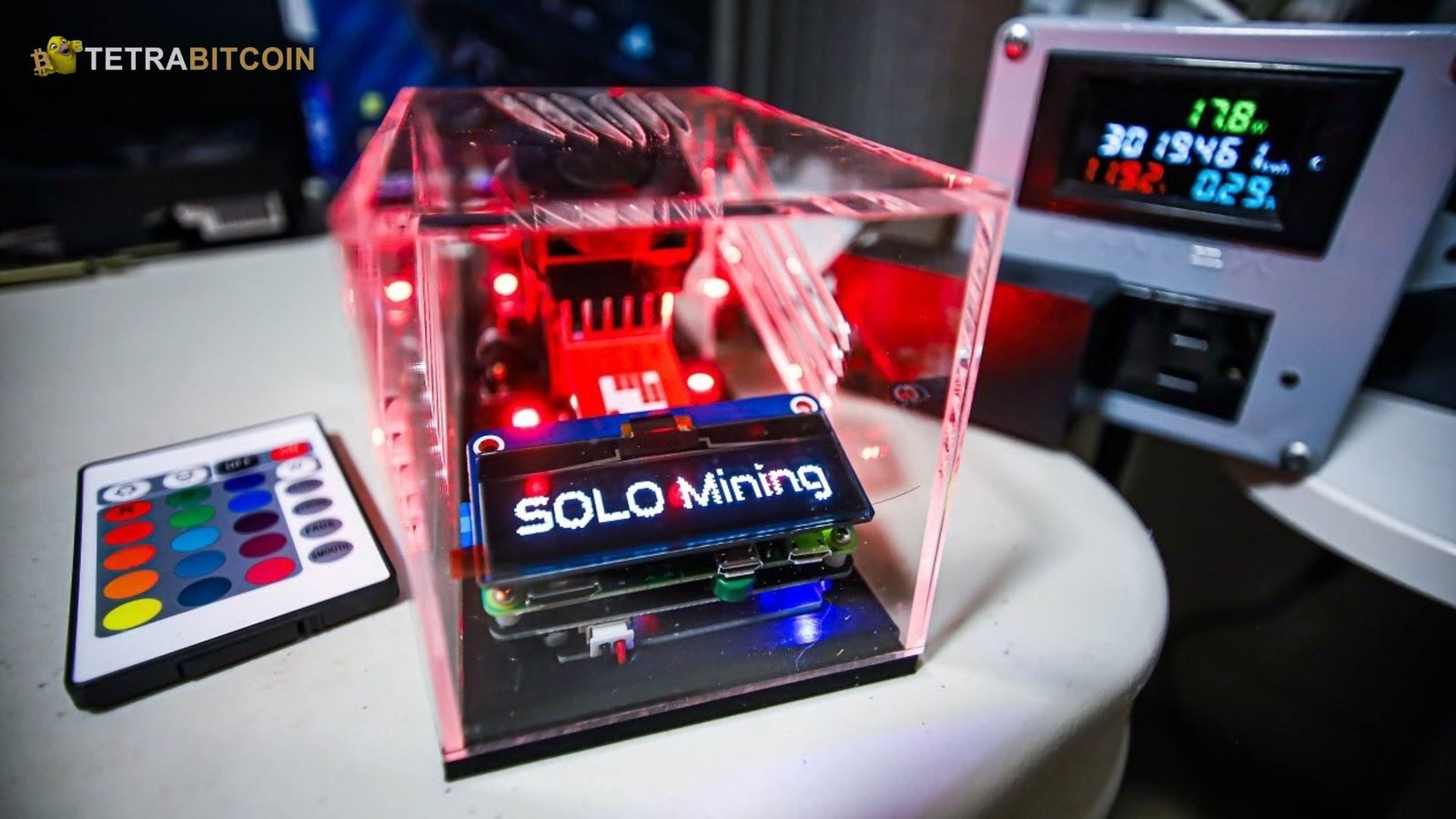

Solo Mining

Solo mining involves mining independently, without joining a mining pool. When solving Bitcoin’s cryptographic puzzles, solo miners work alone and, if successful, receive the full block reward. However, the chances of mining a block as a solo miner have decreased significantly due to the growing competition and network difficulty.

How It Works

In solo mining, the miner sets up their hardware and connects it directly to the Bitcoin network. Unlike pool mining, where the rewards are distributed among participants, solo miners get to keep the entire reward (currently 6.25 BTC per block) if they are the first to solve the puzzle.

Advantages

- No Pool Fees: Solo miners don’t have to pay any fees to a mining pool, allowing them to keep the full reward.

- Full Control: Solo miners fully control their mining setup and operations.

Disadvantages

- High Variance: The chances of mining a block are extremely low for solo miners, especially those without significant mining power. The income can be inconsistent, with long periods of no rewards.

- Requires High Hash Rate: A solo miner would need a large amount of mining power to have a realistic chance of mining a block, making this method impractical for most individuals.

Pool Mining

Pool mining is the most popular method for individuals to mine Bitcoin. In a mining pool, multiple miners contribute their computing power to work together toward solving Bitcoin’s puzzles. When the pool successfully mines a block, the reward is distributed among the participants based on their contributed hash power.

How It Works

Mining pools aggregate the resources of multiple miners to increase the chances of solving a block. Pool members receive a portion of the block reward relative to the amount of computing power they contribute.

Advantages

- Steady Income: By pooling resources, miners increase their chances of earning smaller, more frequent rewards.

- Lower Variance: Compared to solo mining, the income from pool mining is more consistent, though smaller on a per-block basis.

Disadvantages

- Pool Fees: Mining pools typically charge fees, reducing the overall profitability for participants.

- Centralization Risks: Large mining pools control a significant portion of the Bitcoin network’s hash rate, raising concerns about centralization and potential attacks on the network.

Conclusion

The landscape of Bitcoin mining continues to evolve, with new technologies and trends emerging regularly. ASIC mining remains the most profitable option for serious miners, while cloud and pool mining offer more accessible alternatives. However, each method has pros and cons, and the right choice depends on your goals, resources, and risk tolerance. In 2024, Bitcoin mining is more competitive than ever, requiring miners to carefully consider their hardware, energy costs, and market conditions before diving in.